The stock market has been performing positively at its peak, and SAB shares of Saigon Beer-Alcohol-Beverage Corporation (Sabeco) have capitalized on this momentum, hitting their upper limit for the second consecutive session. By the morning of January 14th, SAB climbed to 53,700 VND per share, with nearly 3.7 million shares traded.

Strong buying pressure overwhelmed the selling side, with millions of buy orders at the ceiling price remaining unfilled. SAB’s robust recovery pushed its stock price to a 1.5-year high (since June 2024), with a market capitalization reaching nearly 69 trillion VND.

Vietnam Among the World’s Top Beer Consumers

In reality, Vietnam remains one of the world’s leading beer consumers, bolstering long-term expectations for industry leaders. According to the recent report “Global Beer Consumption by Country in 2024” by Kirin Holdings (Japan), Vietnam consumed nearly 4.58 billion liters of beer in 2024, ranking 8th globally and accounting for 2.4% of total global beer consumption.

Meanwhile, China leads with 40,534 thousand kiloliters, followed by the U.S. with 22,340 thousand kiloliters, while Brazil, Mexico, and Russia trail behind. For a country of approximately 100 million people like Vietnam to be in the global top 10 highlights its significant domestic consumption scale, making beer a substantial sector in the consumer economy.

Furthermore, Vietnam’s beer market is one of the largest in Southeast Asia. According to Expert Market Research, the market value is estimated at around 10.17 billion USD in 2025, reflecting strong domestic demand and increasing consumer spending.

The report also forecasts continued market expansion in the coming years, driven by the growth of the middle class and diversifying consumer trends. As one of the world’s largest beer markets, Vietnam significantly contributes to the global alcoholic beverage industry.

Generous Dividends

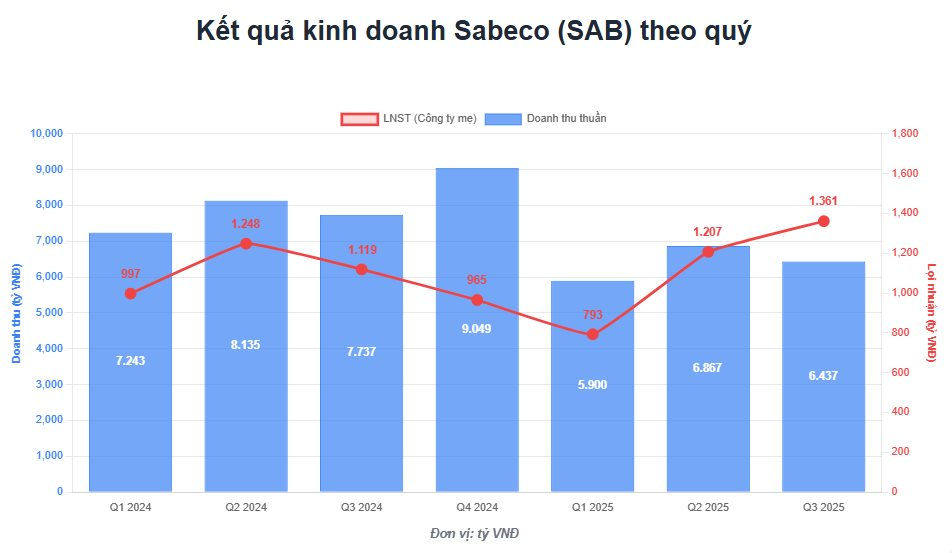

SAB’s upward trend is further supported by its significantly improving financial foundation. According to Sabeco’s Q3/2025 financial report, net revenue reached 6,437 billion VND, a 16% decrease compared to the same period in 2024. However, post-tax profit attributable to the parent company’s shareholders grew by 22%, reaching 1,361 billion VND—the highest quarterly profit in the last 13 quarters.

For the first nine months of 2025, Sabeco recorded net revenue of 19,052 billion VND, a 17% decline compared to the same period in 2024. Post-tax profit of the parent company remained stable, reaching 3,361 billion VND, a slight 0.1% decrease year-on-year, completing 71% of the annual profit plan.

Sabeco’s Business Results from Q1-2024

Future business prospects are optimistically assessed by analysts due to seasonal factors and policy adjustments. DSC Securities predicts that the gross profit margin in Q4/2025 will remain favorable, as Sabeco locked in raw material prices (hops, malt) at low levels from the beginning of the year. Additionally, the adjusted special consumption tax increase roadmap (5% annually from 2027 instead of immediate implementation), along with expectations of major sporting events and a late Lunar New Year in 2026, will provide growth opportunities for the company.

As of September 30, 2025, Sabeco’s financial health remains robust, with cash and bank deposits totaling 20,027 billion VND, accounting for 64% of total assets. Interest income from deposits in the first nine months brought the company 741 billion VND, equivalent to an average daily income of over 2.7 billion VND.

This solid foundation enables the company to maintain its position as a “cash cow” with consistent cash dividend policies. From 2016 to date, the company has never interrupted cash dividend payments, despite market fluctuations or the COVID-19 crisis. Annual dividends have consistently ranged from 3,000 to 5,000 VND per share.

Most recently, the company finalized the shareholder list for a 2025 interim dividend on January 13th, with a 20% cash dividend rate (2,000 VND per share). The dividend payment is scheduled for February 12, 2026. With nearly 1.3 billion outstanding shares, Sabeco will allocate approximately 2,570 billion VND for this dividend payment.

In the current shareholder structure, the parent company, Vietnam Beverage (a Thaibev subsidiary of Thai billionaire Charoen Sirivadhanabhakdi), will receive nearly 1,375 billion VND in dividends, holding 53.59% of the capital. The State Capital Investment Corporation (SCIC), holding 36% of the capital, will receive over 920 billion VND.

The Profit Race Between Vietnam’s Two Beer Giants: Sabeco vs. Habeco

“Sabeco and Habeco’s contrasting fortunes in the first half of 2025 paint a vivid picture of two beverage giants heading in opposite directions. One is struggling to keep up, while the other is making significant strides to enhance its financial performance. This narrative will focus on their journey so far and the strategies employed to navigate the competitive landscape.”