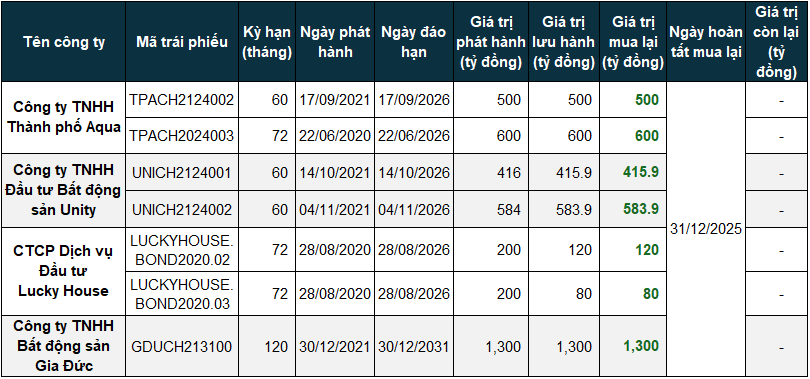

Specifically, four companies redeemed their bonds ahead of schedule: Aqua City LLC (TPAC), Unity Real Estate Investment LLC (UNIC), Lucky House Investment Services JSC (LKHC), and Gia Duc Real Estate LLC (GDUC).

Gia Duc led with the largest redemption value at 1.3 trillion VND, followed by Aqua City with 1.1 trillion VND. Unity Real Estate and Lucky House secured the third and fourth positions with 1 trillion VND and 200 billion VND, respectively.

|

Bonds redeemed by NVL’s subsidiary on December 31, 2025

Compiled by the author

|

In the same year-end session, NVL completed the issuance of nearly 164 million shares to convert a debt of over 2.577 trillion VND.

The shares were directly distributed to two creditors: Novagroup JSC (approximately 156.6 million shares) and Diamond Properties JSC (approximately 7.1 million shares) at an issuance price of 15,747 VND per share. Both entities are related parties of NVL’s Chairman, Bui Thanh Nhon. The issued shares will be restricted from transfer for one year.

Additionally, NVL initiated a share issuance to convert a portion of its 335 million USD international convertible bond package. Specifically, bondholders proposed the conversion of 133 bonds with a total conversion value of 747 billion VND. NVL agreed with the bondholders on a conversion ratio of 156,018 shares per bond at a conversion price of 36,000 VND per share. In the conversion on December 31, 2025, four foreign bondholders received a total of nearly 20.1 million NVL shares.

– 11:46 15/01/2026

What Will Chuong Duong Corp Utilize the Capital Raised from Its Share Offering For?

Chapter Yang Corp anticipates raising over VND 527.7 billion from the issuance of nearly 52.8 million shares to existing shareholders. The proceeds will be allocated to repay debts owed to individuals and organizations, repurchase bonds, and settle bank loans.