Catalysts for Stock Market Breakout

In a recent report, Mirae Asset Securities (Vietnam) suggests that Vietnam’s stock market is entering a decisive breakout phase in 2026. This shift is driven by macroeconomic and market dynamics transitioning from recovery to a new growth cycle, fueled by groundbreaking reforms.

To achieve the ambitious 10% GDP growth target in 2026, the market is expected to benefit from several pivotal catalysts. Monetary policy easing and credit allocation reforms are key to optimizing capital efficiency. Replacing administrative credit caps with bank-driven mechanisms based on capital capacity and risk management will enhance both financial and non-financial sectors.

Additionally, a mega infrastructure investment cycle is anticipated to drive long-term growth. To achieve a 10% average GDP growth from 2026–2030, public investment could reach VND 8,500 trillion, a 162% increase from 2021–2025. Recent institutional reforms have accelerated disbursement in key projects like Long Thanh International Airport, laying the foundation for sustainable economic growth.

Private sector development is another critical pillar for Vietnam’s ambition to become a high-income nation by 2045. The next phase requires robust private investment to reduce public budget pressure and improve project efficiency. Structural reforms, particularly the new PPP legal framework, are expected to mobilize private capital more effectively.

Domestic consumption remains a key growth driver. With per capita income projected to rise from USD 5,026 in 2025 to USD 8,500 by 2030, the consumer sector has significant growth potential. Economic support policies and real estate market recovery are vital for boosting purchasing power. Notably, a 41% increase in personal income tax deductions from 2026 is expected to significantly enhance middle-class spending.

Two Key Risks to Monitor

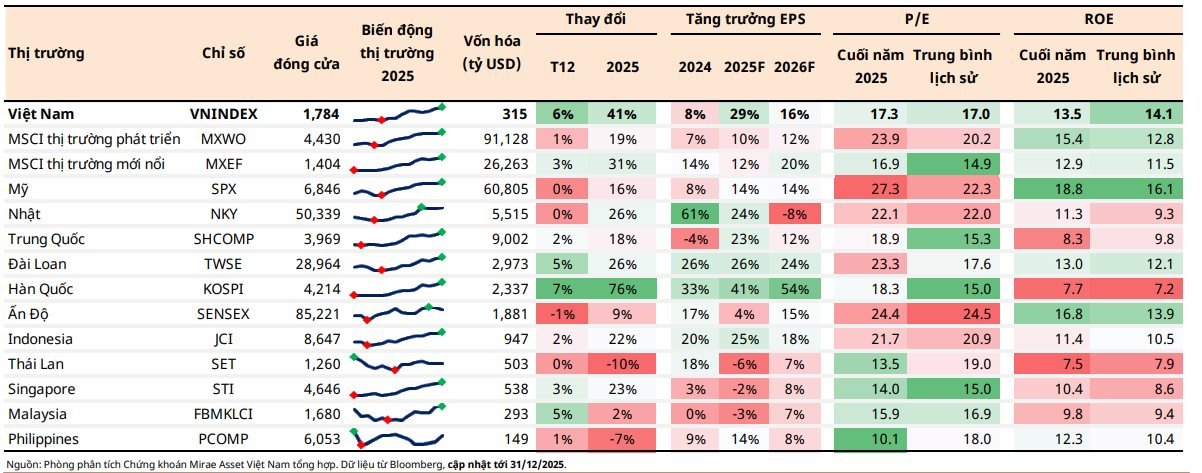

Regarding market valuation, Mirae Asset finds Vietnamese equities attractive relative to mid-term growth potential. Compared to regional peers, Vietnam maintains high ROE and positive growth prospects. Under a base scenario with 20% EPS growth, the VN-Index could target 2,300 points, reflecting a long-term P/E of 17x. Current EPS projections normalize after 2025’s 30–33% profit growth.

Despite positive growth outlooks, proactive risk management remains crucial for capitalizing on investment opportunities. Mirae Asset identifies three factors driving market breakout potential: post-upgrade re-rating, increased liquidity, and restored business confidence.

Notably, Vietnam’s inclusion in FTSE Russell’s Secondary Emerging Market Index on September 21, 2026, could attract USD 1 billion in passive fund inflows. Re-rating potential also stems from sustainable finance initiatives, market structure improvements, transparency enhancements, and foreign investor accessibility. Vietnam is also advancing toward MSCI Emerging Market status by addressing foreign ownership limits, central counterparty mechanisms, and FX market criteria.

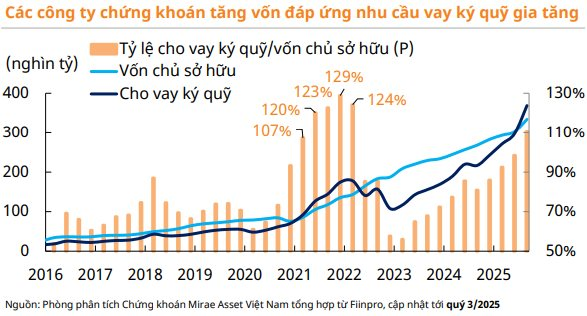

However, Mirae Asset highlights structural risks requiring close monitoring. High margin leverage levels make the market sensitive to shocks, potentially triggering forced selling and heightened volatility. Additionally, rapid price appreciation in large-cap stocks, which drove the 2025 VN-Index rally, increases vulnerability to individual shocks from leading companies.