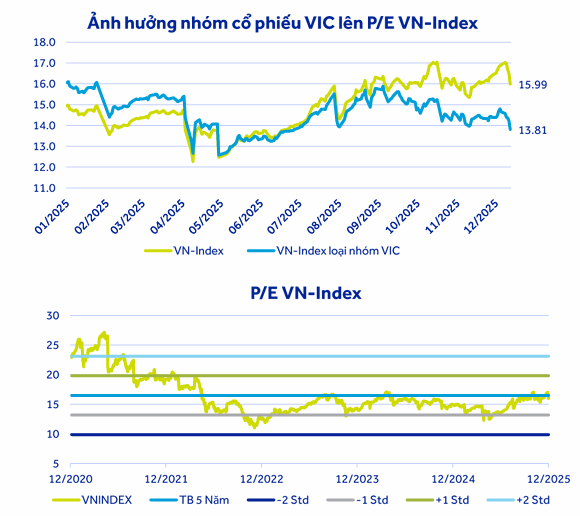

As 2025 drew to a close, the VN-Index surged by over 40% compared to the beginning of the year. However, this growth was primarily driven by Vingroup stocks, with limited spillover effects across the broader market. The year-end P/E ratio stood at around 17.3 times, but excluding Vingroup’s influence, it dropped to 14.6 times (median: 16.3 times), establishing an attractive valuation for medium to long-term investment.

Throughout the year, global stock markets were dominated by tariff negotiations, persistent inflation, and central bank interest rate policies. Gold emerged as the top-performing asset, rising approximately 60% due to geopolitical risks and national debt concerns.

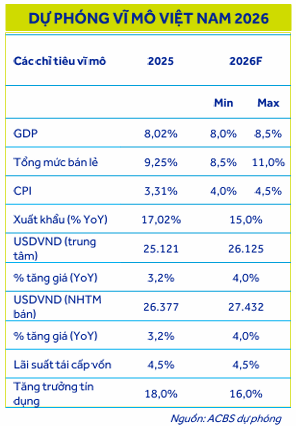

With limited room for further interest rate cuts in 2026, nations are turning to expansionary fiscal measures as an alternative. Global GDP growth is projected to slightly decline to 2.9% in 2026 from 3% in 2025. The most significant risk remains the prolonged decline in consumer confidence across most countries since mid-2025, coupled with tightening financial system liquidity and escalating geopolitical tensions.

|

Amid these challenges, the Vietnamese government remains steadfast in its commitment to high growth. Despite hurdles from tariff issues and severe flooding in Q4/2025, Vietnam reported a GDP growth of 8.02% in 2025. The growth target for 2026–2030 is set at 10%, fueled by internal reforms (institutional, legal, administrative, and private sector empowerment) and traditional strengths (exports, imports, and FDI).

2025 marked a pivotal year for Vietnam’s stock market with its upgrade to FTSE Secondary Emerging Market status, effective October 2026. Consequently, foreign investors continued net selling in 2025, mirroring trends in Southeast Asia. However, this is expected to reverse in 2026 due to the upgrade and positive VND-USD interest rate differential.

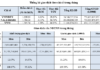

Stocks in ACBS’s analysis portfolio (approximately 50% of HOSE’s capitalization) are forecasted to grow by 14% in after-tax profit in 2026, lower than the 21% growth in 2025. Key sectors like banking, real estate, retail, and public investment will maintain 15–20% profit growth, while the power and energy sectors face a 10% profit decline in 2026.

Given this moderate growth outlook, ACBS anticipates the Vietnamese stock market will trade within +/- 1 standard deviation of the 5-year median P/E ratio. However, ACBS leans toward the VN-Index trading between the median and +1 standard deviation.

Vingroup stocks significantly influenced the VN-Index in 2025, rising from 6% to nearly 25% of market capitalization. While this skewed the index’s valuation, Vingroup’s stock price has already factored in profit expectations. ACBS’s baseline scenario assumes current Vingroup prices and potential upside for the rest of the market, corresponding to a VN-Index target of 2,040 points.

Source: ACBS 2026 Strategic Report

|

ACBS’s 2026 strategic portfolio prioritizes leading stocks in banking, retail, residential real estate, and public investment. These sectors meet key criteria: (1) sustainable core business growth in 2026, (2) benefiting from market upgrades, (3) attractive valuations with potential re-rating from 2026 subsidiary IPOs, and (4) continued gains in the next five-year public investment cycle.

– 11:15 16/01/2026

Market Pulse 16/01: FPT Hits Ceiling, Green Wave Continues to Spread

The green hue intensified as the morning session drew to a close. At the mid-session break, the VN-Index surged by over 30 points (+1.64%), reaching 1,895.34, while the HNX-Index also climbed 0.25% to 253.8. Market breadth favored buyers decisively, with 444 stocks advancing and 291 declining.

Technical Analysis for the Afternoon Session of January 15th: A Sharp Correction

The VN-Index experienced a sharp correction, accompanied by a sell signal from the Stochastic Oscillator, indicating heightened short-term risk. Similarly, the HNX-Index is in a comparable state, currently finding support at the Middle line of the Bollinger Bands.