Apartment Prices Surge, Mostly Above 80 Million VND/m²

According to the latest report from the Ministry of Construction, by 2025, apartment prices have risen significantly, with a widespread increase of 20-30% compared to the previous year. Some areas have seen spikes of over 40%, primarily in the mid-range and luxury segments.

Data from the Vietnam Real Estate Market Research Institute (VARS IRE) also indicates that housing prices continue to climb, setting new records in most regions. The apartment segment remains a “hotspot,” with new listing prices soaring across major cities.

In Hanoi, the average price of new listings reached approximately 100 million VND/m², a 40% increase from 2024. In Ho Chi Minh City (formerly), the average price hit around 111 million VND/m², up 23% year-on-year, with numerous luxury projects launching toward the end of the year.

In the secondary market, Hanoi saw rapid price increases in a short period, with some areas recording jumps of hundreds of millions to billions of VND per unit.

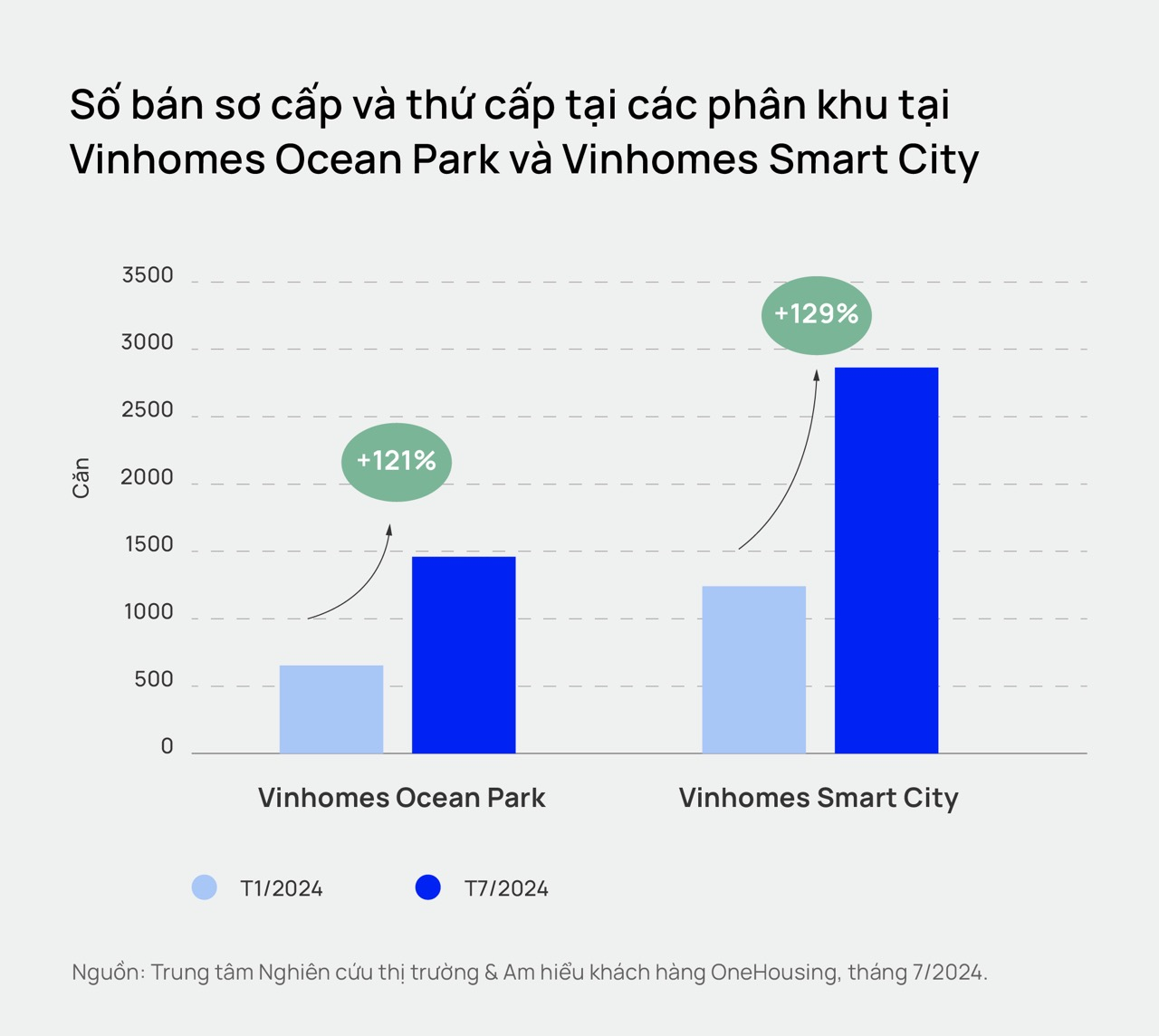

Chart: Hồng Khanh. Data: VARS IRE

Beyond price dynamics, the supply-demand imbalance remains a market bottleneck. In some southern regions, the supply of affordable commercial housing has increased, partially easing the imbalance. However, in Hanoi, Da Nang, and Ho Chi Minh City (formerly), the disparity is more pronounced, as social housing supply, though improving, lags far behind commercial housing priced above 80 million VND/m².

VARS IRE reports that in 2025, the market saw over 80,000 new apartments, double the 2024 figure. Notably, about 25% of new supply, or over 20,000 units, were priced above 100 million VND/m², a nearly tenfold increase from the previous year. In Hanoi and Ho Chi Minh City (formerly), approximately 85% of new apartment listings were priced above 80 million VND/m².

The market structure continues to shift toward luxury, high-end, and ultra-luxury segments, while affordable commercial housing remains scarce.

FOMO Cools Down, Price Adjustments, and Liquidity Shifts

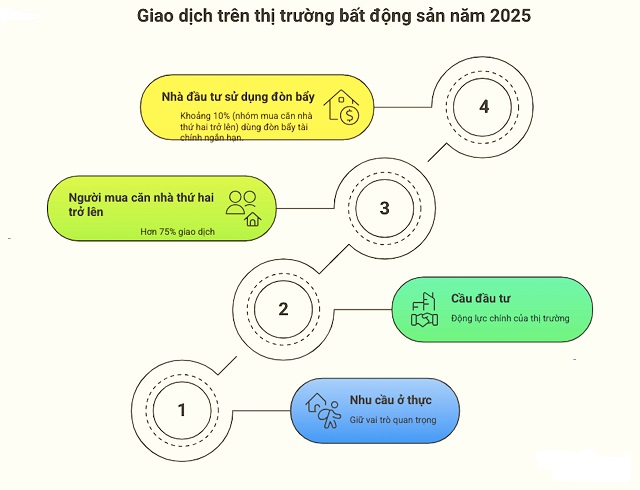

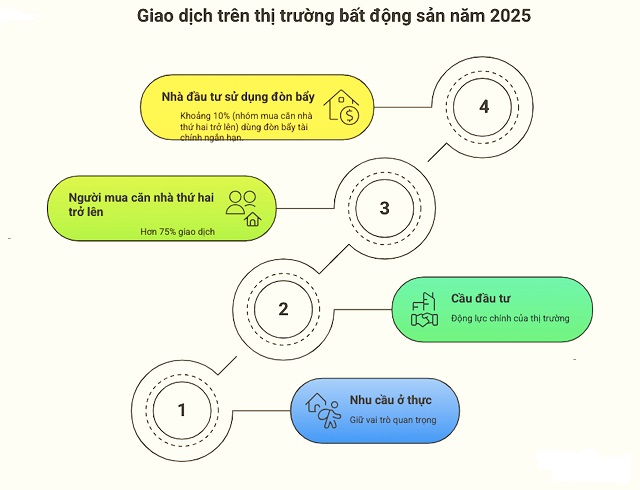

On the demand side, VARS IRE notes that genuine housing needs remain significant, but investment demand still drives the market. Over 75% of transactions come from buyers purchasing their second or subsequent homes, with about 10% using short-term financial leverage.

Graphic: Hồng Khanh

|

However, by late 2025, the apartment market’s growth momentum slowed. Some FOMO-driven investors began selling at a loss, while prices in central areas remained stable.

Speaking to reporters, Mr. Nguyễn Vũ Cao, Chairman of Vạn Khang Phát Group (Khang Land), stated that price movements outpacing liquidity reflect post-recovery market psychology.

He explained that secondary market prices are largely shaped by expectations from the previous cycle, while actual purchasing power is driven by current capital costs and income.

Mr. Cao observed that FOMO has been exaggerated, with some buyers following herd mentality and short-term strategies amid insufficient supply. This has led to rapid, localized price increases, particularly in Hanoi.

In 2026, the market is expected to enter an adjustment phase, focusing on repricing and liquidity redistribution rather than uniform price shifts.

“Liquidity will likely move away from overpriced segments lacking practical value toward products that are easy to live in, rent out, and transfer. The market will increasingly favor genuine buyers over speculative price-driven operations,” Mr. Cao said.

Assessing 2026 real estate risks, Mr. Cao highlighted localized oversupply in rapidly developed areas as the biggest threat.

Additionally, high financial leverage and herd-driven, unverified investments pose risks as the market enters a more rigorous filtering phase.

The growing gap between listing prices and actual market affordability is another factor investors must closely monitor.

Mr. Nguyễn Vũ Cao advised investors to return to fundamentals: prioritize products with clear, transparent legal frameworks; carefully assess cash flow, financial capacity, and developer reputation; limit leverage; and adopt mid- to long-term strategies. “Prudence and financial discipline are key to minimizing risks in a volatile or reversing market,” he emphasized.

Hồng Khanh

– 05:45 16/01/2026