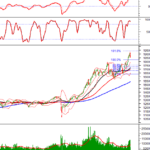

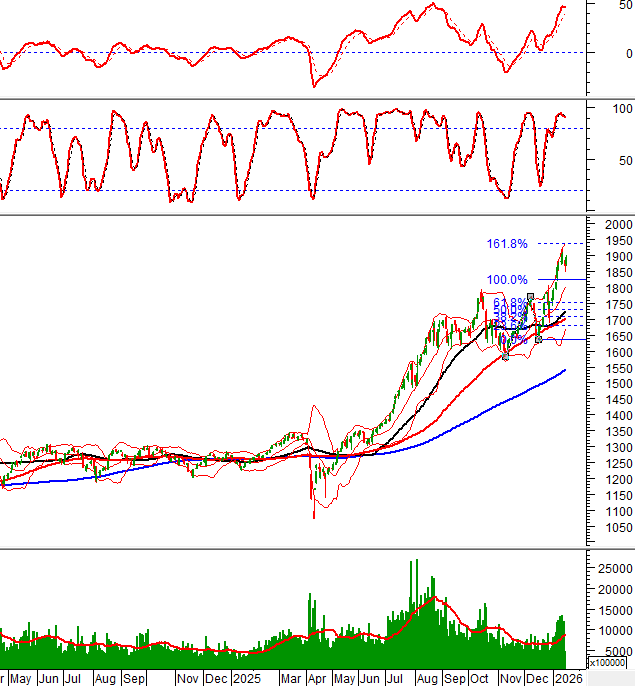

Technical Signals of VN-Index

During the morning trading session on January 16, 2026, the VN-Index staged an impressive recovery with a long green candle, maintaining trading volume above the 20-day average for several consecutive sessions.

The index is now targeting the 1,935-1,950 range (equivalent to the 161.8% Fibonacci Projection level).

Technical Signals of HNX-Index

In the morning session on January 16, 2026, the HNX-Index formed a Long Upper Shadow candlestick pattern, indicating significant selling pressure.

The index remains above the Falling Wedge pattern’s support line, suggesting limited downside risk. The pattern’s price target is the 266-268 range.

DHC – Dong Hai Ben Tre JSC

On January 16, 2026, DHC shares reversed with a slight gain in the morning session, though trading volume remained subdued, reflecting investor hesitation.

Currently, DHC trades near the lower boundary (32,400-33,500 range) of a Triangle pattern, as the MACD indicator narrows its gap with the Signal line.

Additionally, the Stochastic Oscillator continues to decline after a sell signal. Without improvement or support at the pattern’s lower boundary, the outlook for DHC may turn more bearish.

FPT – FPT Corporation

During the January 16, 2026 morning session, FPT shares surged, forming a White Marubozu candlestick with above-average 20-session trading volume, signaling renewed investor activity.

The stock price remains near the upper Bollinger Band, while the MACD indicator continues its upward trend following a buy signal.

Furthermore, FPT maintains its short-term recovery trend, breaking above the 200-day SMA, indicating a more positive long-term outlook.

Note: This analysis is based on real-time data as of the morning session’s close. Signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:09, January 16, 2026

Which Insurance Stocks Are Burning a Hole in Investors’ Pockets?

A promising industry outlook doesn’t guarantee profitability for every stock within it. Amidst this divergence, only companies with exceptional competitive advantages deliver meaningful returns, while misjudged selections can prove costly for investors.

Market Pulse 15/01: Recovery Efforts Underway, Yet Insufficient

After enduring a barrage of challenges in the morning session, the market demonstrated notable recovery efforts in the afternoon. However, these attempts could only partially offset the earlier decline.