According to a report by DKRA Consulting, the primary supply of vacation properties, including villas, townhouses, and condotels, reached over 15,200 units in 2025. Approximately 4,400 units were sold during this period.

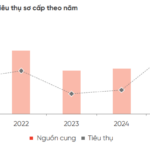

The luxury villa segment saw a 25% increase in supply compared to 2024, with 3,171 units available. Sales improved significantly, reaching 932 units—1.3 times higher than the previous year. However, transactions were primarily concentrated in projects priced under 10 billion VND per unit, with robust legal frameworks and financially stable developers.

Primary selling prices rose by an average of 8% year-over-year, peaking at 200 billion VND per unit in the Central region.

Luxury Villas 2025. Source: DKRA

|

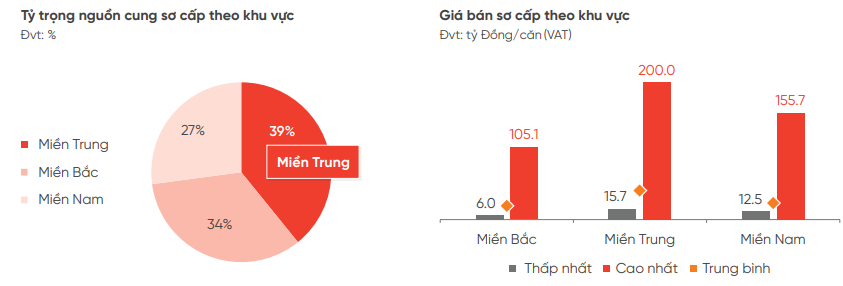

In the townhouse/shophouse segment, supply increased by 15% to 4,229 units, though still below pre-2022 levels.

Demand rebounded strongly, with 665 units sold—a 1.9-fold increase from 2024. New project launches accounted for 89% of total sales, while older projects continued to struggle.

Primary prices remained stable, showing minimal fluctuation compared to the previous year.

Townhouses/Shophouses 2025. Source: DKRA

|

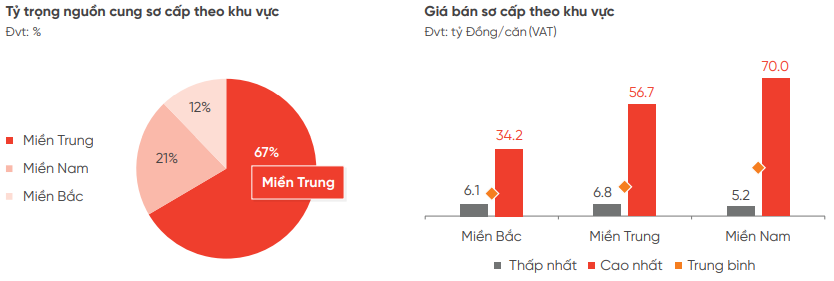

Conversely, the condotel segment faced ongoing challenges. Supply dropped by 8% to 7,838 units in 2025, with unsold inventory from older projects comprising 69%.

Demand remained weak, with only 2,799 units sold—a 9% decline year-over-year. Transactions were largely confined to select new projects, while older developments saw minimal activity.

Market liquidity stayed low, with buyers favoring projects under 3 billion VND per unit, complete legal documentation, and reputable developers. Primary prices rose by 12% year-over-year, maintaining elevated levels.

Condotels 2025. Source: DKRA

|

Supply projected to rise in 2026

For 2026, DKRA forecasts a slight increase in luxury villa supply, ranging from 1,200 to 1,500 units, primarily in Phú Thọ, Ninh Thuận, and Khánh Hòa.

Townhouse/shophouse supply is also expected to rise modestly, with 1,000–1,200 units, largely concentrated in Khánh Hòa.

Condotel supply is projected to remain stable at 2,500–3,000 units, mainly in Ho Chi Minh City, Khánh Hòa, and Quảng Ninh.

Overall, 2026 demand is anticipated to improve but unlikely to surge significantly. Primary prices are expected to rise further due to escalating input costs. Developers will likely continue offering discounts, interest subsidies, and principal grace periods to boost liquidity and sustain market appeal.

– 06:30 14/01/2026

Urban Retreats & MICE Tourism: Leading Trends for Year-End Market

As the year draws to a close, the fast-paced urban lifestyle and mounting work pressures fuel a growing demand for suburban retreats combined with MICE (Meetings, Incentives, Conferences, and Exhibitions) facilities, emerging as a prominent trend in the tourism and real estate market. The proximity to city centers, flexible operations, and integrated amenities make this segment increasingly popular during peak seasons.

Thanh Xuan Valley: Timeless Value with Permanent Ownership Rights

In a real estate landscape where nature-centric properties are predominantly developed as time-limited resorts, Thanh Xuan Valley stands out with its residential land legal status, offering perpetual ownership—a crucial foundation for creating a stable, sustainable, and generationally valuable living space.

Luxury Low-Rise Real Estate in East Hanoi Attracts Major Investment Flow

As the flow of capital shifts from short-term thinking to long-term value, luxury low-rise real estate in prime urban locations has emerged as the next coveted asset class among the affluent. Noble Palace Long Bien, with its limited collection of villas, transparent legal framework, and impressive construction progress, stands as a prime example of this trend in Hanoi’s eastern district.