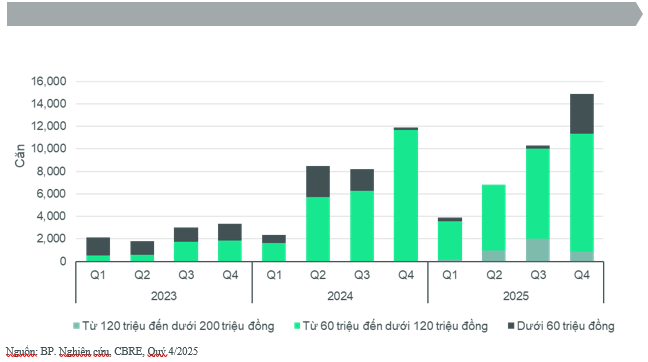

CBRE Vietnam has released its Q4 2025 market highlights for Hanoi’s real estate sector. In the apartment segment, Hanoi saw the launch of 14,905 new units, bringing the total new supply for the year to nearly 36,000 units. This marks the second-highest annual launch volume ever recorded in Hanoi’s apartment market, surpassed only by 2019.

Notably, this year also witnessed a record-breaking launch volume in the high-end segment, with nearly 4,000 units priced above VND 120 million/m² (excluding VAT, maintenance fees, and pre-discounts), accounting for 11% of the year’s total launches.

Another prominent trend observed in Q4 2025 was the significant supply contribution from mega-urban areas in Van Giang (Hung Yen, bordering Hanoi). New launches in this area accounted for over 60% of the quarter’s total supply and nearly 40% of Hanoi’s annual supply in 2025.

Hanoi recorded 14,905 newly launched apartments in Q4 2025.

Demand remained robust despite the strong new supply. Total sales in Q4 2025 exceeded 13,500 units, bringing the annual total to 34,760 units. Newly launched projects in the final quarter achieved an average absorption rate of 79%. Although slightly lower than the previous quarter, this rate still demonstrates the primary market’s stable absorption capacity amidst abundant new supply.

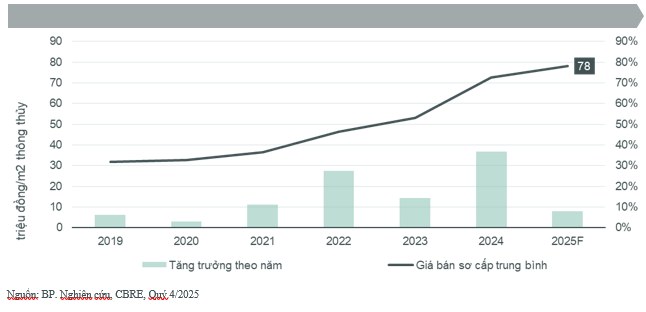

Price movements revealed a clear divergence between inner-city and suburban areas. The average primary price in Q4 2025 reached over VND 78 million/m² (excluding VAT, maintenance fees, and pre-discounts), 14% lower than Q3 but still 8% higher year-on-year. This trend was driven by a large supply of suburban units priced between VND 50-60 million/m². Meanwhile, new projects in Hanoi’s inner districts maintained prices ranging from VND 90-100 million/m².

Primary apartment prices in Q4 2025 averaged over VND 78 million/m².

In the secondary market, average prices in Q4 remained virtually unchanged from Q3 at VND 62 million/m². Year-on-year growth slowed to 24%, down from the peak of 26% in Q3. This cooling occurred towards year-end, attributed to factors such as the substantial price increases in previous quarters, abundant primary supply attracting buyer capital, and initial buyer reactions to rising interest rates.

Hanoi’s apartment market in 2026 is expected to see new supply of approximately 33,000 units, nearly matching 2025 levels. Primary prices are projected to stabilize due to strong supply, competitive pricing from Van Giang projects, and high-priced inner-city developments. Meanwhile, secondary prices may face pressure from rising interest rates and future abundant supply.

Ms. Nguyen Hoai An, Senior Director of CBRE Vietnam’s Hanoi branch, believes that infrastructure development remains a key driver for new real estate projects.

Ms. Nguyen Hoai An, Senior Director of CBRE Vietnam’s Hanoi branch, commented: “Infrastructure development, particularly in transportation, continues to be a crucial driver for new real estate projects, including many large-scale ones. Amidst evolving macro conditions and market competition, developers are expected to thoroughly prepare their investments, ensuring suitable financial, business, and product strategies to effectively adapt to each phase of market fluctuations.”

Emerging Hotspots in Southern Hanoi’s Real Estate Cycle: Where Are Prices Poised to Surge?

After years of being considered a “price trough,” the real estate market in South Hanoi is undergoing a noticeable transformation as a series of national “strategic” infrastructure projects are being implemented simultaneously. Amidst the influx of investment capital seeking opportunities, the question arises: which area and project are positioned at the “starting point” of a new price appreciation cycle?

“Panic Selling” Emerges as FOMO Investors Cut Losses After Market Peak

Real estate experts reveal that secondary market apartment prices in Hanoi have surged dramatically over a short period, with many areas seeing increases ranging from hundreds of millions to billions of Vietnamese dong per unit. However, this upward trend is showing signs of slowing down toward the year-end, as some investors who bought during the peak frenzy due to FOMO (fear of missing out) are now listing their properties at a loss.

West Thang Long Opens to Traffic: Opportunities for Investors and Homebuyers?

West Thang Long Avenue (the section through Tu Liem) is nearing its final stages, poised to become a strategic transportation artery connecting Hanoi’s core with satellite cities. This milestone not only enhances regional connectivity but also catalyzes the local real estate market. Which key locations stand to benefit most from this transformative project?

MBS Reports 86% Surge in Q4 Profits, Exceeding 2025 Annual Targets

MBS Securities Corporation (HNX: MBS) has released its standalone financial report for Q4/2025, reporting a net profit of over 308 billion VND, an 86% increase driven by strong performance in lending, investment, and brokerage activities. This growth offset the decline in proprietary trading profits and rising interest expenses. The results also enabled MBS to surpass its full-year pre-tax profit target.