Silver prices today, as reported by Phu Quy Jewelry Group, have taken a downturn. Fine silver (999) is listed at VND 3,334,000 per tael (buy) and VND 3,437,000 per tael (sell).

Meanwhile, 1kg silver bars (999) are priced at VND 88,906,444 (buy) and VND 91,653,104 (sell), updated at 08:46 on January 15th.

Globally, silver prices have dipped to $88.2 per ounce. This decline mirrors the sharp drop in gold prices worldwide.

Prior to this decline, silver prices surged above $92 per ounce on Wednesday, continuing their upward trajectory as markets weighed easing inflation signals against persistent macroeconomic and political risks.

Recent U.S. data indicates that producer prices largely avoided spikes, aligning with the CPI decrease earlier this week. This reinforces expectations that the Federal Reserve will begin cutting interest rates later this year.

Strong retail sales figures highlight the resilience of American consumer spending. Safe-haven demand remains elevated amidst ongoing geopolitical tensions, rising public debt concerns, and fresh questions about the Fed’s independence following a criminal probe into Chairman Powell’s June testimony.

Beyond macroeconomic factors, silver continues to benefit from structural supply shortages, with the market experiencing multi-year deficits and limited liquidity in London. Steady industrial demand tied to clean energy technology and artificial intelligence has further bolstered the metal’s price momentum.

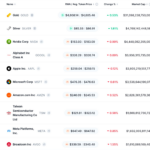

Following its early-year rally, silver has officially become the world’s second most valuable asset, trailing only gold. The estimated global silver market value now exceeds $5 trillion.

Silver Skyrockets, Surpassing Big Tech to Become the World’s Second-Largest Asset

Silver prices continue to surge amid escalating concerns over the Federal Reserve’s independence, mounting geopolitical tensions, and a prevailing trend of monetary policy easing.

Silver Prices Extend Rally on January 13th

Silver prices today remain steadfast at elevated levels, both domestically and globally, reflecting sustained market resilience and investor confidence.