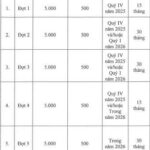

In December alone, the total value of capital raised through private corporate bonds exceeded 90 trillion VND, the highest in several months and second only to June 2025. Compared to the same period in previous years, this is the highest level in four years, though it hasn’t reached the peak of December 2021.

For the entire year of 2025, the market recorded approximately 565 trillion VND in private bonds issued, a more than 30% increase. This scale indicates that the bond market has rebounded, though it remains far from the 2021 boom.

| Private bond issuance rebounded in December 2025 (Unit: billion VND) |

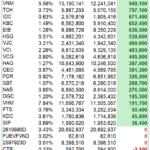

Banks remained the primary drivers in December, accounting for over 60% of total issuance, equivalent to about 56 trillion VND. Notably, many deals were finalized near the year-end, particularly by state-owned banks.

Agribank stood out with a 5 trillion VND bond, a 2-year term, and a fixed interest rate of 5.8%/year, completed on December 25. This was the largest deal of the month and the bank’s third market entry in 2025, raising a total of approximately 17.5 trillion VND.

BIDV (HOSE: BID) accelerated in the final days, adding 8 trillion VND, nearly a quarter of its annual bond capital. The new issuances had 2-year terms and fixed rates of 6.5%/year.

Vietcombank (HOSE: VCB) returned after over a year’s absence with a 2 trillion VND bond, 2-year term, and 5.8%/year rate. This was one of the few sub-6%/year short-term rates, alongside Agribank.

Among private banks, several saw significant increases. VIB (HOSE: VIB) raised about 7 trillion VND in December, nearly a third of its annual total. HDBank (HOSE: HDB) secured over 5.6 trillion VND, mainly near New Year’s Eve. VPBank (HOSE: VPB) and Techcombank (HOSE: TCB) added 5.5 trillion VND and 4.5 trillion VND, respectively.

Some banks entered the market at this time. VietBank (UPCoM: VBB) completed two issuances totaling 2.5 trillion VND just before December 31. VietABank (HOSE: VAB) also issued its first bonds of the year.

Interest rates for 2-3 year bonds varied. State-owned banks maintained rates below 6%/year, while private banks ranged from 7.5-7.6%/year, including VPBank, LPBank, HDBank, VIB, and Bac A Bank.

|

State-owned banks actively raised capital in December

Source: Author’s compilation

|

In 2025, banks raised about 367 trillion VND via private bonds, nearly 65% of the market. Most funds were for 2-3 year terms with fixed rates, rising toward year-end. Longer terms (7-8 years) also saw significant volumes, mainly with floating or mixed rates.

Techcombank led with nearly 52 trillion VND, up sharply from 2024. It focused on 2-3 year terms, with rates rising from 5.2%/year to 6.5%/year. OCB and ACB followed with around 37 trillion VND each, then BIDV, VPBank, and MB.

In non-banking finance, December saw activity only from securities firms. Most issuances were short-term (2-3 years) with higher rates than banks. TCBS (HOSE: TCX) issued 1 trillion VND, totaling 2.5 trillion VND for the year. APG (HOSE: APG), BIDV Securities (HOSE: BSI), and Saigon-Hanoi Securities (HNX: SHS) issued smaller amounts.

In 2025, securities firms raised nearly 10 trillion VND, up from 2024, with rates of 7.5-8.2%/year. Rồng Việt Securities (HOSE: VDS) led with nearly 3 trillion VND, followed by TCBS.

Consumer finance bonds totaled 6.4 trillion VND, with F88 and HomeCredit active, but rates varied widely.

|

December 2025 saw no consumer finance companies issuing bonds

Source: Author’s compilation

|

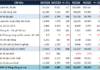

In the non-financial sector, December saw first-time issuances, notably in real estate. Phát Đạt issued 5.4 trillion VND at 11%/year, the month’s highest rate. Mặt Trời Hòa Bình debuted with 3.5 trillion VND at the same rate.

Đại Quang Minh, under Thaco, entered with 1.5 trillion VND, backed by its parent, at 10%/year. Thaco issued 2 trillion VND in December, its only 2025 issuance, at 8.5%/year for 5 years. Thiso, Thaco’s Emart operator, raised 2.2 trillion VND for a Hanoi project.

Thái Sơn, linked to Vinhomes, expanded to 10 trillion VND annually at 12.5%/year. TNR Holdings raised nearly 18 trillion VND in 2025, with 6-9 year terms at 9-9.3%/year.

Vietjet accelerated, raising 6.5 trillion VND in December, totaling 10.5 trillion VND for the year at around 10%/year.

In 2025, Vingroup (HOSE: VIC) led with 25 trillion VND. Vinhomes (HOSE: VHM) followed with 15 trillion VND. VinFast added 7.5 trillion VND. Including related entities like Thái Sơn and Trường Minh, the total was significantly higher.

|

Non-financial sector had a bustling December in private bonds

Source: Author’s compilation

|

– 19:00 16/01/2026

VBMA: December Buyback Bonds Drop by 15%

As of December 31, 2025, VBMA data compiled from HNX and SSC reveals a total of 68 corporate bond issuances. These include 62 private placements valued at nearly VND 58.7 trillion and 6 public offerings exceeding VND 3.77 trillion, all completed in December 2025.

How Do Hundred-Million-Dollar ETFs Trade During Portfolio Rebalancing Week?

During the period of December 12-19, the VanEck Vectors Vietnam ETF (VNM ETF) exhibited significant trading activity in the stocks within its portfolio. This coincided with the effective date (December 19, 2025) of the fourth-quarter 2025 review of the MarketVector Vietnam Local Index, the benchmark index for the Fund.

What Will CII Do With the Anticipated VND 780 Billion Raised Through Bond Issuance?

CII plans to raise a total of VND 780 billion through bond issuance, aiming to restructure debt and secure additional capital for the expansion of the Ho Chi Minh City – Trung Luong – My Thuan Expressway project.