According to the latest update from the data aggregation and mining platform Metric.vn, in 2025, the combined revenue of Vietnam’s four leading e-commerce platforms—Shopee, TikTok Shop, Lazada, and Tiki—soared to VND 429.7 trillion, marking a robust 34.75% increase compared to 2024.

In 2024, these platforms, including Sendo (which has since shifted its business model and is no longer included in statistics), recorded a total revenue of VND 318.9 trillion.

Over 3.94 million products were sold to customers in 2025, reflecting a 15.23% growth compared to the previous year.

The combined revenue of the four e-commerce platforms reached VND 429.7 trillion in 2025. (Source: Metric)

Everyday items priced between VND 100,000 and VND 200,000 remained the most popular choices among consumers, accounting for approximately 25% of total sales. Products priced above VND 200,000 up to VND 1 million received less attention from buyers.

The beauty, home & living, and women’s fashion categories continued to dominate sales in 2025. Beauty products led with 29.5% of total revenue, generating over VND 74.486 trillion; home & living followed with VND 56.656 trillion; and women’s fashion contributed over VND 54.515 trillion.

However, the fastest-growing categories were health, children’s fashion, and stationery, with growth rates exceeding 80%.

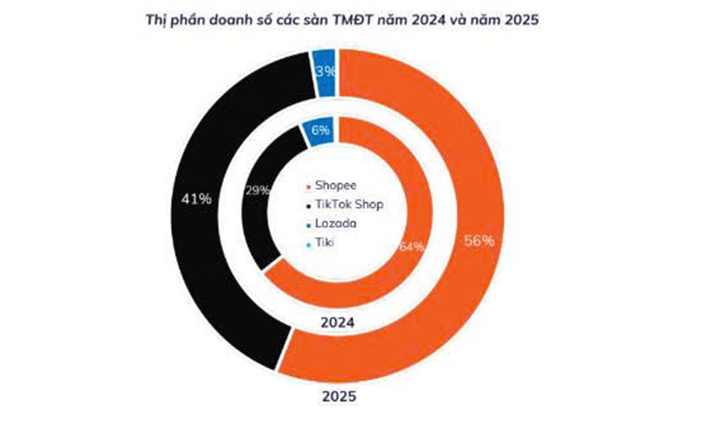

The e-commerce market share is predominantly held by Shopee and TikTok Shop. (Source: Metric)

Despite the revenue surge, the number of active sellers has not fully recovered. As of 2025, there were 601,800 active sellers across the four major platforms, a 7.43% decrease from the end of 2024. However, compared to September 30, 2025, when only 537,900 sellers were active, there has been a notable increase of 63,900 returning sellers by year-end.

The decline in seller numbers alongside rising revenue highlights a strengthening e-commerce business model. Market consolidation is natural, as less competitive and unstable businesses are phased out.

Metric’s report also reveals that in 2025, Shopee maintained its leading position with a 56.04% market share. Meanwhile, TikTok Shop is reshaping the industry with its “shoppertainment” model, achieving remarkable growth and expanding its market share to 41.31%.

In 2024, Shopee held a 64% market share, while TikTok Shop accounted for 29%.

Traditional retailers are adapting to e-commerce trends to stay competitive. (Illustrative image)

Lazada and Tiki collectively held only about 3% of the market share in 2025, down from 6% the previous year, underscoring significant challenges in competing and scaling within Vietnam’s e-commerce landscape.

The report further indicates that domestic e-commerce revenue is heavily concentrated in Ho Chi Minh City and Hanoi, accounting for approximately 83% of total sales. However, neighboring industrial provinces like Tay Ninh and Hung Yen are experiencing impressive growth rates, with Tay Ninh increasing by 63.41% and Hung Yen by 39.41%.

In 2024, Metric reported that the five platforms (Shopee, Lazada, TikTok Shop, Tiki, and Sendo) generated VND 318.9 trillion, representing nearly 6.5% of the country’s total retail sales.

Unveiling the Scam: 25 Tons of Counterfeit Cosmetics from China Flood Facebook and Shopee at Bargain Prices

A network of individuals is importing counterfeit cosmetics of various types, manufactured in China, and subsequently advertising them on platforms like Facebook and Shopee at attractively low prices to unsuspecting consumers.

Derivatives Market 2025: VPS Loses Ground, DNSE Surges Ahead

According to the top 10 derivatives brokerage market share rankings for Q4/2025 and the full year 2025, recently released by the Hanoi Stock Exchange (HNX), it’s evident that the market landscape is gradually reshaping. VPS is facing intense competition from rivals, most notably DNSE, as the battle for market dominance intensifies.

DNSE Surges Ahead, Capturing Over 24% Market Share in Derivatives Brokerage

DNSE continues to make its mark in the derivatives securities segment, expanding its market share to 24.26% in Q4 and 21.47% for the entire year of 2025. This solidifies its position as the second-largest player in the derivatives market, as reported by HNX data.

Online Exports: The Essential Step Propelling Vietnamese MSMEs to Global Success

According to Mr. Phan Mạnh Hà, Director of External Affairs at Shopee Vietnam, online exports are emerging as a new growth driver, enabling Vietnamese micro, small, and medium-sized enterprises (MSMEs) to expand into the ASEAN market faster, more cost-effectively, and sustainably. This trend is particularly significant as the region’s e-commerce sector continues to experience double-digit growth year after year.