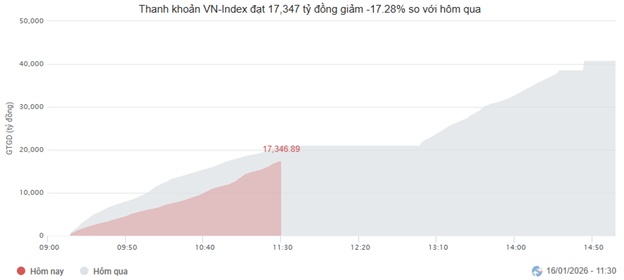

Despite a slight dip in market liquidity this morning, trading volumes on the HOSE reached nearly 480 million units, equivalent to over 17 trillion VND, marking a 17.28% decrease from the previous session.

Source: VietstockFinance

|

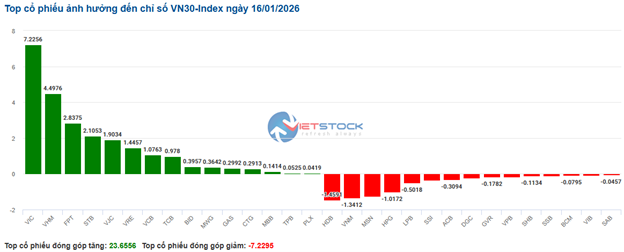

In terms of impact, the top 10 stocks contributed positively, adding nearly 27 points to the VN-Index. Notably, VIC alone contributed almost 12 points. Conversely, HDB and HVN exerted the most downward pressure, collectively reducing the index by over 1 point.

| Top 10 Stocks Influencing VN-Index on January 16, 2025 (Point-Based) |

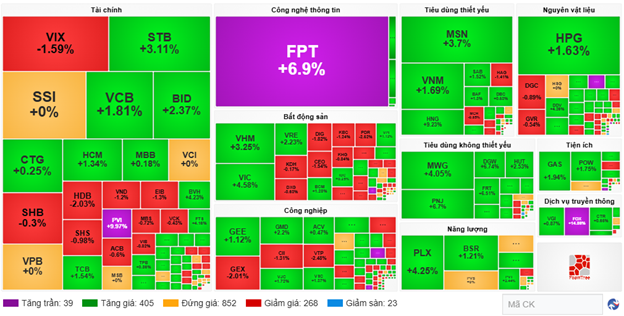

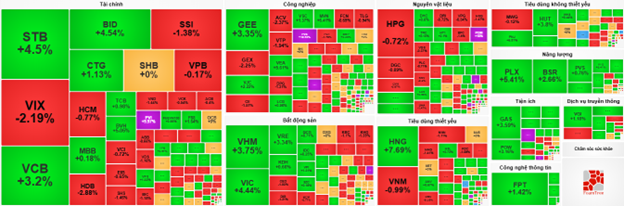

Green dominated across sectors, with 7 out of 11 sectors recording gains of 1% or more. The IT sector led with a remarkable 6.74% increase, driven by strong performances from FPT (ceiling), CMG (+4.94%), ELC (+3.38%), VEC (+10.24%), DLG (+3.6%), POT (+7.62%), and ITD (+5%).

Real estate, non-essential consumer goods, and media services sectors also performed well, with several stocks rising over 2%, including VHM, VRE, VIC, CTX, MWG, PNJ, DGW, HUT, FRT, PET, MSH, TTN, MFS, and FOC. Notably, TIP and FOX hit their upper limits.

Large-cap industrial and financial stocks significantly boosted the index, with gains from VJC (+1.72%), MVN (+6.82%), GEE (+1.12%), VEA (+7.4%), GMD (+2.2%), VCB (+1.81%), BID (+2.37%), TCB (+1.54%), and F88 (+1.31%).

Source: VietstockFinance

|

Foreign investors continued net selling, totaling 1.1 trillion VND across all three exchanges. Selling pressure was concentrated on VIX (152.28 billion VND), followed by PNJ and GMD (100-110 billion VND). Conversely, FPT led net buying with 215.61 billion VND, significantly outpacing other stocks.

| Top 10 Stocks with Strongest Foreign Net Buying/Selling on January 16, 2025 Morning Session |

10:30 AM: Caution Prevails in the Market

Investor caution led to subdued trading volumes, with major indices narrowing early gains and entering a tug-of-war. As of 10:30 AM, the VN-Index rose 21.14 points to 1,885.94, while the HNX-Index fell 1.09 points to 254.25.

VN30 basket stocks saw mixed movements, with buying momentum slightly dominating. VIC, VHM, FPT, and STB contributed 7.22, 4.49, 2.83, and 2.1 points, respectively. Conversely, HDB, VNM, MSN, and HPG faced selling pressure, reducing the VN30-Index by over 5 points.

Source: VietstockFinance

|

Real estate stocks rebounded positively, though divergence persisted. Notable performers included TIP (ceiling), VHM (+3.92%), VIC (+4.44%), and VRE (+3.02%). However, some stocks like TAL (-2.34%), TIG (-1.16%), NVL (-0.82%), and CEO (-1.54%) remained in the red.

Utility stocks also performed well, with strong gains from GAS (+3.5%), POW (+1.75%), NT2 (+0.77%), and PVG (+4.11%).

Essential consumer goods faced headwinds, with selling pressure on large-caps like VNM (-0.99%), MSN (-1.11%), DBC (-0.18%), and MCH (-4.97%).

Compared to the opening, divergence persisted, but buyers gained the upper hand, with 361 advancing stocks versus 279 declining.

Source: VietstockFinance

|

Opening: Green Dominates Early Session

At 9:30 AM on January 16, the VN-Index rose over 18.3 points to 1,883, while the HNX-Index gained 1.6 points to 254.

Green dominated early, with over 330 advancing stocks. Raw material stocks like POM (+15%), HT1 (+2.4%), and DHC (+0.76%) performed well from the start.

Financial stocks grew steadily, with most in the green. Notable gainers included BID (+2.37%), STB (+1.21%), and VCB (+2.09%).

Large-caps like VIC, VHM, and VCB led the index, contributing over 13.4 points. Conversely, HDB, GVR, and PLX weighed down the market, reducing it by over 1.5 points.

– 12:05 16/01/2026

Which Insurance Stocks Are Burning a Hole in Investors’ Pockets?

A promising industry outlook doesn’t guarantee profitability for every stock within it. Amidst this divergence, only companies with exceptional competitive advantages deliver meaningful returns, while misjudged selections can prove costly for investors.

Market Pulse 15/01: Recovery Efforts Underway, Yet Insufficient

After enduring a barrage of challenges in the morning session, the market demonstrated notable recovery efforts in the afternoon. However, these attempts could only partially offset the earlier decline.