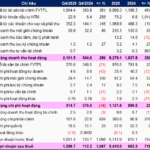

According to the Q4/2025 financial report, DNSE’s revenue reached VND 437.2 billion, marking an 81% increase compared to the same period in 2024. Within the revenue structure, brokerage revenue stood out with a remarkable 217% growth, hitting VND 125 billion, more than tripling its previous figure. Interest income from loans and receivables climbed 48% to VND 155.9 billion, while income from financial assets measured at fair value through profit or loss (FVTPL) surged 333% to nearly VND 53 billion.

Alongside revenue growth, DNSE’s margin lending and advance payment debt reached a new record of VND 5,832 billion by the end of Q4/2025.

In Q4, expenses totaled VND 425.6 billion, a 112% increase year-over-year, with brokerage expenses accounting for the largest share at nearly VND 150 billion, up 198%.

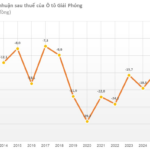

DNSE’s pre-tax profit for Q4 was VND 11.7 billion, with post-tax profit at VND 9.3 billion, a 72% decline compared to Q4/2024.

DNSE’s leadership attributed the profit decrease to provisions for proprietary trading portfolios amid a polarized stock market, increasing risk across sectors, despite positive growth in core business areas due to expanded operations and heightened trading demand.

|

Q4/2025 and 2025 Business Results of DNSE

Source: DNSE

|

For the full year 2025, DNSE recorded revenue of over VND 1,467 billion, a 77% increase from 2024. Brokerage revenue surged 179% to VND 404 billion, significantly contributing to overall growth. Interest income from loans and receivables rose 54% to VND 555.8 billion, while FVTPL income jumped 258% to VND 171.4 billion.

Despite a 2025 expense rise to VND 1,127 billion, DNSE exceeded its annual targets with pre-tax profit of VND 340.2 billion and post-tax profit of VND 272.5 billion, a 50% increase from 2024.

As of December 31, 2025, DNSE’s total assets surpassed VND 15 trillion, a 42% increase from the beginning of the year.

Thus, DNSE’s revenue, profit, and total assets all reached historic highs, surpassing the challenging targets set at the start of the year.

Maintaining Top 2 Market Share in Derivatives and 20% New Account Market Share

Alongside financial metrics, DNSE saw growth in customer base and market share, with 1.5 million customer accounts representing 13% of the market total. DNSE also led in new account openings, capturing 20% market share.

By December 31, 2025, DNSE managed over 2.1 billion shares. Notably, the average daily net asset value (NAV) of all customers exceeded VND 52 trillion, reflecting DNSE’s successful expansion and customer quality enhancement.

In derivatives, DNSE’s market share rose to 24% in Q4/2025 and 21% for the year, solidifying its Top 2 position.

DNSE’s derivatives market share soared from 0% to nearly 24% within two years of entering the market

|

Ms. Nguyễn Ngọc Linh, DNSE’s CEO, highlighted that investments in infrastructure and technology, emphasizing speed as a competitive edge, drove rapid growth in derivatives. Long-term strategies, including T0 policies and shorter trading times, will enable quick trading strategies from derivatives to be applied to the base market, offering significant growth potential.

Technology platform and trading speed are key competitive advantages for DNSE

|

To bolster capital, DNSE successfully issued VND 1,000 billion in bonds and is issuing 85.65 million shares to existing shareholders at a 4:1 ratio, aiming to increase charter capital for margin lending, advance payments, and proprietary trading.

On January 8, DNSE announced a 7% cash dividend for 2025, distributing VND 700 per share, totaling nearly VND 240 billion.

|

To provide comprehensive and accurate business results, DNSE will host a virtual event, “Announcement of Q4 and 2025 Business Results,” at 3:30 PM on Wednesday, January 28, 2026. The event will be live-streamed on DNSE’s official YouTube and Facebook channels. YouTube: https://www.youtube.com/@dnse Facebook: https://www.facebook.com/ChungkhoanDNSE |

– 11:01 16/01/2026

Đất Xanh Services Offers Full Equity Transfer of Đất Xanh Miền Nam

The Board of Directors of Dat Xanh Services has approved the plan to transfer all shares in Dat Xanh Mien Nam.

VIX Records Historic Profits in 2025, Proprietary Trading Thrives on GELEX Group’s Success

VIX Securities Corporation (HOSE: VIX) has announced its Q4/2025 financial report, revealing a remarkable surge in profits compared to the same period last year, capping off 2025 with record-breaking earnings. The primary drivers of this outstanding performance were the lending and proprietary trading segments, with a significant portion of the portfolio attributed to GELEX group stocks.

Derivatives Market 2025: VPS Loses Ground, DNSE Surges Ahead

According to the top 10 derivatives brokerage market share rankings for Q4/2025 and the full year 2025, recently released by the Hanoi Stock Exchange (HNX), it’s evident that the market landscape is gradually reshaping. VPS is facing intense competition from rivals, most notably DNSE, as the battle for market dominance intensifies.