Vingroup Redefines Market Order in 2025 – Illustrative Image

|

The year 2025 marks a significant milestone for Vietnam’s stock market as the VN-Index reached a historic closing high of 1,784.49 points, a 40.87% increase from the previous year-end. This surge not only propelled the index to its highest level in over two decades but also set the stage for continued momentum into early 2026, with the VN-Index quickly breaking new records within the first few trading weeks.

|

VN-Index Continually Conquers New Milestones |

|

Source: VietstockFinance

|

Against this backdrop, the market capitalization witnessed a remarkable surge. By the end of 2025, the total market capitalization reached nearly VND 9.88 quadrillion, a 60% increase from 2024. Non-financial enterprises alone accounted for over VND 6.66 quadrillion, a 61% growth, becoming the primary driver of the market’s expansion.

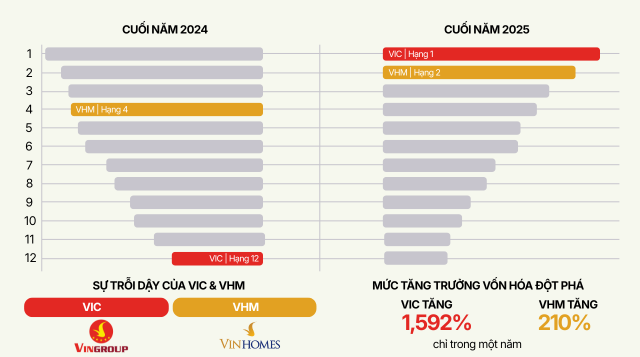

Beyond the growth in scale, 2025 also saw a significant reshuffling within the Top 10 non-financial enterprises by market capitalization. Notable breakthroughs, pivotal shifts, and the emergence of new players characterized this transformation compared to the previous year’s rankings.

Absolute Dominance: The Vingroup Era

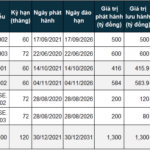

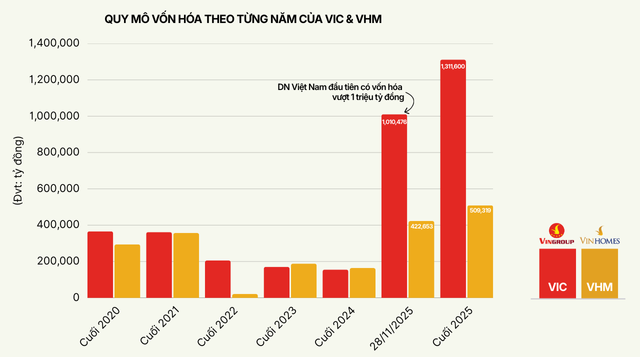

The highlight of the 2025 market capitalization rankings is Vingroup Joint Stock Company (HOSE: VIC), which experienced a groundbreaking growth. From the 12th position in 2024, VIC‘s market capitalization soared by 1,592%—from VND 77.5 trillion to over VND 1.3 quadrillion—officially topping the list of non-financial enterprises.

Vingroup’s lead is overwhelming, with VIC‘s market capitalization 2.5 times that of the second-ranked company and accounting for nearly 40% of the total market capitalization of the entire Top 10. This shift signifies not just a change in rankings but a complete reshaping of the market’s power dynamics.

The driving force behind this surge stems from the synergistic effect of stock price appreciation and increased circulating shares. The largest-ever bonus share issuance at a 1:1 ratio doubled the share volume, amplifying the impact of the 736.5% price increase during the year, thereby establishing a record valuation.

The strength of the Vingroup ecosystem is further solidified as Vinhomes Joint Stock Company (HOSE: VHM) secures the second position with a market capitalization exceeding VND 509 trillion, a 210% increase from the previous year, creating a significant gap from the chasing group.

Source: VietstockFinance, compiled by the author

|

Source: VietstockFinance, compiled by the author

|

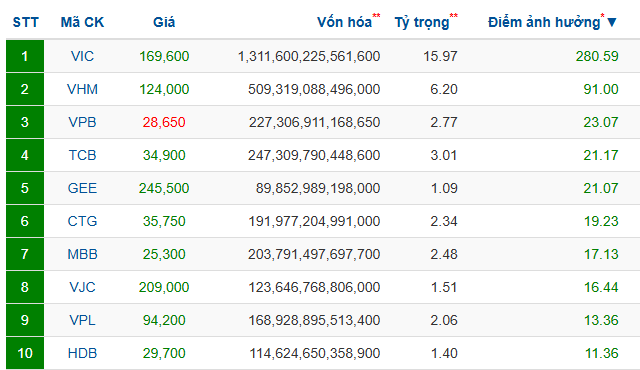

The Vingroup’s influence on the VN-Index is evident in its contribution. The four stocks VIC, VHM, VPL, and VRE collectively contributed 395.28 points to the VN-Index‘s rise in 2025, representing over 76.35% of the market’s total increase. VIC alone contributed 280.6 points, and VHM added 90.7 points, underscoring their decisive leadership role.

Top 10 Stocks with the Most Positive Impact on VN-Index in 2025 – Source: VietstockFinance

|

Former Leaders Falter: Dominance No Longer Absolute

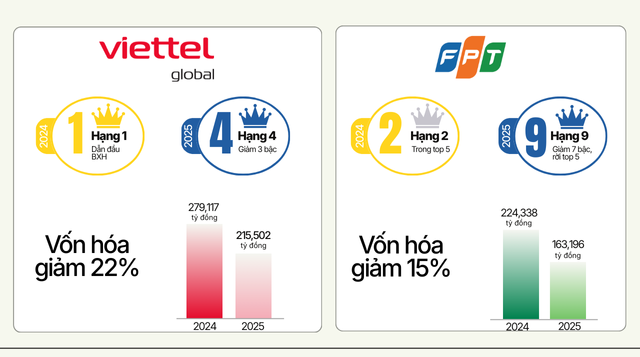

In contrast to the leading group’s surge, 2025 saw capitalization adjustments in several enterprises that previously held top positions. Viettel Global Investment Joint Stock Company (Viettel Global, UPCoM: VGI), the 2024 market capitalization leader, experienced a 22% decline and dropped to the fourth position. This shift partly reflects the sensitivity of enterprises with significant overseas assets and operations to geopolitical fluctuations and exchange rate volatility. It also highlights the short-term adjustment pressure on tech stocks after a strong price increase phase, as profit-taking sentiment grew.

Source: VietstockFinance, compiled by the author

|

FPT Corporation (HOSE: FPT) also recorded a 15% capitalization decline, falling from the second position in 2024 to ninth in 2025. This shift reflects the challenges in maintaining high growth rates at a large scale, amidst slowing global IT spending and more cautious international investment plans and digital transformation project implementations.

The decline of former leaders indicates an increasingly polarized capitalization race, where positions are not fixed and heavily depend on the ability to sustain growth momentum across market phases.

New Entrants and Stable Pillars

A notable highlight of the 2025 rankings is the emergence of Vinpearl Joint Stock Company (HOSE: VPL). As a newly listed stock in the year, VPL quickly entered the Top 10 at eighth position with a market capitalization of nearly VND 169 trillion. The stock began trading on May 13, 2025, with a reference price of VND 71,300 per share and closed the year at VND 94,200 per share, a 32% increase.

Alongside the rise of new entrants, many leading enterprises maintained stable growth, contributing to a balanced market foundation. Masan Consumer Holdings (HOSE: MCH) saw an 84% capitalization increase, Mobile World Investment Corporation (HOSE: MWG) grew by 49%, reflecting the resilience of the domestic consumer sector. Hoa Phat Group Joint Stock Company (HOSE: HPG) increased by 43%, indicating the steel industry’s recovery, while Petrovietnam Gas Joint Stock Corporation (PV GAS, HOSE: GAS) rose by 16%, maintaining its role as an energy sector pillar.

The combination of strong breakthroughs and steady growth has created a dual-speed market structure, with overwhelming dominance at the top and stable depth from leading enterprises.

Top 10 Restructuring: Shifting Investment Preferences

The 2025 Top 10 capitalization changes clearly reflect shifting investment preferences. Three names—Vietnam Dairy Products Joint Stock Company (Vinamilk, HOSE: VNM), Vietnam Rubber Group Joint Stock Company (HOSE: GVR), and Masan Group Corporation (HOSE: MSN)—exited the rankings, making way for VIC, VPL, and MWG compared to 2024. This shift indicates capital moving away from traditional, slow-growth sectors toward breakthrough growth stories, newly listed companies, and models tied to domestic consumption.

In terms of exchange composition, the 2025 Top 10 includes eight HOSE-listed companies, up from seven the previous year, primarily due to MCH‘s official transfer from UPCoM. This trend, along with the decline of VGI and ACV on UPCoM, somewhat reflects larger capital increasingly favoring the transparency, liquidity, and reputation of the main exchange.

Source: VietstockFinance, compiled by the author

|

– 20:00 15/01/2026

Technical Analysis for the Afternoon Session of January 15th: A Sharp Correction

The VN-Index experienced a sharp correction, accompanied by a sell signal from the Stochastic Oscillator, indicating heightened short-term risk. Similarly, the HNX-Index is in a comparable state, currently finding support at the Middle line of the Bollinger Bands.

Vietstock Daily 16/01/2026: Mounting Pressure

The VN-Index continues its adjustment phase, with trading volumes remaining above the 20-day average, indicating significant profit-taking pressure. Short-term risks appear to be rising as the Stochastic Oscillator weakens further following a sell signal, while the MACD shows signs of slowing its upward momentum. In this context, the previously breached October 2025 peak will serve as a critical short-term support level.