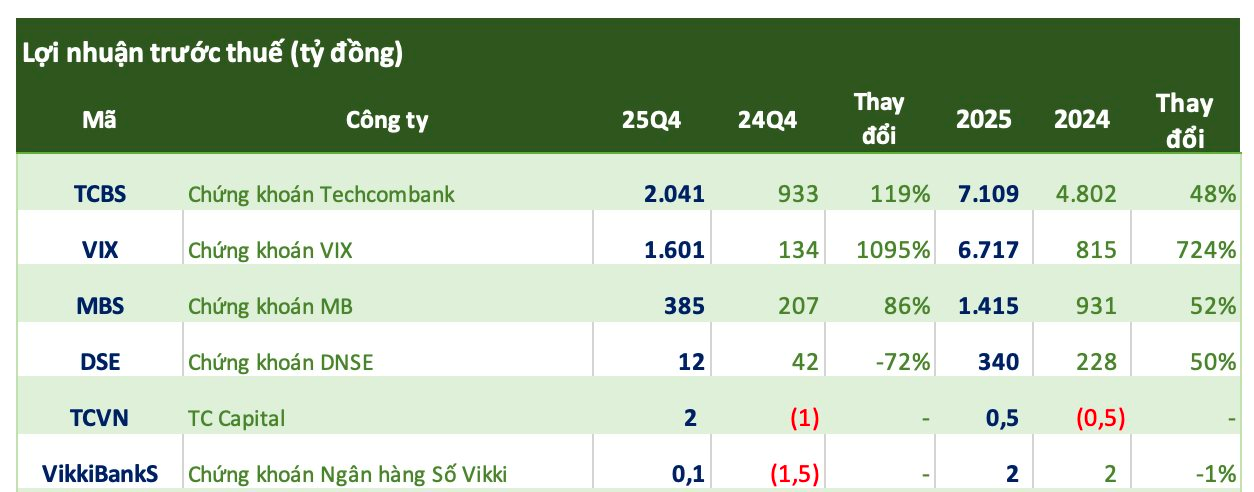

As of January 16th, six securities companies have released their Q4/2025 financial reports.

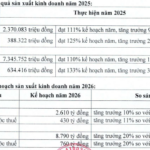

Techno-Commercial Securities (TCBS, stock code: TCX) has announced its Q4/2025 business results. Specifically, pre-tax profit for Q4 reached VND 2,041 billion, a 119% increase compared to the same period last year. For the entire year of 2025, TCBS achieved a record pre-tax profit of VND 7,109 billion, meeting 123% of the annual plan and a 48% increase compared to 2024.

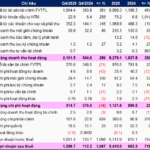

Total net revenue in Q4 reached VND 3,365 billion, and for the whole year of 2025, it reached VND 11,217 billion, a 47% growth compared to the previous year. In terms of structure, brokerage and securities custody revenue in Q4/2025 reached VND 89 billion, a 19% increase compared to the same period last year, and for the entire year of 2025, it reached VND 356 billion, a 63% increase compared to the previous year.

Additionally, in Q4/2025, income from margin loans and advance payments reached VND 1,119 billion, a 12% increase compared to the record-breaking previous quarter and a 64% increase compared to the same period last year. This brought the total income from margin loans and advance payments in 2025 to VND 3,664 billion, contributing 37% to the total net income from business operations and a 43% growth compared to 2024.

The investment banking segment recorded a net revenue of VND 468 billion in Q4/2025, a 110% increase compared to the same period last year, and a total revenue of VND 2,018 billion for the entire year of 2025, a 50% increase compared to 2024. Net income from capital trading and bond distribution in Q4/2025 reached VND 1,225 billion, a 101% increase compared to the same period last year, and a total revenue of VND 3,966 billion for the entire year of 2025, contributing 40% to the total revenue and a 42% growth compared to the previous year.

As of December 31, 2025, TCBS’s total assets reached over VND 80,632 billion, a 51% increase compared to the end of 2024. Margin loan and advance payment debt reached VND 43,860 billion.

VIX Securities reported a pre-tax profit of VND 1,601 billion, nearly 12 times higher than the VND 134 billion recorded in the same period last year (a 1,098% increase). This result was supported by a 418-fold increase in proprietary trading profits to over VND 1,383 billion, along with a 2.4-fold increase in lending profits to over VND 352 billion. For the entire year of 2025, this securities company reported a profit of VND 6,717 billion, a 724% increase compared to 2024.

MB Securities Corporation (stock code: MBS) recorded an operating revenue of VND 1,016 billion in Q4, a 34% increase compared to the same period last year.

In more detail, in the proprietary trading segment, profits from financial assets recorded through profit/loss (FVTPL) reached VND 178 billion, an 18% decrease compared to Q4/2024. In contrast, lending and receivables profits increased by 60% to VND 429 billion. Brokerage revenue also saw a positive growth of 74% compared to the same period, reaching VND 229 billion.

On the other hand, operating expenses in Q4/2025 were reduced, reaching VND 310 billion, a 6% decrease compared to the same period last year, mainly due to a 21% reduction in losses from FVTPL financial assets to VND 137 billion.

Pre-tax profit in Q4/2025 reached VND 385 billion, a significant 86% increase compared to the same period in 2024. Corresponding after-tax profit reached VND 308 billion, an 87% increase compared to Q4/2024.

For the entire year of 2025, MBS’s operating revenue reached VND 3,639 billion, a 17% increase compared to the previous year. Thanks to effective cost control, pre-tax profit for the year reached VND 1,415 billion, a 52% increase compared to 2024; after-tax profit reached VND 1,131 billion, also a 52% increase compared to the same period.

VIX Records Historic Profits in 2025, Proprietary Trading Thrives on GELEX Group’s Success

VIX Securities Corporation (HOSE: VIX) has announced its Q4/2025 financial report, revealing a remarkable surge in profits compared to the same period last year, capping off 2025 with record-breaking earnings. The primary drivers of this outstanding performance were the lending and proprietary trading segments, with a significant portion of the portfolio attributed to GELEX group stocks.

TCBS Issues ESOP Shares to 22 Individuals

TCBS is set to issue 275,475 ESOP shares to 22 employees at an offering price of 10,000 VND per share.

Derivatives Market 2025: VPS Loses Ground, DNSE Surges Ahead

According to the top 10 derivatives brokerage market share rankings for Q4/2025 and the full year 2025, recently released by the Hanoi Stock Exchange (HNX), it’s evident that the market landscape is gradually reshaping. VPS is facing intense competition from rivals, most notably DNSE, as the battle for market dominance intensifies.