I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON JANUARY 15, 2026

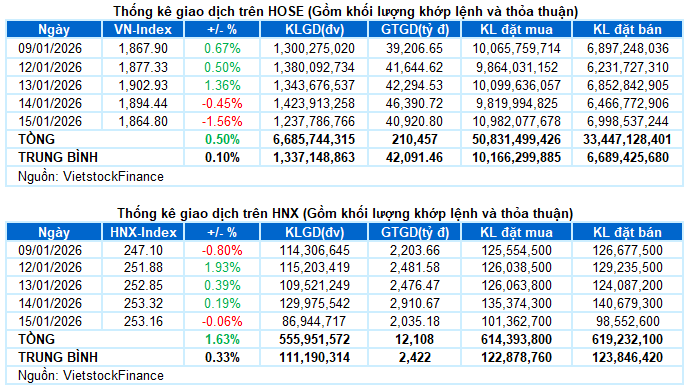

– Major indices declined during the January 15 trading session. The VN-Index dropped sharply by 1.56%, closing at 1,864.8 points. The HNX-Index hovered near the reference level, ending at 253.16 points.

– Matching volume on the HOSE decreased by 10.2%, reaching nearly 1.2 billion units. The HNX recorded over 85 million matched units, a 29.9% decline compared to the previous session.

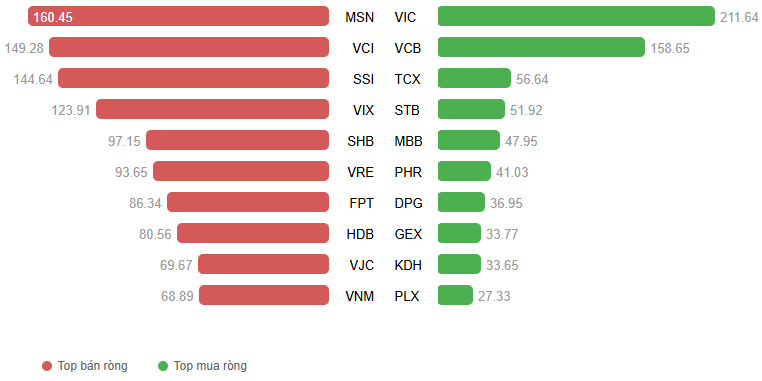

– Foreign investors continued to net sell, with a value of over 910 billion VND on the HOSE and 90 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market experienced a strong correction during the January 15 session. Pressure from blue-chip stocks quickly dragged the VN-Index downward in the morning session, although market breadth remained relatively balanced due to sustained demand for mid and small-cap stocks. The absence of strong pillars to support the index caused the VN-Index to fall below the 1,850-point mark before the lunch break. In the afternoon session, bottom-fishing demand emerged, helping the index narrow its decline, but the rebound was cautious and insufficient to reverse the trend as selling pressure remained dominant. At the close, the VN-Index settled at 1,864.8 points, down 1.56% from the previous session.

– Among market capitalization groups, VS-LargeCap faced noticeable correction pressure after a strong rally, becoming a significant drag on the market. In contrast, VS-MidCap and VS-SmallCap maintained their gains, indicating a shift in capital flow toward mid and small-cap stocks, which helped prevent market breadth from turning broadly negative.

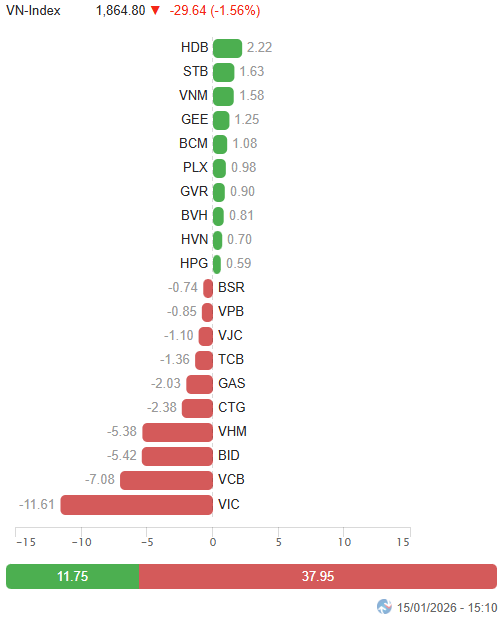

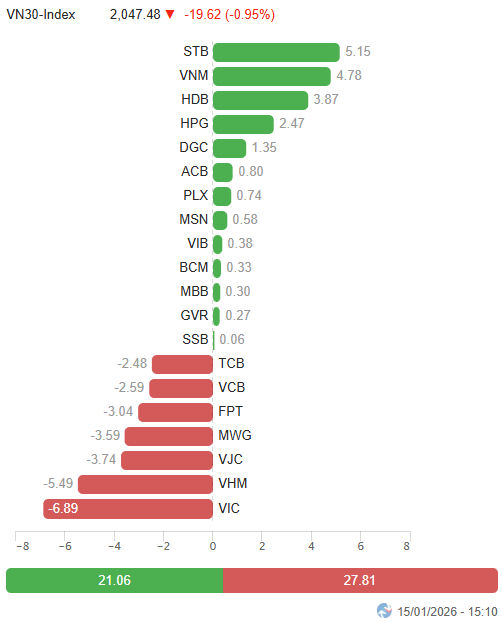

– In terms of influence, VIC was the biggest drag, single-handedly taking away 11.6 points from the VN-Index. This was followed by VCB, BID, and VHM, which collectively pulled the index down by nearly 18 points. On the positive side, support primarily came from HDB, STB, VNM, GEE, and BCM, but they only managed to recover about 8 points, which was insignificant compared to the pressure from the deeply declining blue chips.

Top Stocks Influencing the Index. Unit: Points

– The VN30-Index lost nearly 20 points (-0.95%), closing at 2,047.48 points. The basket’s breadth was mixed, with 17 decliners and 13 gainers. On the negative side, BID faced strong profit-taking pressure with a floor drop, while more than half of the other declining stocks also recorded adjustments of over 2%. In contrast, HDB, PLX, and STB bucked the trend with notable purple gains, alongside BCM, DGC, and VNM, which attracted positive demand with increases of over 4%.

Sector performance was mixed. The communication services sector continued to lead the market with an impressive 6.51% gain, largely driven by VGI (+7.78%), FOX (+2.22%), FOC (+1.23%), and TTN (+4.05%).

The industrial sector also traded impressively, with MVN, GEE, VEA, and SGN hitting their upper limits, followed by ACV (+4.37%), HVN (+3.37%), GEX (+1.69%), CC1 (+8.81%), VTP (+4.8%), PC1 (+6%), CII (+2.7%), and PHP (+5.41%).

On the downside, the two sectors with the largest market capitalization—real estate and finance—exerted significant pressure, declining by 3.16% and 1.76%, respectively. The correction was notably influenced by VIC (-4.49%), VHM (-4.99%), VRE (-1.1%), IDC (-1.25%), TAL (-2.09%), DIG (-1.2%); VCB (-5.39%), TCB (-2.47%), VPB (-1.69%), CTG (-3.5%), TCX (-2.84%), SSI (-2.1%), SHB (-1.2%), and even VCR and BID hitting their lower limits. However, these sectors still recorded some notable bright spots bucking the trend, including BCM (+6.13%), KDH (+3.61%), CEO (+2.09%), KHG (+2.13%); VIX (+1.62%), ACB (+1.01%), along with HDB, STB, BVH, and PVI hitting their upper limits.

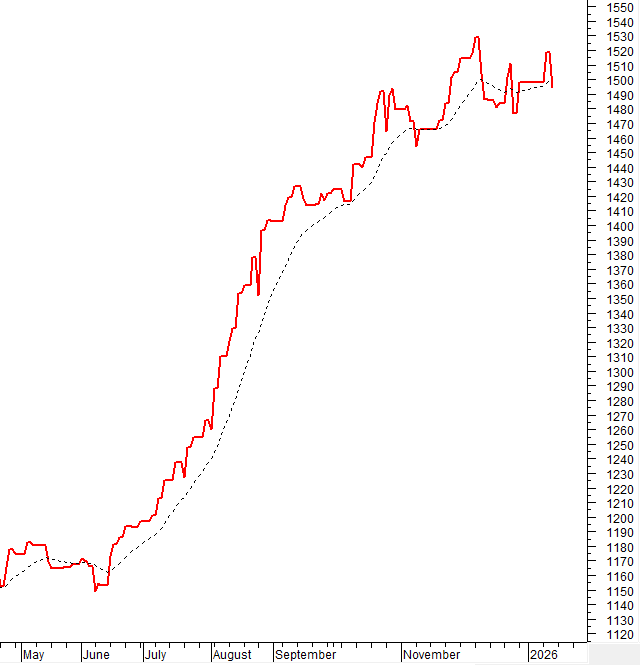

The VN-Index continued its correction, with trading volume remaining above the 20-day average, indicating strong profit-taking pressure. Short-term risks increased as the Stochastic Oscillator continued to weaken after giving a sell signal, while the MACD also began to stall its upward momentum. In this context, the previously broken October 2025 peak will serve as a crucial short-term support level.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Stochastic Oscillator Continues to Weaken

The VN-Index continued its correction, with trading volume remaining above the 20-day average, indicating strong profit-taking pressure.

Short-term risks increased as the Stochastic Oscillator continued to weaken after giving a sell signal, while the MACD also began to stall its upward momentum.

The fully breached October 2025 peak will serve as a crucial short-term support level.

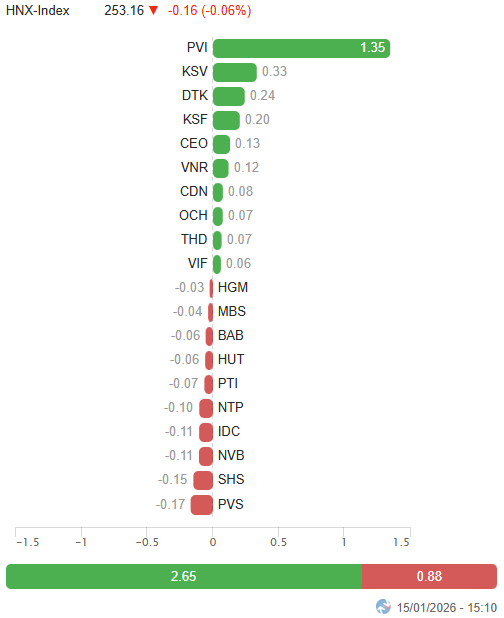

HNX-Index – Long Lower Shadow Candle Pattern Emerges

The HNX-Index experienced strong volatility during the session, forming a Long Lower Shadow candle pattern, indicating robust support around the SMA 200-day level.

Currently, the MACD continues to widen its gap with the Signal line after giving a buy signal. If this indicator can rise above the 0 threshold in upcoming sessions, the index’s short-term outlook will become more favorable.

Capital Flow Analysis

Smart Money Flow Dynamics: The Negative Volume Index of the VN-Index crossed below the EMA 20-day line. If this condition persists in the next session, the risk of a sudden downward thrust will increase.

Foreign Capital Flow Dynamics: Foreign investors continued to net sell during the January 15, 2026 session. If foreign investors maintain this action in upcoming sessions, market volatility will persist.

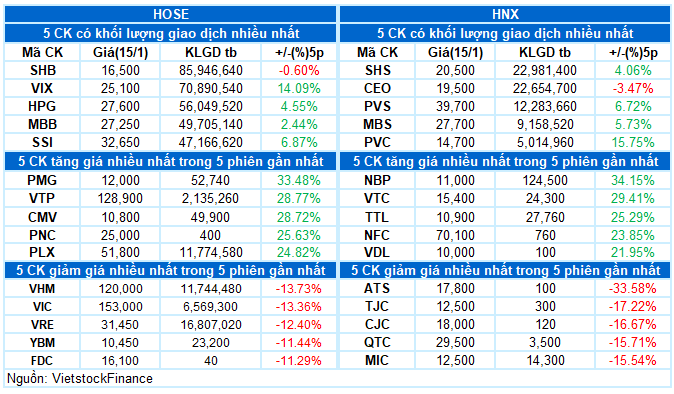

III. MARKET STATISTICS FOR JANUARY 15, 2026

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:37 January 15, 2026

Vietnam Needs $200-300 Billion Enterprises to Lead Its Economic Transformation

“With a population of 100 million, a vast and dynamic workforce, a robust domestic market, and an unwavering ambition to rise, the emergence of globally competitive enterprises is not just desirable but essential. We must embrace this vision as a unified national goal as we step into an era of unprecedented growth and transformation,” shared economic expert Đinh Thế Hiển with Tiền Phong.

VN-Index Projected to Surpass 2,100 Points in Optimistic Scenario, Brokerages Highlight Attractive Investment Opportunities

In the short term, the positive growth outlook for Q4 corporate earnings, coupled with recovering liquidity, alongside foreign investors resuming net buying in recent weeks, are key factors supporting the market.

Market Pulse 14/01: Real Estate Sector Struggles as VN-Index Fails to Break 1,900-Point Barrier

At the close of trading, the VN-Index fell by 8.49 points (-0.45%), settling at 1,898.44 points, while the HNX-Index rose by 0.47 points (+0.19%), reaching 253.32 points. Market breadth was relatively balanced, with 394 gainers and 317 decliners. Similarly, the VN30 basket showed equilibrium, featuring 14 advancers, 13 decliners, and 3 unchanged stocks.

Tracking the Shark Money Trail: January 14th Sees Buying Pressure Concentrated in Bank Stocks

In the January 14th session, proprietary trading firms and foreign investors continued their net selling streak, yet buying momentum notably concentrated on banking stocks, drawing significant attention.