At the “Vietnam Real Estate Market Overview Q4/2025” press conference hosted by CBRE Vietnam, Mr. Le Trong Hieu, Senior Director of Industrial & Office Real Estate at CBRE Vietnam, assessed that Vietnam’s industrial real estate market experienced significant fluctuations in 2025 due to global geopolitical tensions and domestic reforms.

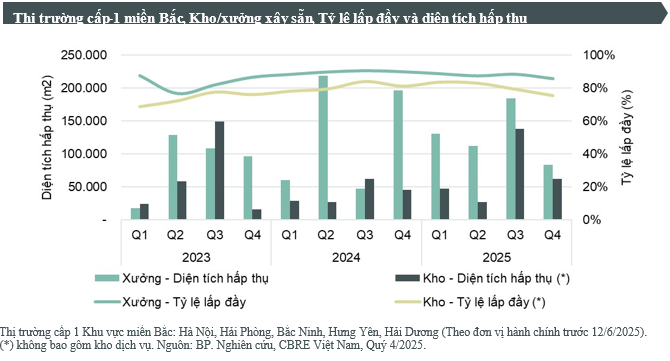

In the Northern region, the ready-built warehouse segment witnessed a record-high new supply, with nearly 1.2 million sqm completed in 2025. Ready-built factories accounted for over 60% of this new supply. Multi-story warehouses and hybrid warehouse/factory products became more prevalent, particularly in Bac Ninh, enhancing flexibility in project structures.

Despite the surge in supply, the average occupancy rate in Tier 1 cities in the North slightly decreased to 75.4% for ready-built warehouses (down 5.8 percentage points year-on-year) and 85.8% for ready-built factories (down 4.2 percentage points year-on-year). However, demand remained robust as manufacturers favored ready-built options for their flexibility and lower initial investment costs. Absorption for both segments reached 0.8 million sqm in 2025, a 4.3% increase from the previous year.

Rental prices in Tier 1 cities averaged $4.9/sqm/month for ready-built warehouses and $5.0/sqm/month for ready-built factories, rising by 6.3% and 3.3% respectively. Electronics manufacturers remained the dominant tenants in the North, while logistics companies and sports equipment firms also recorded significant transactions.

For industrial land, absorption in Tier 1 cities totaled nearly 480 hectares in 2025, a 24% decline year-on-year. Slower leasing activity led to a moderation in rental price growth, with average asking prices rising 4% to $143/sqm/lease term, compared to 6-11% annual increases from 2021 to 2023.

Mr. Le Trong Hieu noted that in 2026, industrial real estate supply is expected to remain high as numerous projects launched in late 2025 are set to complete and lease out between 2026 and 2027.

Mr. Le Trong Hieu, Senior Director of Industrial & Office Real Estate at CBRE Vietnam

A key highlight is the ongoing development of critical transportation infrastructure and the establishment of free trade zones. These factors are expected to expand the industrial real estate market into new potential areas, such as Gia Binh Airport (Bac Ninh) and southern Hai Phong, home to emerging industrial zones and a free trade zone.

Navigating the New Cycle: Office and Industrial Markets Face Intensifying Competitive Pressures

Following a cautious recovery phase in 2025, Vietnam’s office and industrial leasing market is poised to enter a new growth cycle in 2026, driven by high-quality supply, improved transportation infrastructure, favorable policies, and a shifting demand landscape.

Up-Close Look at the $315 Million Thuong Cat Bridge Construction Site Spanning the Red River

The Thuong Cat Bridge project is a state-of-the-art cable-stayed bridge design, spanning over 5.2 kilometers in length, including both the bridge and its approach roads. Its impressive structure features an 8-lane cross-section, accommodating 6 lanes for motorized vehicles and 2 lanes for non-motorized traffic.

LA Home: Bridging Northern Markets, Leading Infrastructure in Ho Chi Minh City’s Western District

On January 8, 2026, Hanoi witnessed the unveiling and orientation training event for the LA Home Eco-Urban Area Project – Northern Region, themed “LA Home: The Epicenter of Flow – Riding the 2026 Infrastructure Wave.”