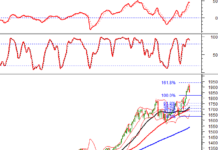

As of the trading session close on January 14th, amidst a market correction in high-value regions, VGI shares of Viettel Global Investment JSC (Viettel Global) maintained their upward momentum, closing at a vibrant purple. The stock price reached 119,900 VND per share, marking a nearly 15% increase. This was the third ceiling session in the last four for this stock, with a total trading volume of over 2.8 million shares.

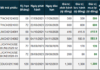

In reality, the surge in VGI shares mirrors the performance of the “Viettel” group, which began its upward trajectory in the previous week’s session on January 7th. Over six consecutive sessions, VGI consistently closed with gains, positioning itself as one of the hottest stocks in the early days of the new year. Viettel Global’s market capitalization surpassed 348.516 trillion VND, equivalent to 13.4 billion USD. In just the first half of January 2026, Viettel Global’s market value increased by over 149.4 trillion VND, propelling the company into the top 5 largest market capitalization companies in the entire stock market.

Viettel Global stands as one of Vietnam’s largest overseas investors, operating in numerous countries across Asia, Africa, and the Americas. These are developing nations with ample room for expansion and business growth.

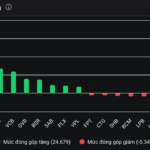

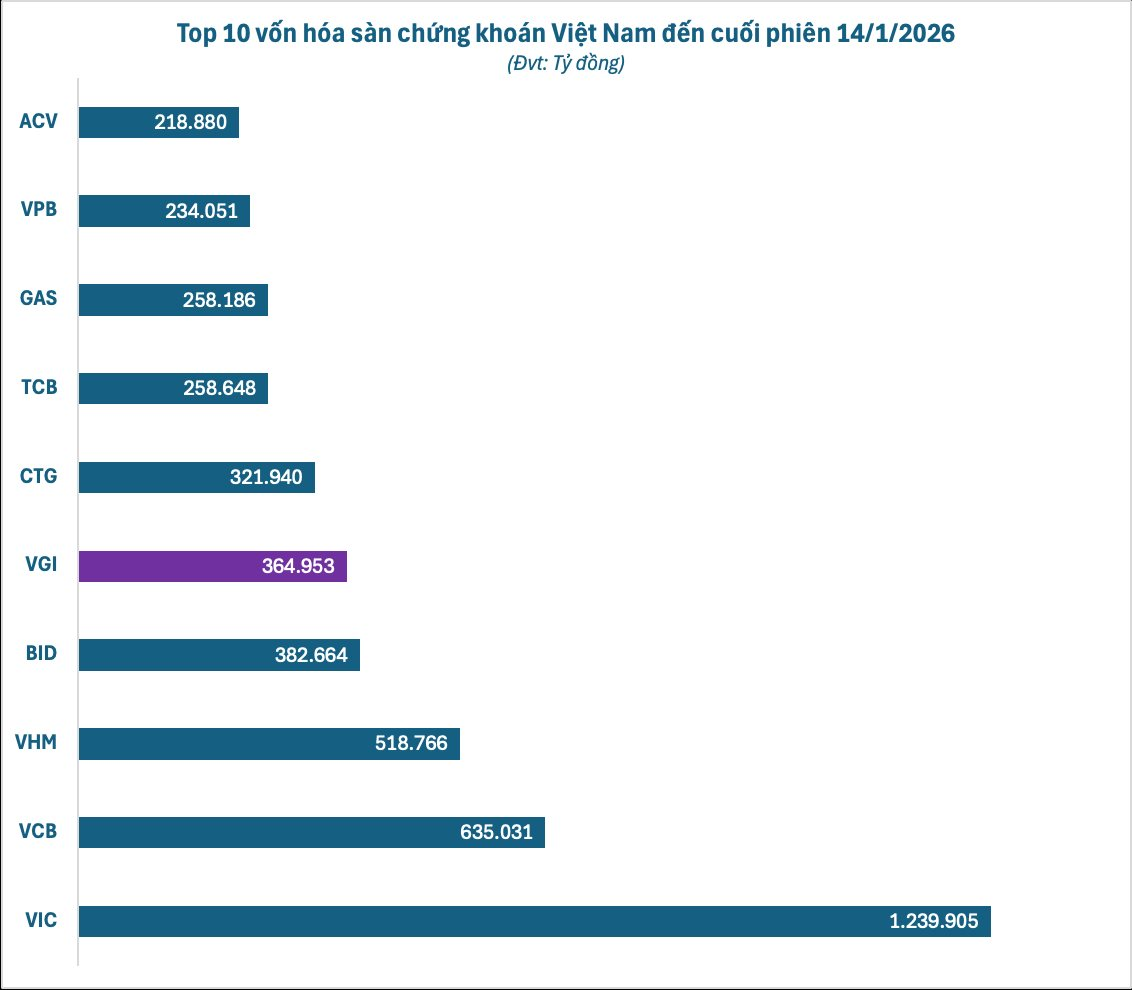

In terms of business performance, in the first nine months of 2025, VGI’s net revenue reached 31,881 billion VND, a 24% increase compared to the same period last year. After-tax profit reached 7,427 billion VND, more than double the figure from the first nine months of 2024.

Not only has there been significant growth in revenue and profit, but Viettel Global’s asset scale has also seen notable improvement. As of September 30, 2025, the consolidated total assets reached 73,877 billion VND, an increase of 10,438 billion VND (equivalent to 16%) compared to the beginning of the year.

Currently, Viettel Group holds 99% of the capital and is the sole major shareholder of VGI. Recently, the parent company Viettel announced its 2025 production and business results with impressive figures. The consolidated revenue of Viettel in 2025 reached 220.4 trillion VND, a 13.8% growth, contributing to Vietnam’s high GDP growth target. Pre-tax profit reached 56.8 trillion VND, with a state budget contribution of 40.9 trillion VND. In overseas markets, Viettel’s revenue grew by 23.9%, the highest in the last nine years. Among its ten foreign investment markets, Viettel is the largest telecom operator in seven countries: Laos, Cambodia, Myanmar, East Timor, Burundi, Haiti, and Mozambique.

Additionally, VGI, along with the Viettel group, similar to other state-owned enterprises on the market, is expected to have further growth potential in the future. Resolution No. 79-NQ/TW, recently issued, identifies the state-owned economy as a particularly important component, playing a leading role, and sets detailed quantitative targets for the international position of economic groups and national financial capacity in the new era.

The breakthrough highlight of the Resolution lies in the quantitative targets for enterprise scale. Specifically, by 2030, Vietnam aims to have 50 state-owned enterprises among the 500 largest in Southeast Asia, and notably, 1 to 3 state-owned enterprises in the global top 500.

Looking ahead to 2045 – the centennial of the nation’s founding – the number of enterprises in the global top 500 is expected to increase to 5, alongside approximately 60 enterprises in the regional top 500. To ensure quality growth, the Resolution sets a “hard target”: 100% of state-owned enterprises will implement digital governance, and 100% of economic groups and state-owned corporations will apply OECD international governance standards.

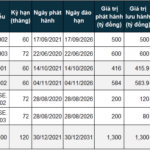

Khánh Hòa Officially Lists 5 Million KHX Shares on the Stock Exchange

On the morning of January 15, 2026, 5 million KHX shares of Khanh Hoa Publishing Joint Stock Company (UPCoM: KHX) officially began trading on the UPCoM market with a reference price of 17,900 VND per share.

Resolution 79: Aligning State-Owned Enterprises with Market Frameworks

Resolution 79/2026 by the Politburo redefines the concept of the state economy, emphasizing market-driven governance of public assets. Public assets must generate profits, and citizens must benefit from them.