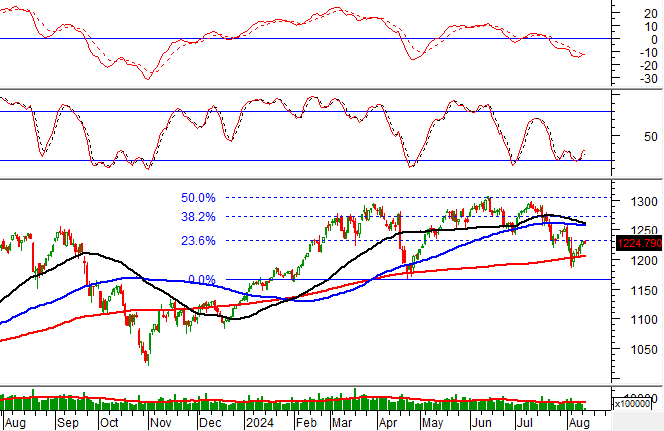

The market faced significant downward pressure on January 15th, marked by speculative trading and rapid rotations across various stock groups. By the close, the VN-Index dropped by 29.64 points (-1.56%) to 1,864.80. Foreign trading activity remained negative, with net selling exceeding 1 trillion VND across the market.

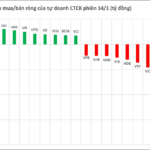

Securities firms’ proprietary trading desks reduced net selling to 14 billion VND on HOSE.

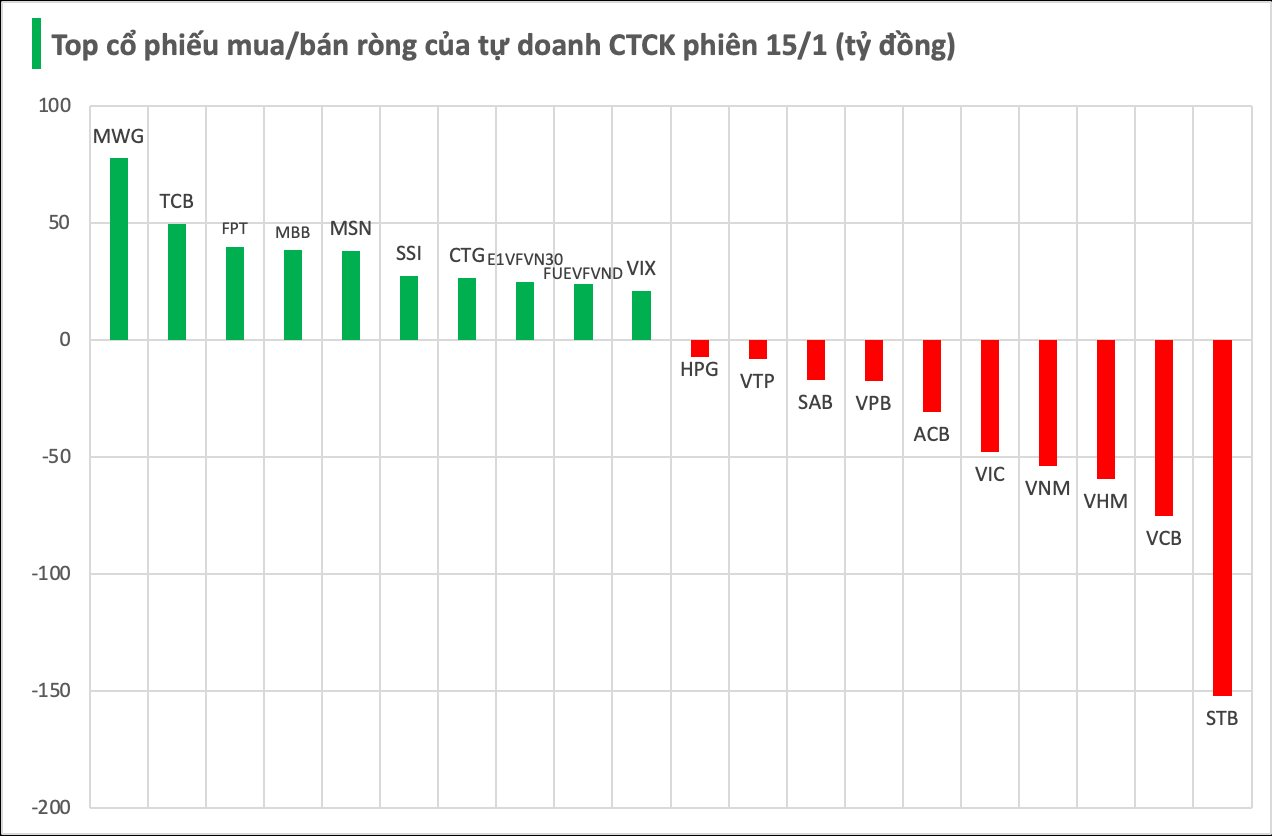

Specifically, proprietary trading desks of securities firms led net selling in STB with -152 billion VND, followed by VCB (-75 billion), VHM (-59 billion), VNM (-54 billion), and VIC (-48 billion VND). Other stocks with notable net selling included ACB (-31 billion), VPB (-17 billion), SAB (-17 billion), VTP (-8 billion), and HPG (-7 billion VND).

Conversely, MWG saw the strongest net buying at 78 billion VND. Other top net buys were TCB (50 billion), FPT (40 billion), MBB (38 billion), MSN (38 billion), SSI (28 billion), CTG (27 billion), E1VFVN30 (25 billion), FUEVFVND (24 billion), and VIX (21 billion VND).