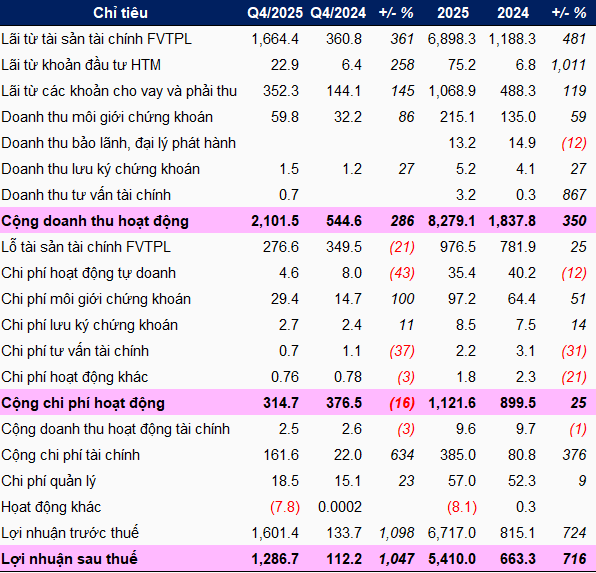

In Q4/2025, VIX reported pre-tax profits of over VND 1,601 billion and post-tax profits of nearly VND 1,287 billion, marking a 12-fold and 11.5-fold increase, respectively, compared to the same period in 2024. This remarkable performance was driven by a 418-fold surge in proprietary trading profits to over VND 1,383 billion and a 2.4-fold increase in lending revenue to more than VND 352 billion.

In the brokerage segment, VIX generated profits exceeding VND 30 billion, a 73% year-on-year growth. However, its contribution to the overall results remained modest compared to the proprietary trading and lending segments.

Conversely, the most significant pressure came from a 7.3-fold increase in financial expenses, reaching nearly VND 162 billion, primarily due to a sharp rise in borrowing costs.

For the full year 2025, VIX achieved pre-tax and post-tax profits of over VND 6,717 billion and VND 5,410 billion, respectively, both 8.2 times higher than 2024, slightly exceeding the annual target. This marked the most profitable year in VIX‘s operational history.

|

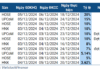

Q4 and full-year 2025 business results of VIX

Source: Q4/2025 Financial Report of VIX

|

The proprietary trading portfolio was highlighted by investments in GELEX stocks.

By the end of 2025, VIX‘s total assets reached VND 34,167 billion, the highest in its history, representing a 74% increase from the beginning of the year. This growth was primarily driven by a significant expansion in lending and financial assets measured at fair value through profit or loss (FVTPL), which were the main contributors to the recent exceptional business results.

| VIX establishes new total asset scale |

Lending increased from nearly VND 5,774 billion to over VND 15,380 billion, primarily for margin trading activities, with a smaller portion for advance payments on customer sales.

FVTPL financial assets grew from over VND 12,517 billion to nearly VND 14,691 billion, with stocks accounting for the largest share at 78%, followed by investment trusts and unlisted bonds.

Examining VIX‘s stock portfolio, it’s evident that investments in EIB and the GELEX group (GEE, GEX, and GELEX Infrastructure – GICC) were dominant. Not only did these investments increase compared to the beginning of the year, but their fair values were also significantly higher than their book values, reflecting the strong price appreciation of GEE and GEX.

Source: Q4/2025 Financial Report of VIX

|

On the stock market, GEX surged 2.5 times over the past year, from VND 17,000 per share to VND 43,000 per share, while GEE increased ninefold, from VND 27,000 per share to VND 245,000 per share, particularly accelerating in Q4, contributing significantly to proprietary trading profits through asset revaluation.

Regarding capital sources, asset funding primarily came from short-term loans of VND 11,332 billion, nearly four times higher than the beginning of the year, and owner’s equity of over VND 15,314 billion, up 5%.

Note that VIX plans to increase its capital to VND 24,503 billion by issuing nearly 919 million shares in the near future, with the list of shareholders eligible for the rights issue expected to be finalized in Q1/2026.

At an offering price of VND 12,000 per share, VIX is estimated to raise over VND 11,026 billion, which will be fully disbursed immediately after the offering. The company will allocate over VND 5,013 billion to supplement capital for proprietary trading, over VND 5,013 billion for margin lending, and VND 1,000 billion to contribute additional capital to VIXEX Cryptocurrency Exchange JSC (VIXEX).

– 13:20 14/01/2026

VIX Stock Surges, Achieving 2025 Profit Targets Ahead of Schedule

VIX Securities Corporation is rapidly emerging as a standout player in the brokerage industry, showcasing exceptional profit growth that outpaces its peers.

Derivatives Market 2025: VPS Loses Ground, DNSE Surges Ahead

According to the top 10 derivatives brokerage market share rankings for Q4/2025 and the full year 2025, recently released by the Hanoi Stock Exchange (HNX), it’s evident that the market landscape is gradually reshaping. VPS is facing intense competition from rivals, most notably DNSE, as the battle for market dominance intensifies.