The stock market witnessed significant volatility during the January 14th session. The VN-Index narrowed its decline by the close, ending with an 8.5-point adjustment at 1,894 points. Liquidity remained high, with trading value on HOSE surging to over 46 trillion VND.

Foreign trading was a notable downside, with net selling of approximately 409 billion VND.

On HOSE, foreign investors net sold 451 billion VND

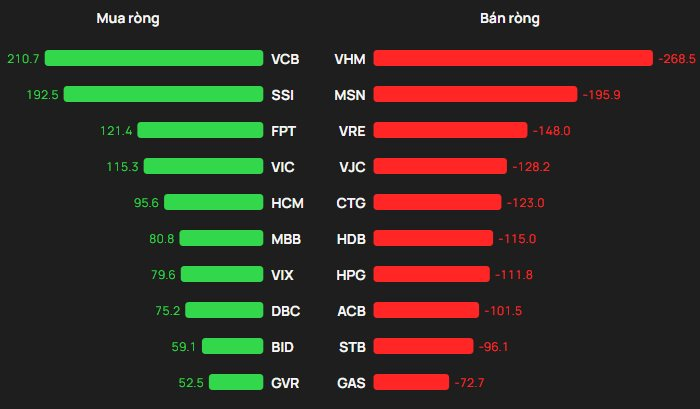

On the buying side, VCB was the most purchased stock by foreign investors on HOSE, with a value of over 210 billion VND. SSI followed closely, with 193 billion VND. Additionally, FPT and VIC were bought for 121 billion VND and 115 billion VND, respectively.

Conversely, VHM was the most sold stock by foreign investors, with 269 billion VND. MSN and VRE followed, with sell-offs of 196 billion VND and 149 billion VND, respectively.

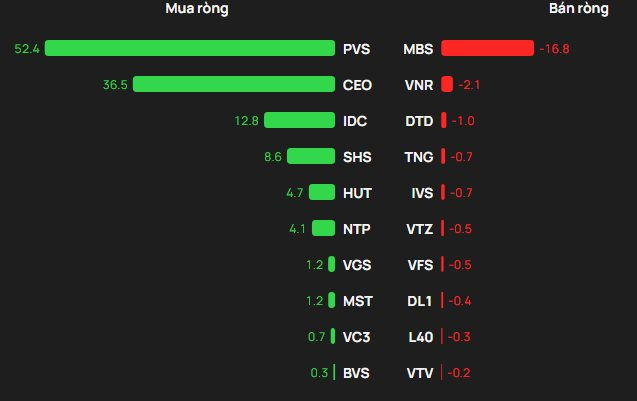

On HNX, foreign investors net bought 102 billion VND

On the buying side, PVS was the most net bought stock with a value of 52 billion VND. CEO was next, with 36.5 billion VND. Foreign investors also spent a few billion VND to net buy IDC, SHS, and HUT.

On the selling side, MBS faced the most selling pressure from foreign investors, with nearly 17 billion VND. VNR followed with 2 billion VND, while DTD, TNG, and IVS were sold for a few billion VND each.

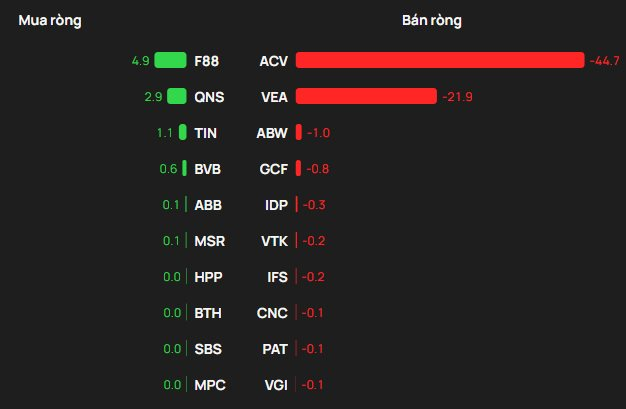

On UPCOM, foreign investors net sold 60 billion VND

On the buying side, F88 was purchased by foreign investors for 5 billion VND. QNS and TIN were also net bought, each for a few hundred million VND.

Conversely, ACV was net sold by foreign investors for 45 billion VND. Foreign investors also net sold VEA, ABW, and others.

Stock Market Plunges from Historic Highs

The VN-Index has retreated from its historic peak of 1,900 points as profit-taking pressure intensifies among large-cap stocks.