I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON JANUARY 14, 2026

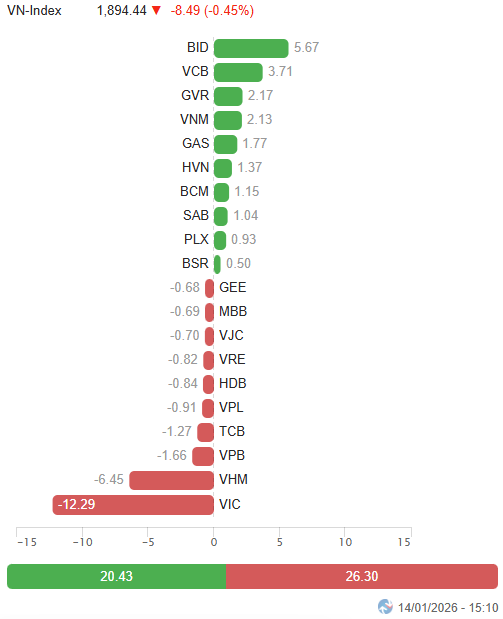

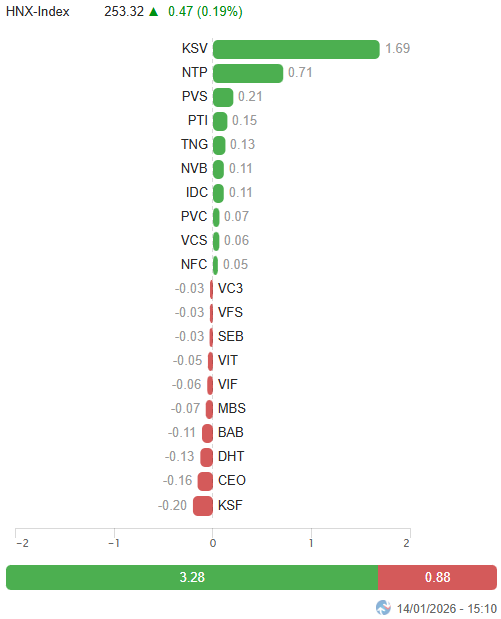

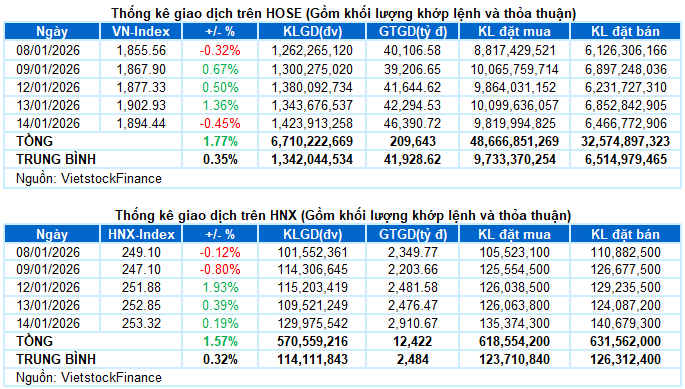

– Key indices showed mixed movements during the January 14 trading session. Specifically, the VN-Index decreased by 0.45%, closing at 1,894.44 points. Meanwhile, the HNX-Index increased by 0.19%, reaching 253.32 points.

– Trading volume on the HOSE floor rose by 3.6%, exceeding 1.3 billion units. The HNX floor recorded over 122 million matched units, a 13.2% increase compared to the previous session.

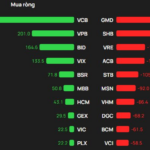

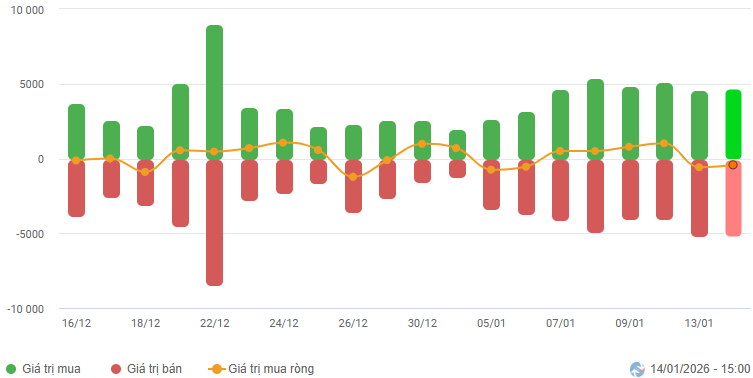

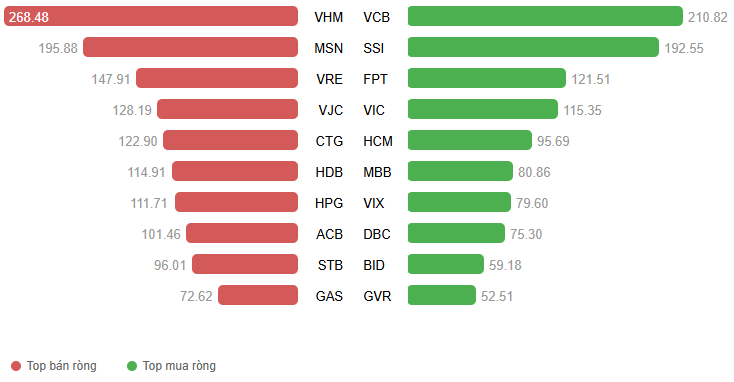

– Foreign investors continued to net sell with a value of over 470 billion VND on the HOSE floor, while net buying approximately 100 billion VND on the HNX floor.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market experienced a session of strong fluctuations on January 14. Starting with increased profit-taking pressure, the VN-Index dropped nearly 12 points within the first half-hour. However, the alternating support from blue-chip stocks quickly helped the index regain balance. Despite the weakness in Vingroup stocks creating significant pressure, other major pillars provided timely support, maintaining the VN-Index in a tug-of-war around the 1,900-point mark for most of the trading session. Towards the end of the afternoon session, the market witnessed a surprising development as the index plunged over 30 points, but buying power quickly emerged, significantly narrowing the decline and preventing widespread panic. At the close, the VN-Index settled at 1,894.44 points, down 8.49 points from the previous session.

– Among market capitalization groups, all three indices—VS-LargeCap, VS-MidCap, and VS-SmallCap—experienced fluctuations but maintained slight gains, indicating that capital flow remains active but is becoming more selective.

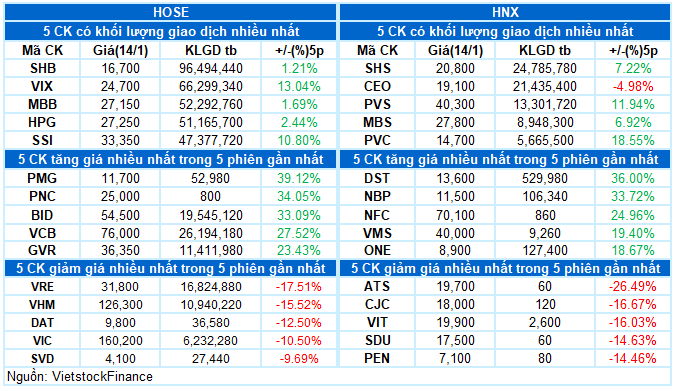

– In terms of impact, the duo VIC and VHM had the most negative effect, subtracting 12.29 points and 6.45 points from the VN-Index, respectively. Conversely, the most significant offsetting efforts came from BID, VCB, GVR, and VNM, contributing a total of nearly 14 points to the index.

Top Stocks Influencing the Index. Unit: Points

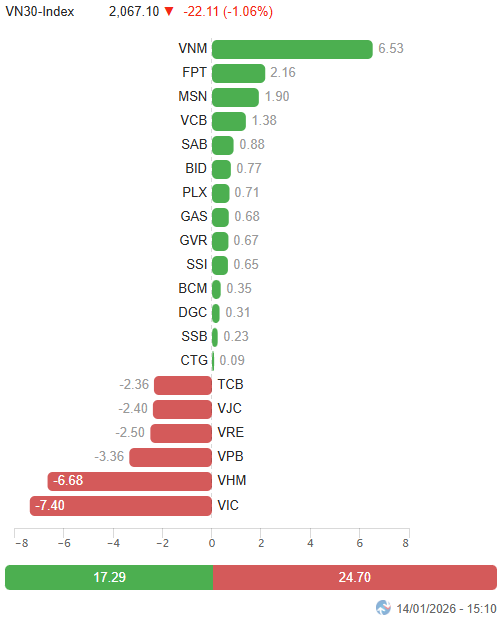

– The VN30-Index closed down over 22 points (-1.06%), ending at 2,067.1 points. The basket’s breadth was strongly divided, with 14 gainers, 13 losers, and 3 unchanged stocks. The Vin trio (VHM, VRE, and VIC) faced heavy selling pressure, weighing down the index with declines of 4-6%. Additionally, VJC, HDB, TCB, VIB, and TPB all adjusted downward by more than 2%. On the positive side, six stocks hit their upper limits, including BCM, SAB, VNM, BID, GVR, and PLX.

Green dominated most sectors despite the market’s strong fluctuations. Viettel-related stocks continued to maintain strong appeal, with VGI and CTR hitting their upper limits and VTK rising by 7.86%, propelling the communication services sector index to lead the market with an impressive gain of nearly 12%.

Furthermore, the energy sector remained a notable highlight, rising over 3%, bringing its year-to-date cumulative increase to 27% since the beginning of 2026. Many leading stocks in the sector continued to trade impressively, with PLX, OIL, and PVC hitting their upper limits, while BSR (+2.15%), PVS (+1.77%), MVB (+1.8%), and TMB (+2.02%) also performed well.

Additionally, several individual stocks across various sectors created positive highlights with notable purple hues, such as HVN, MVN, VTP (industrials); GVR, KSV, NTP, CSV (basic materials); and VNM and SAB (consumer staples).

On the downside, real estate and consumer discretionary sectors lagged the market, declining by 3.62% and 1.08%, respectively. The adjustment was primarily driven by leading stocks such as VIC (-4.59%), VHM (-5.75%), VRE (-5.22%), KDH (-3.17%); VPL (-2.53%), MWG (-1.26%), and PNJ (-1.36%).

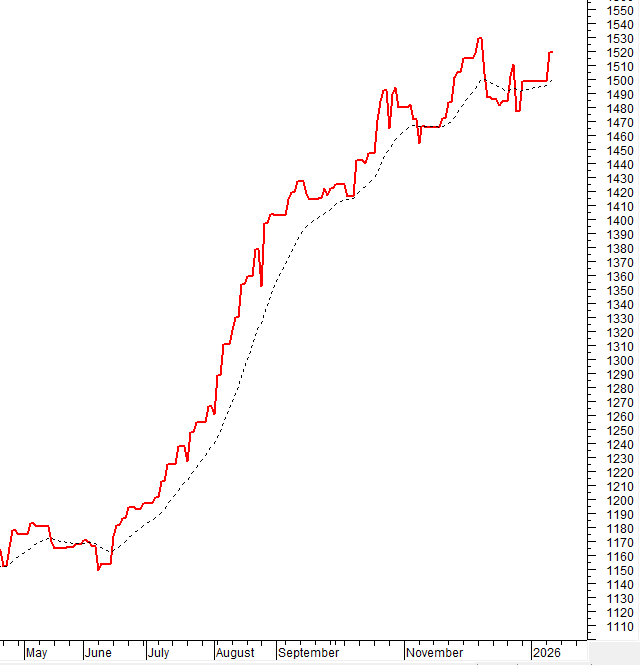

The VN-Index paused its upward momentum as strong fluctuation pressure emerged near the new peak around the 1,900-point mark. With the Stochastic Oscillator reversing and giving a sell signal in the overbought zone, the index may need more time to establish a new price level. The old peak from October 2025 has been completely broken and will serve as strong support in the short term.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Stochastic Oscillator Gives Sell Signal

The VN-Index paused its upward momentum as strong fluctuation pressure emerged near the new peak around the 1,900-point mark.

The Stochastic Oscillator reversed and gave a sell signal in the overbought zone, indicating that the index will likely need more time to establish a new price level.

The old peak from October 2025 has been completely broken and will serve as strong support in the short term.

HNX-Index – Maintains Above the Middle Line of Bollinger Bands

The HNX-Index increased slightly after a session of tug-of-war, maintaining its position above the Middle line of the Bollinger Bands.

The recovery outlook remains positive as both the Stochastic Oscillator and MACD continue to trend upward after giving buy signals.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is currently above the 20-day EMA. If this state is maintained in the next session, the risk of a sudden downward thrust will be limited.

Foreign Capital Movement: Foreign investors continued to net sell in the January 14, 2026, trading session. If foreign investors maintain this action in the upcoming sessions, market fluctuations will likely continue.

III. MARKET STATISTICS FOR JANUARY 14, 2026

Economic & Market Strategy Analysis Department, Vietstock Consulting Division

– 17:13 January 14, 2026

Massive Capital Inflow Returns: Brokerages Highlight Stocks Poised for January Breakout

The formation of a higher low price structure indicates that institutional money has begun re-entering the market, providing crucial support and reigniting investor interest.

New Year’s Delight: VN-Index Surpasses 1900 Points for the First Time

The CEO of TCBS attributes the driving force behind Vietnam’s stock market momentum to a combination of robust macroeconomic growth and the solid fundamentals of Vietnamese enterprises.