Despite ongoing fluctuations in the global textile market, Vietnam’s textile and garment industry aims for an export turnover of approximately $50 billion in 2026, a nearly $3 billion increase from 2025.

Significant Improvement in Localized Textile Production

This information was shared by Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association (VITAS) and Chairman of the Board of Directors of Viet Tien Garment Joint Stock Corporation.

According to Mr. Giang, 2025 will be a challenging year for the textile industry as the market no longer accommodates pure processing models.

Nevertheless, the industry’s exports are expected to reach around $46 billion, a 5.6% increase from 2024; the trade surplus is estimated at $21 billion, reinforcing its role as a pillar in the national trade balance.

Notably, one of the industry’s positive aspects is the significant presence of domestic enterprises. Mr. Giang stated that in the 2025 export structure, the added domestic value increased by approximately 52%, indicating substantial progress in sourcing raw materials locally. Businesses are also gradually meeting international brands’ requirements for deeper integration into the supply chain, from finance and materials to governance and social responsibility.

Mr. Vu Duc Giang emphasized that failure to meet these standards would leave foreign partners unable to assess a company’s capabilities, significantly risking order losses.

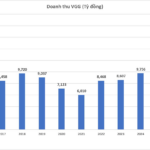

Citing Viet Tien Garment as an example, Mr. Giang noted that despite U.S. tariff barriers and increasing demands from partners for localization and origin principles, the company’s consolidated revenue by the end of 2025 exceeded VND 18.5 trillion, with exports growing 6-7% annually.

Viet Tien’s localization rate in production materials is approximately 70%. Photo: HA QUYEN |

This achievement is attributed to the company’s investment in raw material production facilities, increasing the localization rate to about 70%. This reduces dependence on imports and better complies with rules of origin in free trade agreements. The company is also gradually investing in technology, moving towards greener practices and higher value-added models instead of mere cut-and-sew processing.

After 50 years of development, the company now supplies products to major brands like Nike and Uniqlo, with Nike accounting for approximately 28% of total orders.

According to company leadership, involvement from design research to material sourcing, production, and logistics has made Viet Tien more resilient to order and trade policy fluctuations.

Increasing Intellectual Value in Exports

Beyond material origin requirements, VITAS leadership noted that personalization and custom design are becoming global trends, requiring companies to enhance the intellectual value of their products.

Mr. Giang cited a northern garment company that sold 6.8 million customized shirts globally in 2025, thanks to personalization.

Personalization and custom design in garment production are gaining global popularity. Photo: HA QUYEN |

Similarly, Garment Company 10, specializing in suits for Japan and the U.S., maintains export orders through made-to-measure production, with 60% handcrafted and 40% machine-made.

Mr. Than Viet Duc, CEO of Garment Company 10, reported that by the end of 2025, the company’s revenue reached VND 5.136 trillion with a profit of VND 212 billion, exceeding targets. This highlights the value created by personalized, custom-designed Vietnamese garments.

Looking ahead to 2026, Mr. Vu Duc Giang believes the textile industry will continue growing on three main pillars. First, benefits from new-generation free trade agreements (FTAs) and tariff reductions.

Second, investment shifts due to global geopolitical and economic changes. Vietnam is emerging as a new investment destination, especially in product segments previously beyond domestic capabilities. Several projects launched in 2025 offer opportunities to elevate the industry’s global value chain position.

Lastly, companies are proactively localizing materials and logistics, investing deeply in technology, digitalization, automation, and green practices.

THU HÀ

– 16:22 14/01/2026

Driving Export Growth in 2026: Strengthening Institutional Frameworks and Combating Origin Fraud

Mr. Tran Thanh Hai, Deputy Director of the Import-Export Department (Ministry of Industry and Trade), stated that in 2026, the total export turnover is projected to increase by over 8% compared to 2025. Simultaneously, the trade balance is expected to maintain a surplus of more than $23 billion, marking a 15% rise from the previous year.

Vietnam’s GDP Poised to Enter Global Top 10, Predicts Kinh Bac Chairman Dang Thanh Tam

“United by our love for our nation and driven by extraordinary determination, we must collectively build and execute this plan to confidently step into the new era,” emphasized Mr. Đặng Thành Tâm.