Amidst a positive psychological outlook driven by improved liquidity, the market continued its upward trajectory at the start of the session. The benchmark index faced adjustment pressures, dipping to 1,870 points before rebounding. By the close, the VN-Index settled at 1,894.44 points, down 8.49 points (-0.45%), slightly below the psychological threshold of 1,900 points. Foreign trading activity was a notable downside, with net selling reaching approximately VND 409 billion.

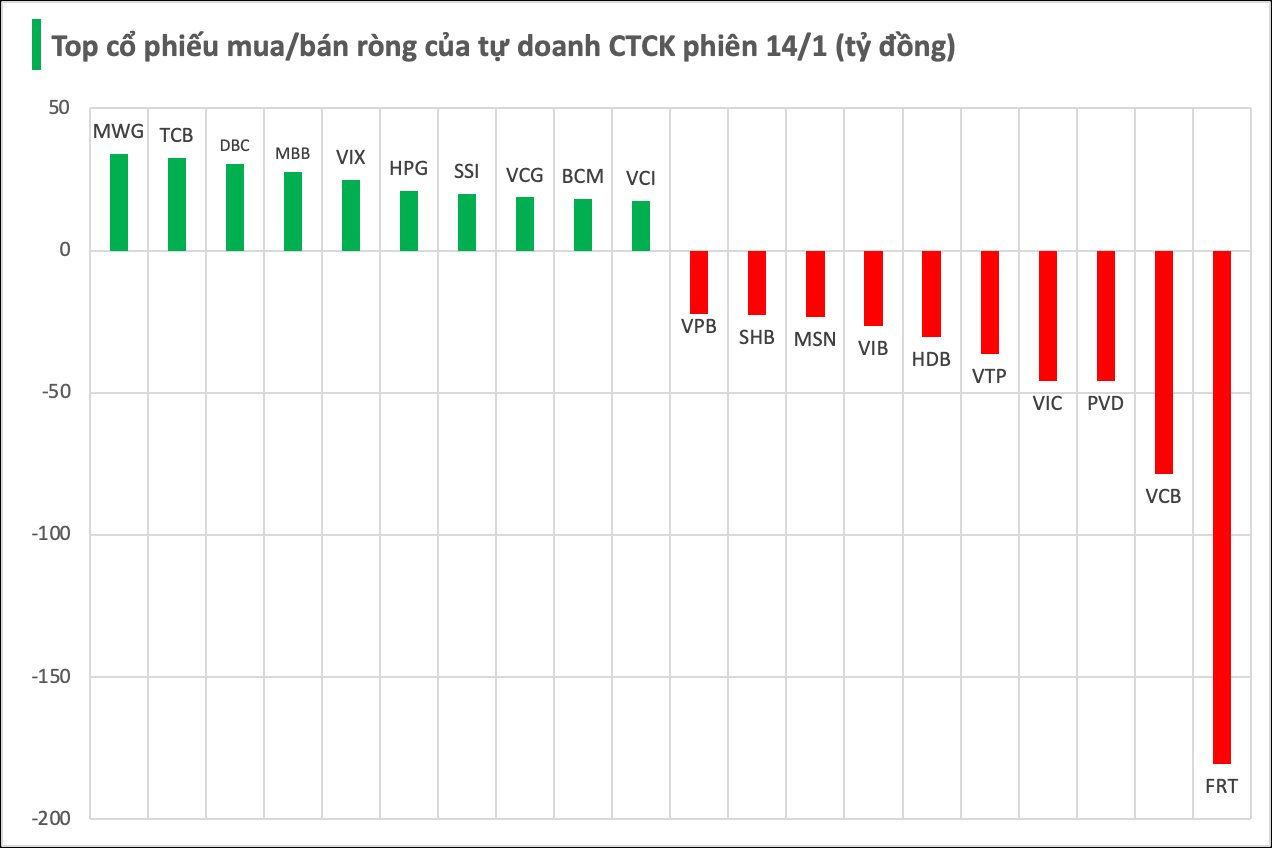

Securities firms’ proprietary trading desks recorded a net sell of VND 63 billion on HOSE.

Specifically, securities firms’ proprietary trading desks led net selling in FRT, totaling VND -180 billion, followed by VCB (-VND 78 billion), VIC (-VND 46 billion), PVD (-VND 46 billion), and VTP (-VND 36 billion). Other stocks with significant net selling included HDB (-VND 30 billion), VIB (-VND 27 billion), MSN (-VND 23 billion), SHB (-VND 23 billion), and VPB (-VND 22 billion).

Conversely, MWG saw the strongest net buying at VND 34 billion. This was followed by TCB (VND 33 billion), DBC (VND 30 billion), MBB (VND 28 billion), VIX (VND 25 billion), HPG (VND 21 billion), SSI (VND 20 billion), VCG (VND 19 billion), BCM (VND 18 billion), and VCI (VND 17 billion).

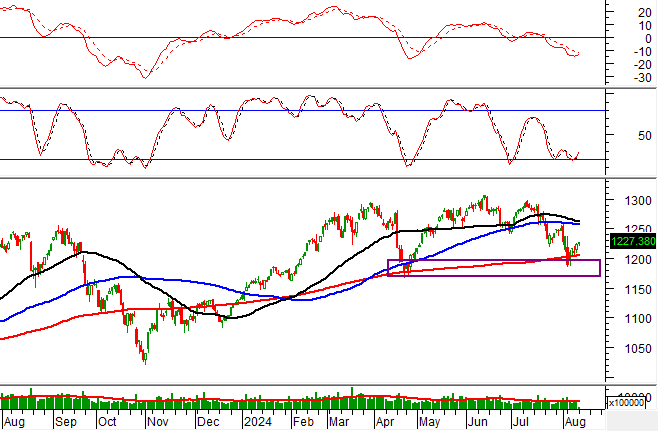

Technical Analysis for the Afternoon Session of January 15th: A Sharp Correction

The VN-Index experienced a sharp correction, accompanied by a sell signal from the Stochastic Oscillator, indicating heightened short-term risk. Similarly, the HNX-Index is in a comparable state, currently finding support at the Middle line of the Bollinger Bands.

Vietstock Daily 16/01/2026: Mounting Pressure

The VN-Index continues its adjustment phase, with trading volumes remaining above the 20-day average, indicating significant profit-taking pressure. Short-term risks appear to be rising as the Stochastic Oscillator weakens further following a sell signal, while the MACD shows signs of slowing its upward momentum. In this context, the previously breached October 2025 peak will serve as a critical short-term support level.

VN-Index Projected to Surpass 2,100 Points in Optimistic Scenario, Brokerages Highlight Attractive Investment Opportunities

In the short term, the positive growth outlook for Q4 corporate earnings, coupled with recovering liquidity, alongside foreign investors resuming net buying in recent weeks, are key factors supporting the market.