On the afternoon of January 15, 2026, the Dat Xanh Services Economic-Finance-Real Estate Research Institute (DXS-FERI) hosted the Vietnam Real Estate Market Research Report 2025 & Forecast for 2026 event, themed “Shifting Gears.”

DXS-FERI experts outlined nine essential conditions for the real estate market’s growth in 2026. These include macroeconomic challenges targeting a 10% growth rate, sustained recovery in purchasing power and business activities from 2025, and controlled inflation. Institutional frameworks must continue to act decisively through systemic regulations and new policies, with increased government oversight. Localities should further refine comprehensive development plans aligned with national strategic planning, while also promoting social housing projects.

Monetary policies will closely follow macroeconomic stabilization goals, risk management, and coordination with fiscal policies and growth support measures. Legal reviews for projects will be expedited to resolve pending issues. Demographic trends indicate a continued decline in birth rates, potentially leading to labor shortages in major cities.

Infrastructure investment is projected to meet its target of approximately VND 995 trillion, a 10.4% increase from 2025. The government will introduce mechanisms to encourage private sector participation. Developers’ capabilities are expected to improve with faster legal completions, technological upgrades, innovative business strategies, and enhanced legal compliance and customer protection. Financial resources will diversify, offering more funding channels for real estate.

Housing supply in 2026 is forecast to rise by over 40%

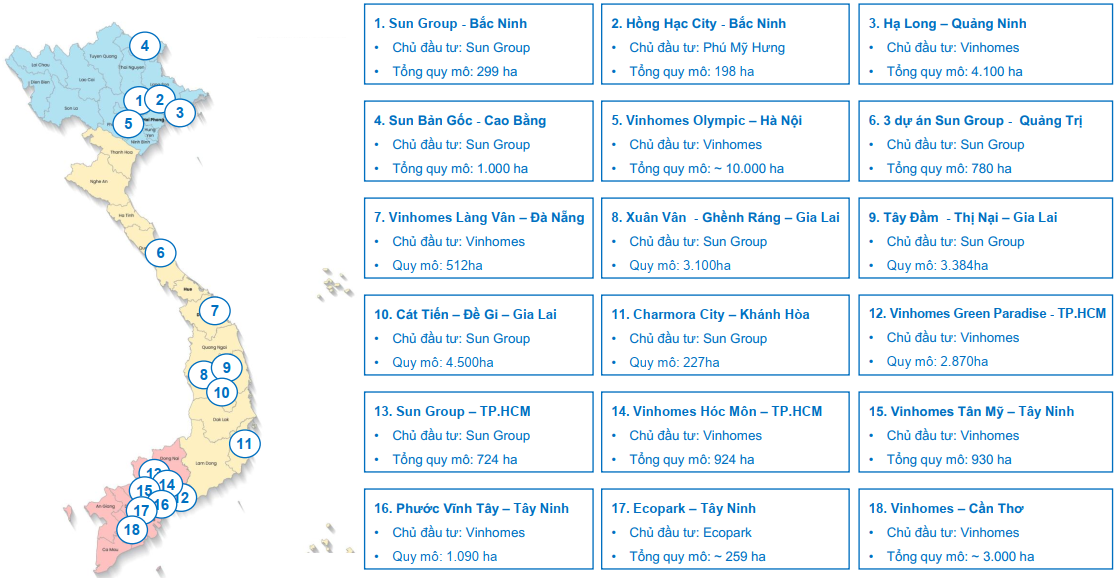

In 2026, the country anticipates over 125 new projects, adding around 136,000 units—a 40% increase. This brings the total primary supply to nearly 200,000 units. The Northern region will see 43 projects with 60,056 units (up 44%); the Central region, 19 projects with 11,614 units (up 9%); the Southern region, 46 projects with 54,795 units (up 40%); and the Western region, 17 projects with 9,848 units (up 7%).

Secondary supply will diversify across markets and segments as numerous projects are completed in 2026. Apartments will dominate new supply, with integrated urban and green projects offering distinct competitive advantages.

Primary absorption rates are projected at 45-50%, driven by genuine demand and mid-to-long-term investments, with limited short-term speculation. Experts also predict increased demand for income-generating properties.

Primary prices are expected to stabilize or rise slightly by 5-10% from 2025’s highs. Secondary prices will increase by 5-10% across all segments, while rental prices remain steady.

Lending interest rates are forecasted at 10-12%, a level considered acceptable for most property buyers. However, buyers will be more cautious, favoring projects with prime locations and suitable financing options.

The implementation of property identification codes will enhance market transparency, reduce buyer risks, and promote sustainable development. Additionally, the 10% GDP growth target will positively influence real estate policies in 2026.

|

Major Projects Across Vietnam in 2026

|

DXS-FERI outlines three market scenarios for 2026. In the optimistic scenario, supply increases by 40-50%, prices rise by 10-15%, interest rates float at 9-11%, and absorption reaches 50-60%. The expected scenario projects a 30-40% supply increase, 5-10% price growth, 10-12% interest rates, and 40-50% absorption. The cautious scenario forecasts a 20-30% supply increase, 2-5% price growth, 12-14% interest rates, and 25-35% absorption.

Genuine demand continues to lead trends in 2025

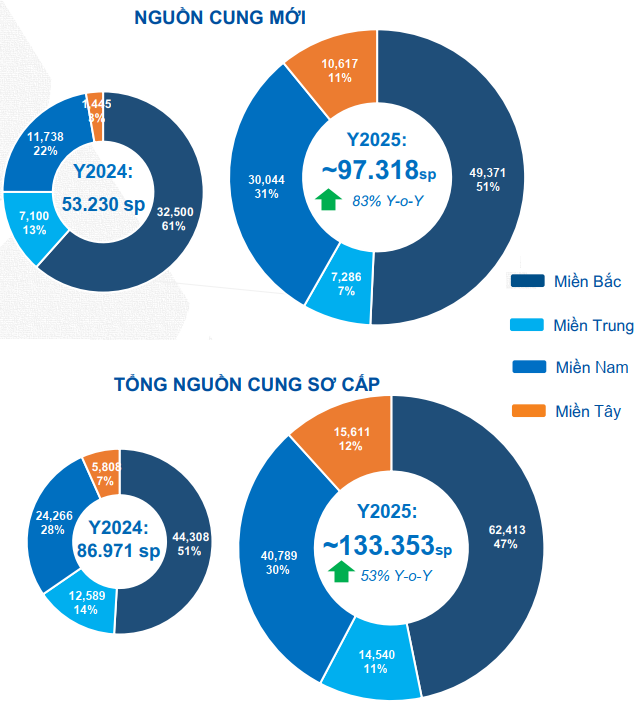

In 2025, total primary supply reached over 133,000 units, a 53% increase, driven by large-scale projects and diverse product types. Market absorption hit 50-55%, nearly doubling 2024’s rate, with over 65,000 successful transactions.

New supply added 97,318 units, an 83% increase. The Northern region led with 49,371 units (up 52%), accounting for 51% of national supply. Total primary supply in the North reached 62,413 units (up 41%), with absorption at 50-55% (up 5%).

The Southern region saw a 147% increase in new supply to 30,044 units, raising total primary supply to 40,789 units (up 68%). Absorption reached 45-50%, a 20% increase.

Primary prices continued rising, with variations by location and product type. In leading markets, apartment prices increased by 15-25%, while low-rise prices rose by 7-10%. Other markets saw modest 3-5% increases. In the North, apartment prices rose to VND 45-170 million/m², townhouses to VND 80-250 million/m², villas to VND 85-300 million/m², and land plots to VND 50-100 million/m².

In the South, apartment prices reached VND 35-150 million/m², townhouses VND 50-250 million/m², villas VND 60-320 million/m², and land plots VND 25-70 million/m².

Secondary prices rebounded sharply, with apartments rising 30-50% and low-rise properties 5-10% in central areas.

In 2025, projects near ring roads led trends. In the North, new projects concentrated in Dong Anh, Long Bien, and Van Lam, Van Giang, Hung Yen. Ring Road 1 and 2 had 10,900 units, Ring Road 3 and 3.5 had 17,200 units, and Ring Road 4 had 35,400 units.

In the South, Ring Road 2 had 7,000 units, National Highway 13 had 11,000 units, Ring Road 3 had 11,100 units, and Ring Road 4 had 15,500 units.

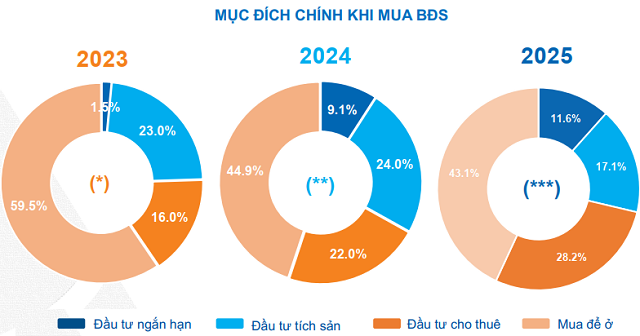

According to DXS-FERI experts, genuine demand remains dominant at 44%, while investment demand is rising. A “Southern shift” in real estate investment is also observed.

Survey Period: December 2025. Sample Size: 1,421. Survey Locations: Hanoi, Ho Chi Minh City, Da Nang, Nha Trang, Can Tho.

|

|

New Supply Up 83%, Total Supply Up 53% Year-on-Year

|

– 17:16 16/01/2026

Unusual Shifts in the Condominium Market After Years of Price Surges

The prolonged price surge in the apartment segment shows signs of stagnation as numerous investors begin to list properties at a loss. Market reports indicate a decline in liquidity, with genuine demand now steering price dynamics, signaling the onset of a corrective phase following the rapid growth cycle.

The Shifting Investment Mindset of Vietnam’s Affluent Class

As Vietnam enters an aging phase, the demand for long-term healthcare is no longer a distant concern. In this context, healthcare real estate—particularly projects integrated with therapeutic hot mineral springs—is emerging as a new “core asset” among Vietnam’s affluent. It not only accumulates value but also serves as essential infrastructure to safeguard the quality of life for families.

Luxury Condo Investment Opportunity: Premium Units Starting at Just 56 Million VND/m² in TOD Urban Development

As property prices near metro lines continue to soar, investors are turning their attention to emerging TOD areas with more accessible price points and clear growth potential. Legacy Hinoiri in Hòa Lạc, priced from 56 million VND/m², stands out as a compelling option.