As multinational corporations restructure their global operations, Global Capability Centres (GCCs) are evolving from back-office units to hubs of technology, innovation, and strategic operations. In Vietnam, Ho Chi Minh City (HCMC) is emerging as a prime destination for the new wave of GCCs, thanks to its robust workforce, cost advantages, and high-quality office supply.

According to Ms. Lai Thi Nhu Quynh, Deputy Director of Commercial Leasing Services at Savills HCMC, the growth of GCCs is not only boosting office demand but also reshaping market standards, structures, and long-term development strategies.

GCCs Redefining Their Role in Global Operations

“Historically, GCCs in Vietnam were established primarily to optimize costs for support functions. However, this model is rapidly changing. New GCCs are increasingly strategic, focusing on technology, R&D, data, and innovation—core functions in the global value chain,” Ms. Quynh noted.

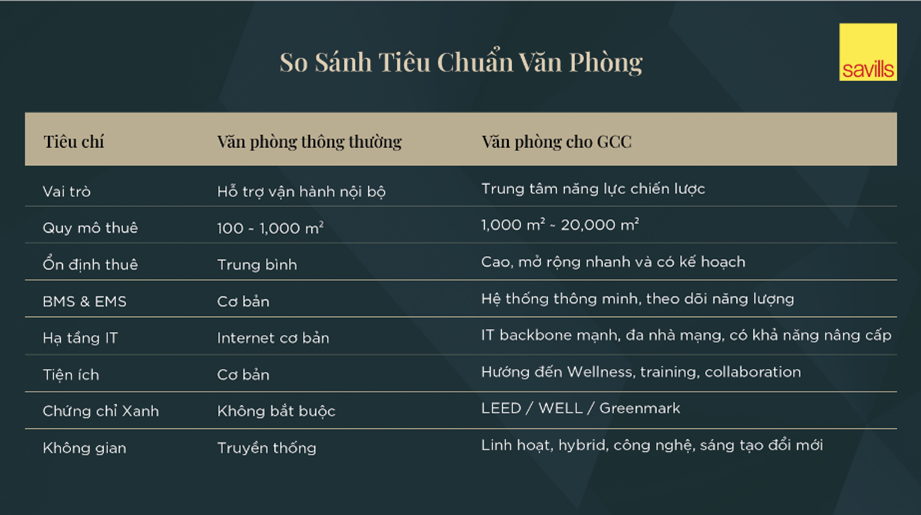

Comparison of leasing criteria between standard offices and GCC offices

Savills analysis reveals that GCCs typically start with 1,000–3,000 m² and can expand to 5,000–20,000 m² or more in the stable growth phase. Notably, long-term leases of 5–10 years highlight their commitment and stability.

This trend is evident in HCMC’s office transactions. In the first nine months of 2025, Savills recorded 145 office leases across all grades, with IT tenants leading at 37% of new leasing volume, averaging 924 m² per deal—a sector closely tied to new-generation GCCs.

HCMC’s Workforce, Costs, and Ecosystem Attract GCCs

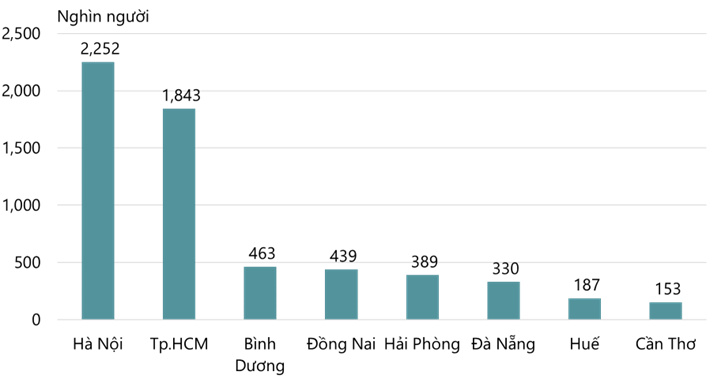

Ms. Quynh emphasizes that HCMC’s high-quality workforce is its most significant advantage in attracting large-scale GCCs.

“HCMC boasts a young, abundant labor force with strong tech, engineering, and language skills. The city is also home to leading universities, training centers, and Vietnam’s largest tech ecosystem, making it an attractive talent hub for GCCs,” she shared.

Trained workforce data in major Vietnamese cities, 2024

Beyond talent, HCMC’s Grade A office rents remain competitive regionally. Compared to hubs like Singapore, Hong Kong, or Tokyo, HCMC offers significantly lower costs, enabling long-term operational efficiency while maintaining international standards.

As of Q4 2025, HCMC’s total office supply reached 2.9 million m², with Grade A offices accounting for 17% (over 490,000 m²). Notably, 76% of Grade A supply holds green certifications, reflecting the market’s strong focus on sustainability.

GCCs Elevate Office Standards and Shape Long-Term Trends

The rise of new-generation GCCs is directly influencing HCMC’s office market, particularly in the Grade A and A+ segments.

“Savills observes that GCCs predominantly target Grade A buildings with green certifications like LEED, WELL, or Green Mark, robust IT infrastructure, smart building management, and flexible expansion options,” Ms. Quynh explained.

Modern workspaces are no longer just desks but reflect corporate culture and support employee wellbeing, training, collaboration, and innovation—critical for retaining tech talent.

Geographically, GCCs follow clear strategies. The central core remains preferred for management and international operations, while expanded central areas like Thu Thiem and Thu Duc City attract large GCCs, R&D centers, and delivery hubs due to flexible expansion and lower costs.

With limited new Grade A supply forecast until 2028, GCCs’ stable, long-term demand will be pivotal in sustaining market occupancy and rents. Notably, The Kross—the only Grade A office building set to launch in HCMC in 2026—will add significant supply.

“GCCs are not a short-term trend. They are strategic tenants with clear expansion plans and high standards. Long-term, their presence will elevate market standards and drive the development of internationally certified office projects in HCMC,” Ms. Quynh concluded.

Unleashing Potential: Ho Chi Minh City’s Expanded Special Mechanisms Propel Its Rise as a Global Metropolis

The new resolution introduces pivotal mechanisms to foster a fresh development landscape for Ho Chi Minh City, particularly through the Transit-Oriented Development (TOD) model, the establishment of a Free Trade Zone (FTZ), and the robust attraction of strategic investors.

Vietnam’s TOD Urban Revolution: Unlocking the Potential of Next-Gen Megacities

The Transit-Oriented Development (TOD) model is an essential strategy for creating modern, sustainable living spaces and addressing land scarcity in major urban areas, particularly in Ho Chi Minh City. By integrating urban development with public transportation, TOD fosters efficient land use, reduces congestion, and enhances quality of life, making it a cornerstone for future-proof cities.

Why FDI Waves Reversed, Costing Northern Vietnam’s Largest Industrial Hub Its Crown

After four months of provincial mergers, Vietnam’s economic landscape is beginning to reveal a fresh palette of opportunities. The consolidation and expansion of development spaces have not only facilitated infrastructure connectivity and resource sharing among localities but have also rapidly amplified the ripple effect in attracting foreign direct investment (FDI).