The Ho Chi Minh City Stock Exchange (HOSE) has announced the listing and first trading day of An Giang Agricultural and Foodstuffs Joint Stock Company (Antesco, stock code: ANT).

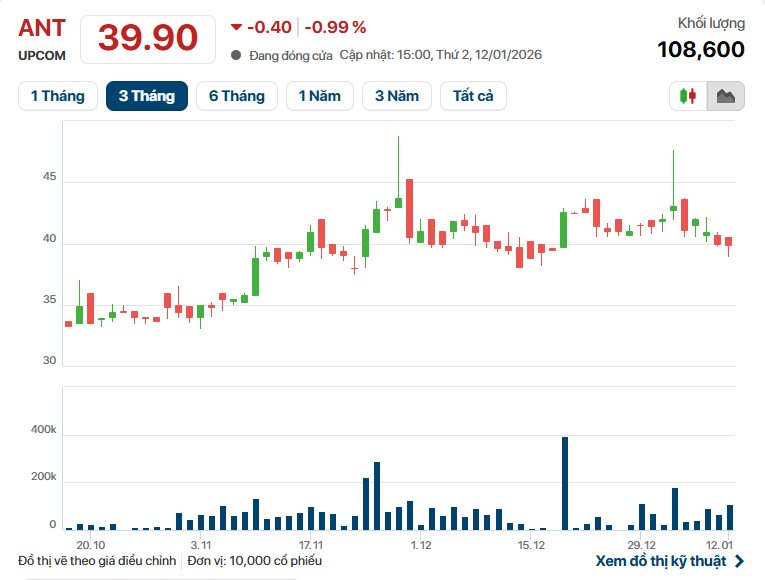

Over 24 million ANT shares will commence trading on HOSE from January 20, 2026. The reference price for the initial session is set at VND 40,900 per share, corresponding to a market capitalization of nearly VND 982 billion. The price fluctuation range on the first trading day is 20%.

The decision to list ANT on HOSE was approved by shareholders through a written ballot concluding on November 4, 2025. By November 19, 2025, HOSE confirmed receipt of all necessary listing documents from the company.

On December 30, 2025, HOSE issued its approval for the listing, while Antesco’s Board of Directors also approved the reference price on the same day. This price was calculated based on the average of 30 consecutive trading sessions prior to ANT’s delisting from UPCoM.

Established in 1975 as An Giang Agricultural Supplies Company, Antesco has evolved over 50 years to become one of Vietnam’s leading agricultural processors and a key player in the Mekong Delta region. The company boasts an annual processing capacity of approximately 75,000 tons and holds the distinction of being Vietnam’s first exporter of frozen agricultural products to international markets.

Antesco recently issued 3.5 million shares privately to strategic investor Ylang Holdings JSC at a price of VND 12,900 per share. The proceeds of approximately VND 45 billion will be used to repay debt to VietinBank. Following this private placement, Ylang Holdings holds 8.1 million shares, representing 33.8% of the newly increased charter capital.

As of the close of trading on January 14, ANT shares were priced at VND 19,900 per share, with a market capitalization of VND 957 billion.

Masan Consumer Boosts Capital for Growth While Sustaining High Dividends

On January 9th, Masan Consumer (HOSE: MCH) announced its second dividend payment for 2025, offering a cash dividend and bonus shares at a rate among the highest in the market.

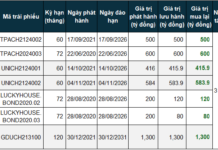

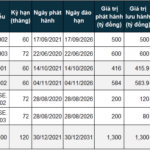

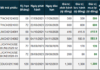

Vietnamese Billionaires Rush to Raise Nearly $1.5 Billion Through Bonds, Enticed by Up to 12% Interest Rates

The corporate bond market concluded 2025 with a staggering scale of nearly 590 trillion VND. Notably, in just the past month, the market witnessed a remarkable “final sprint” from billionaire ecosystems such as Vingroup, Sovico, Thaco, and Techcombank, collectively raising an estimated total of over 35 trillion VND.