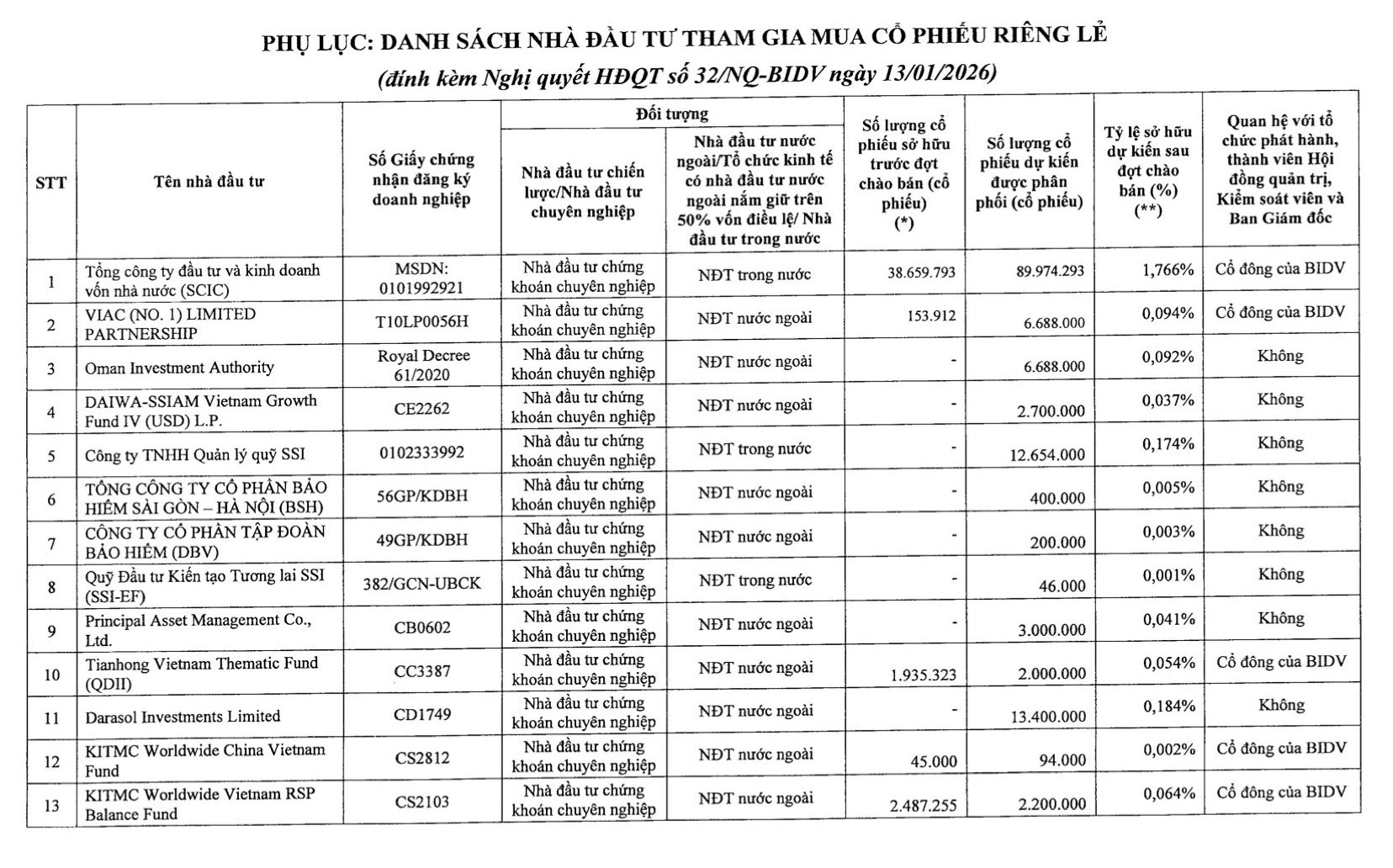

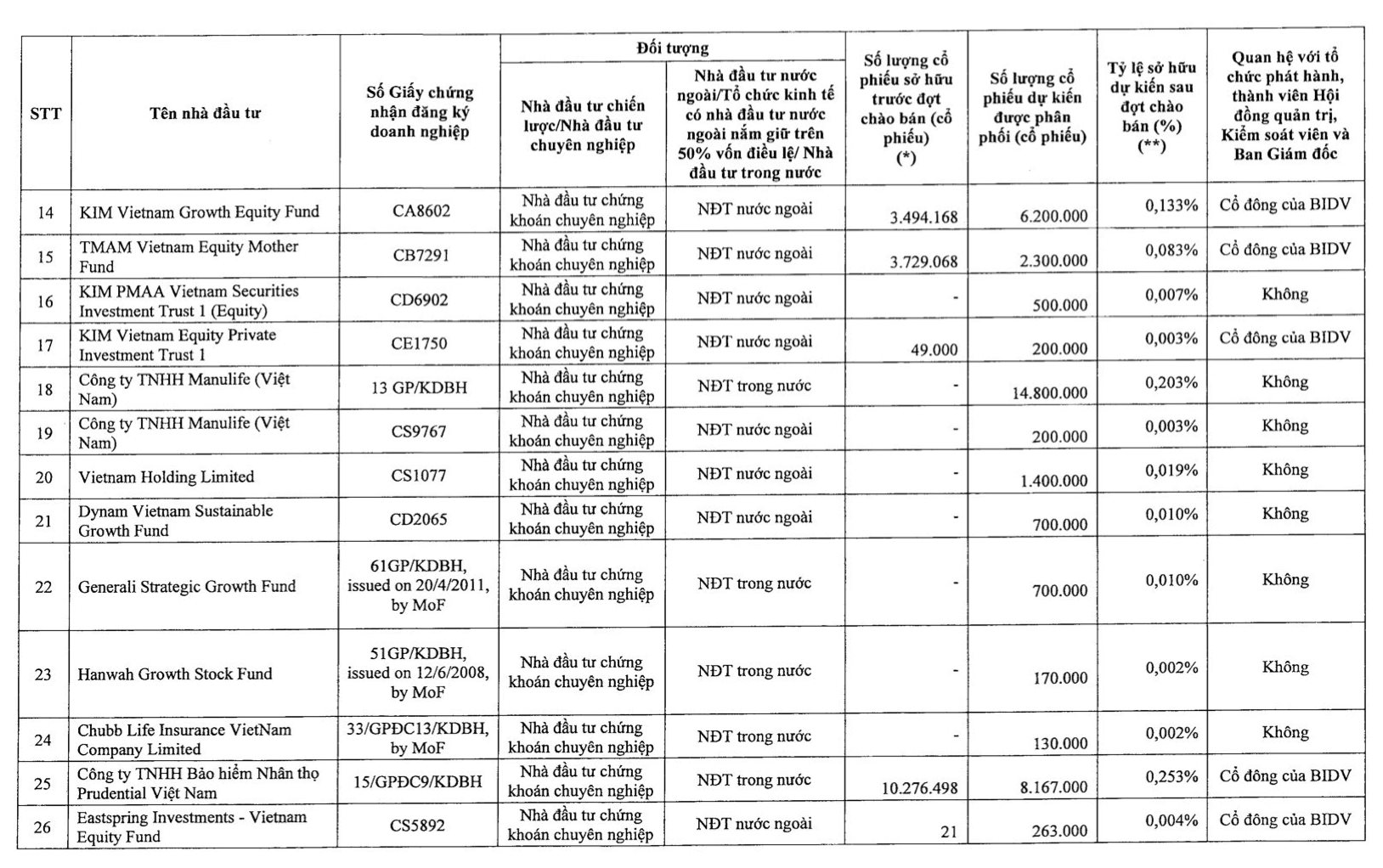

Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV – stock code: BID) has recently disclosed unusual information regarding its board of directors’ resolutions on the private placement of shares to investors.

Specifically, BIDV plans to issue 264.07 million common shares through a private placement at a price of VND 38,900 per share. The issuance is expected to take place in Q1. The privately placed shares will be subject to a one-year transfer restriction.

The total expected capital raised from this issuance is approximately VND 10,272 billion. The proceeds from the private placement are intended to be used by BIDV to supplement its credit activities in 2026.

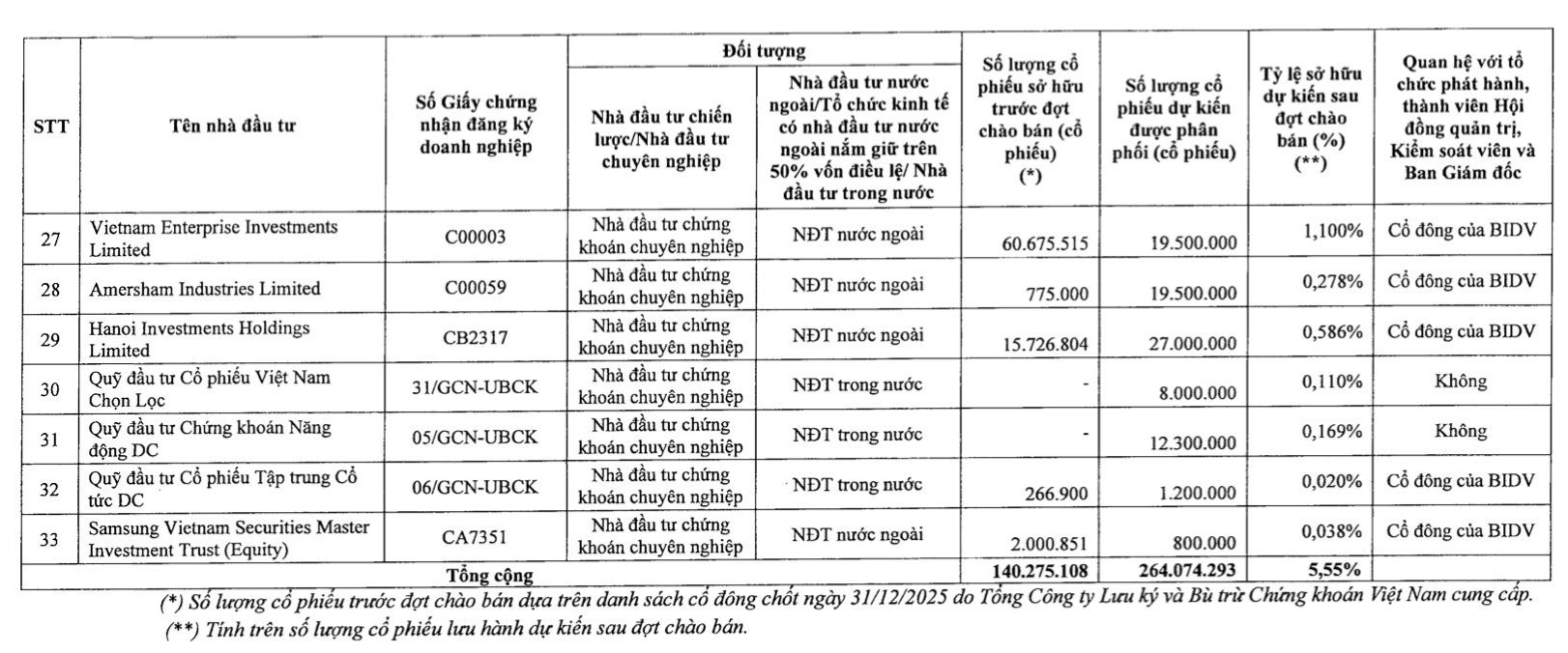

The participants include 33 professional securities investors, comprising both domestic and foreign institutions. The list of expected investors features prominent organizations and investment funds such as the State Capital Investment Corporation (SCIC), funds associated with Dragon Capital, Darasol Investments Limited, KIM, SSIAM, and Manulife…

SSI serves as the advisor and arranger for BIDV’s private placement, attracting interest from numerous financial institutions both domestically and internationally, including securities companies, fund management companies, investment funds, insurance companies, and state organizations. The ability of a large-scale transaction to mobilize capital from such a diverse group of investors underscores the growing role of the capital market in channeling long-term funds into the banking system.

Banks Attract Record-Breaking Deposits

In 2025, numerous banks reported significant growth in deposits from individuals and businesses, bolstering their capital inflows and creating a robust foundation to accelerate credit expansion. This surge in deposits enables banks to meet the increasing demand for capital, supporting the recovery and growth of economic production and business activities.

Bad Debt Auctions Surge as Banks Offload Corporate Non-Performing Loans

As the Lunar New Year approaches, the pace of non-performing loan (NPL) resolution intensifies across commercial banks. With numerous businesses struggling to secure funds for timely debt repayment, banks are increasingly resorting to auctioning off collateralized assets and debts to recover capital.