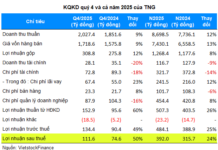

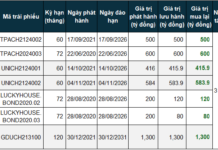

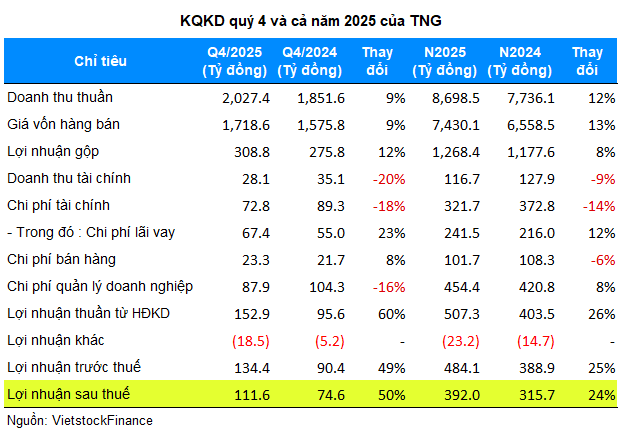

TNG has announced its Q4/2025 financial report, revealing a net profit of nearly 112 billion VND, a 50% increase compared to the same period last year. Although this profit is lower than the peak recorded in the previous two quarters, the Q4 results significantly contributed to TNG concluding 2025 with its most robust business performance to date.

For the full year, the company recorded a net profit of 392 billion VND, a 24% increase from 2024 and the highest in its operational history. Revenue for 2025 reached nearly 8,700 billion VND, an additional 1,000 billion VND (+12%) compared to the previous year.

With these achievements, TNG surpassed its annual targets by approximately 7% in revenue and 15% in profit.

|

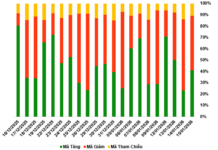

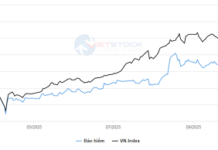

On the HNX market, the price movement of TNG shares shows a notable improvement. As of the session on January 15th, TNG traded at 20,600 VND per share, a 13% increase in less than two weeks into the year. This marks a significant reversal compared to the 19% decline in share price throughout 2025.

| TNG shares are returning to September 2025 price levels |

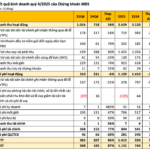

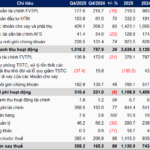

Alongside positive profit results, the financial report also highlights significant cash flow fluctuations. By the end of 2025, TNG‘s net cash flow from operating activities was negative at 259.5 billion VND, compared to a positive figure of over 1,000 billion VND in the same period the previous year. This was primarily due to a sharp increase in cash outflows and a shortfall in other operating income collections compared to the previous year.

Inventory and debt surge

In addition to cash flow fluctuations, TNG‘s inventory levels also saw a significant increase. By the end of 2025, the inventory value reached over 1,400 billion VND, a 35% increase from the beginning of the year. Finished goods accounted for the largest share at over 506 billion VND, a 76% increase.

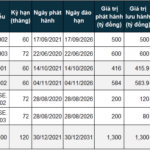

Conversely, financial pressure mounted as TNG‘s financial debt at the end of 2025 exceeded 3,300 billion VND, a 28% increase from the beginning of the year. Short-term loans constituted the majority, at nearly 2,400 billion VND.

Meanwhile, the company’s bank deposits decreased by 29%, to 317 billion VND. This partly explains why TNG‘s financial activity revenue in 2025 dropped by 9% compared to the previous year, falling below 117 billion VND.

– 08:44 16/01/2026

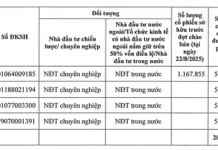

First Securities Firm Releases Q4/2025 Financial Report: Profit Surges Nearly 90% Year-on-Year, Margin Debt Cools Down

In 2025, the brokerage firm impressively surpassed its profit target by nearly 9% for the entire year.

Vietlott Awards Over 5.342 Trillion VND in Prizes in 2025, Including a Record-Breaking Jackpot Winner

In 2025, Vietlott (Vietnam Computerized Lottery One Member Limited Liability Company) achieved a remarkable revenue of over 9.686 trillion VND, marking a 22% increase compared to 2024 and surpassing the Ministry of Finance’s target by 11%. The company contributed more than 2.495 trillion VND to local budgets, a 20% rise year-over-year. Vietlott recorded over 32 million winning entries and distributed prizes totaling over 5.342 trillion VND to players nationwide, reflecting a 25% growth in payouts.

MBS Reports 86% Surge in Q4 Profits, Exceeding 2025 Annual Targets

MBS Securities Corporation (HNX: MBS) has released its standalone financial report for Q4/2025, reporting a net profit of over 308 billion VND, an 86% increase driven by strong performance in lending, investment, and brokerage activities. This growth offset the decline in proprietary trading profits and rising interest expenses. The results also enabled MBS to surpass its full-year pre-tax profit target.