I. FUTURE CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

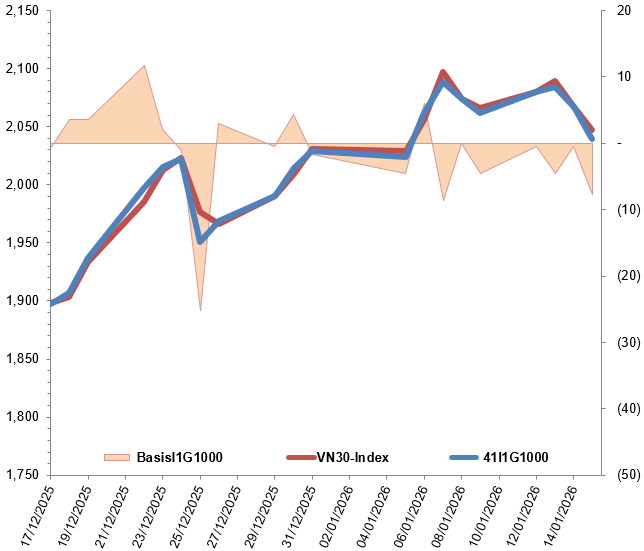

On January 15, 2026, all VN30 futures contracts experienced declines. Specifically, 41I1G1000 (I1G1000) dropped by 1.3% to 2,039.8 points; 41I1G2000 (I1G2000) fell by 1.21% to 2,041.1 points; 41I1G3000 (I1G3000) decreased by 0.27% to 2,040.4 points; and 41I1G6000 (I1G6000) declined by 0.73% to 2,040 points. The underlying index, VN30-Index, closed at 2,047.48 points.

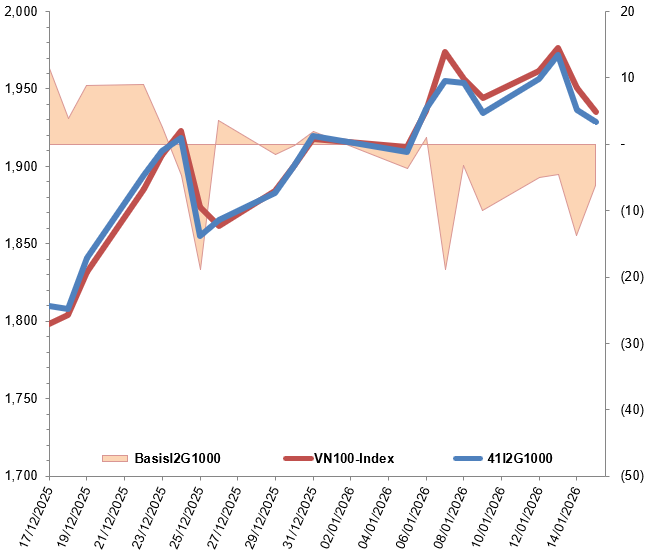

Similarly, all VN100 futures contracts saw declines on the same day. Notably, 41I2G1000 (I2G1000) dropped by 1.45% to 1,929 points; 41I2G2000 (I2G2000) fell by 0.42% to 1,930.7 points; 41I2G3000 (I2G3000) decreased by 1.46% to 1,923.4 points; and 41I2G6000 (I2G6000) declined by 0.59% to 1,920 points. The underlying index, VN100-Index, closed at 1,935.22 points.

During the January 15, 2026 session, the 41I1G1000 contract opened lower, with short sellers intensifying pressure, causing a steep decline throughout the morning session. In the afternoon, buyers re-emerged but failed to reverse the trend. Consequently, I1G1000 fluctuated and closed in the red, losing 26.8 points.

Intraday Chart of 41I1G1000

Source: https://stockchart.vietstock.vn

At the close, the basis of the I1G1000 contract widened compared to the previous session, reaching -7.68 points. This indicates increased pessimism among investors.

Fluctuations of 41I1G1000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN30-Index

Meanwhile, the basis of the I2G1000 contract narrowed compared to the previous session, reaching -6.22 points. This suggests a slight easing of investor pessimism.

Fluctuations of 41I2G1000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN100-Index

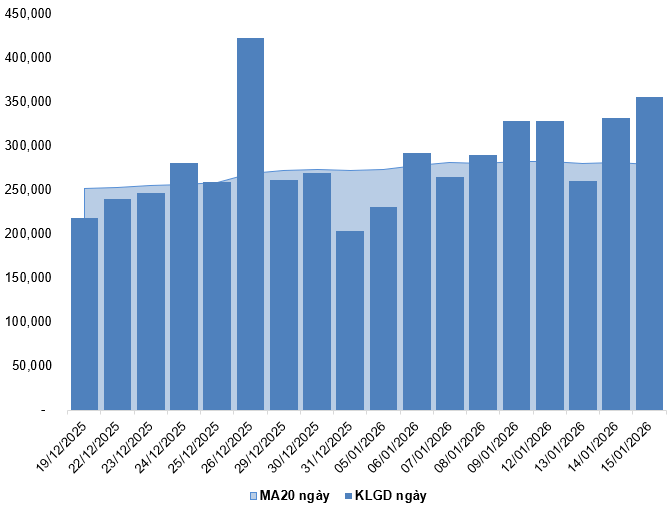

Trading volume and value in the derivatives market increased by 7.31% and 5.72%, respectively, compared to the previous session on January 14, 2026. Specifically, the trading volume of I1G1000 decreased by 0.8% to 314,189 contracts. The trading volume of I2G1000 was 34 contracts, down 5.56%.

Foreign investors continued to sell, with a net selling volume of 919 contracts on January 15, 2026.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

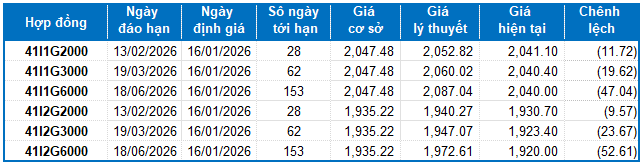

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of January 16, 2026, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate is replaced by the average deposit rate of major banks, with term adjustments for each futures contract.

I.3. Technical Analysis of VN30-Index

On January 15, 2026, the VN30-Index continued to decline, accompanied by trading volumes exceeding the 20-session average, reflecting heightened investor pessimism.

Currently, the MACD indicator is narrowing its gap with the Signal line. If a sell signal re-emerges, the outlook for upcoming sessions may worsen.

Additionally, the Stochastic Oscillator continues to decline after issuing a sell signal in the overbought region. If the indicator exits this region in upcoming sessions, short-term correction risks will increase.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURE CONTRACTS OF THE BOND MARKET

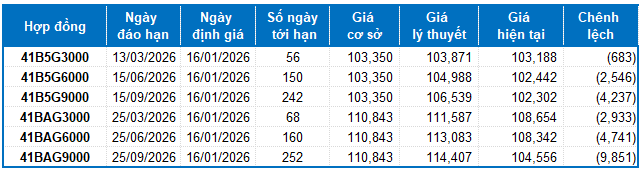

Based on the fair pricing method as of January 16, 2026, the reasonable price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate is replaced by the average deposit rate of major banks, with term adjustments for each futures contract.

According to the above valuation, contracts 41B5G3000, 41B5G6000, 41B5G9000, 41BAG3000, 41BAG6000, and 41BAG9000 are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they present favorable market opportunities.

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 18:28 15/01/2026

Technical Analysis for the Afternoon Session of January 14: Ongoing Tug-of-War in Market Dynamics

The VN-Index is experiencing a tug-of-war after reaching a historic high, with its sights set on the 1,935-1,950 point range. Meanwhile, the HNX-Index continues its upward trajectory, maintaining its position at the upper edge of a Falling Wedge pattern.

Technical Analysis for the Afternoon Session of January 12: Aiming for New Targets

The VN-Index continues its upward trajectory, eyeing a new target range of 1,935-1,950 points. Meanwhile, the HNX-Index has seen a robust increase, positioning itself to potentially test the upper boundary of the Falling Wedge pattern.