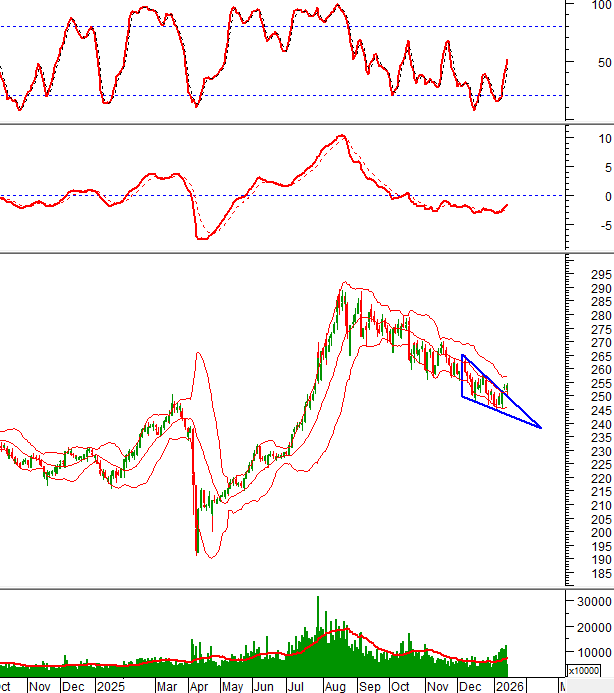

Technical Signals of VN-Index

During the morning trading session on January 15, 2026, the VN-Index experienced a sharp correction, marked by a long red candle.

The sell signal from the Stochastic Oscillator indicates increased short-term risk. However, the likelihood of a deep correction remains low, as trading volume consistently exceeds the 20-day average.

The previous peak from October 2025 has been fully breached and will now serve as a strong support level moving forward.

Technical Signals of HNX-Index

During the morning trading session on January 15, 2026, the HNX-Index adjusted and found support at the Middle Band of the Bollinger Bands.

However, the index remains above the Falling Wedge pattern’s edge, suggesting limited downside risk.

NT2 – Nhon Thanh 2 Petro Power JSC

The share price of NT2 rose during the morning session on January 15, 2026, accompanied by trading volume surpassing the 20-session average, reflecting investor optimism.

Currently, NT2’s price continues to rise, closely tracking the Upper Band after successfully breaking through the October 2025 peak (around 24,900-25,300), indicating a positive outlook.

Additionally, the MACD indicator continues to rise after generating a buy signal, further supporting the long-term upward trend.

SZC – Sonadezi Chau Duc JSC

During the morning session on January 15, 2026, SZC’s share price rose for the fifth consecutive session, closely following the Upper Band of the Bollinger Bands, with trading volume expected to exceed the average by session’s end, indicating strong investor optimism.

Currently, SZC maintains a short-term recovery trend and is approaching the long-term downward trendline, which coincides with the November 2025 peak (around 32,700-33,600).

However, the Stochastic Oscillator has entered the overbought zone. If a sell signal reappears and the indicator exits this zone in upcoming sessions, the risk of a downward correction may arise.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:05 January 15, 2026

Market Pulse 15/01: Recovery Efforts Underway, Yet Insufficient

After enduring a barrage of challenges in the morning session, the market demonstrated notable recovery efforts in the afternoon. However, these attempts could only partially offset the earlier decline.

Vietstock Daily 16/01/2026: Mounting Pressure

The VN-Index continues its adjustment phase, with trading volumes remaining above the 20-day average, indicating significant profit-taking pressure. Short-term risks appear to be rising as the Stochastic Oscillator weakens further following a sell signal, while the MACD shows signs of slowing its upward momentum. In this context, the previously breached October 2025 peak will serve as a critical short-term support level.

Vietnam Needs $200-300 Billion Enterprises to Lead Its Economic Transformation

“With a population of 100 million, a vast and dynamic workforce, a robust domestic market, and an unwavering ambition to rise, the emergence of globally competitive enterprises is not just desirable but essential. We must embrace this vision as a unified national goal as we step into an era of unprecedented growth and transformation,” shared economic expert Đinh Thế Hiển with Tiền Phong.