Recently, the Hanoi City Tax Department has highlighted several important notes regarding administrative penalties for tax and invoice violations under Decree No. 310/2025/NĐ-CP, which amends and supplements certain provisions of Decree No. 125/2020/NĐ-CP dated October 19, 2020, issued by the Government on administrative penalties for tax and invoice violations.

This decree takes effect from January 16, 2026, introducing several amendments and additions to the principles of administrative penalties for tax and invoice violations, as follows:

– On the same day, if a taxpayer incorrectly declares one or more indicators on tax documents (not necessarily under the same tax category), the incorrect declaration will be penalized as a single procedural tax violation, subject to the highest penalty within the applicable framework.

– If a taxpayer commits multiple violations of issuing invoices at the wrong time or failing to issue invoices, and these violations are within the statute of limitations and penalized in a single administrative case, only one penalty will be applied for the violation of issuing invoices at the wrong time or failing to issue invoices, with the fine corresponding to the number of invoices violated.

– For incorrect declarations of multiple indicators on a single tax document, only one administrative violation with the highest penalty framework will be penalized, or a penalty under Article 16 or Article 17 of Decree 125/2020/NĐ-CP will apply.

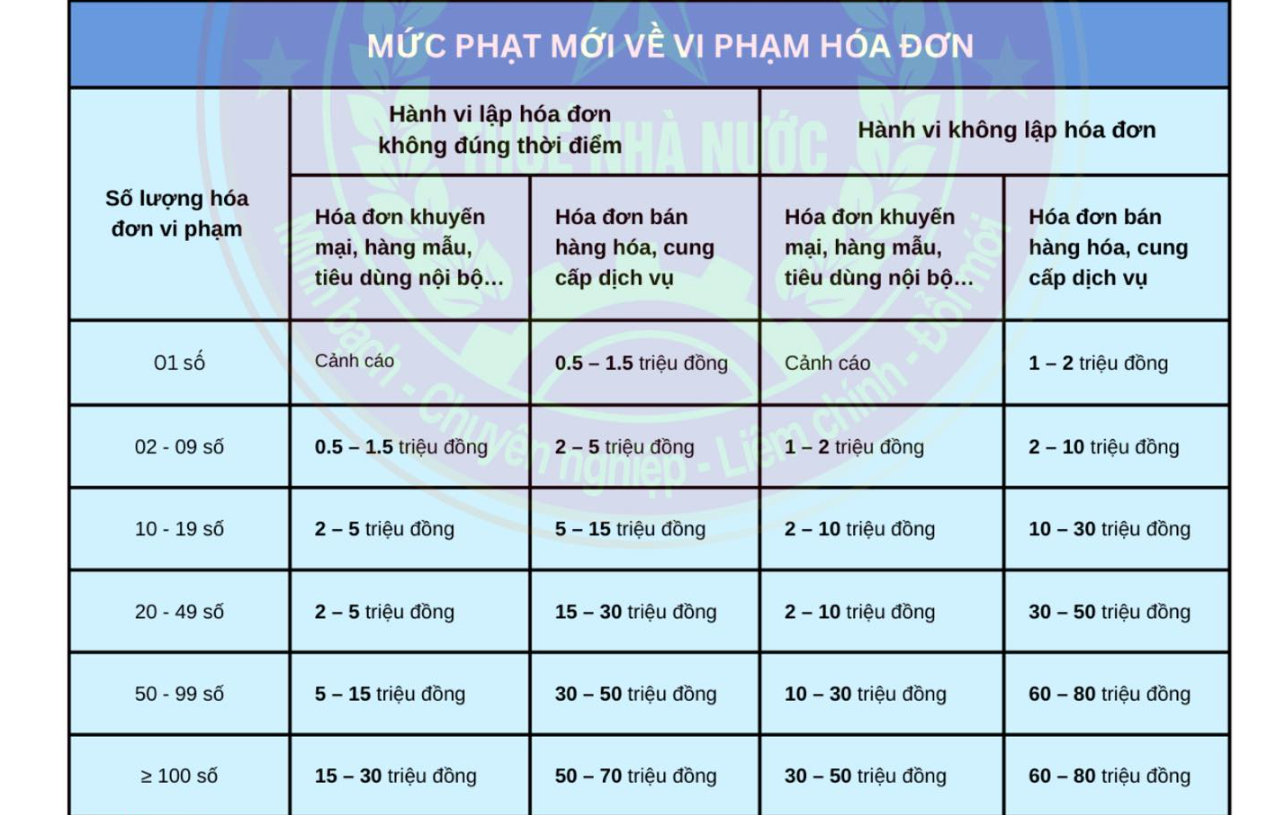

Additionally, taxpayers should note the new penalty levels for invoice violations under Decree No. 310, as detailed below:

New penalty levels for invoice violations (Source: Hanoi City Tax Department)

Decree 310 shifts from penalizing based on behavior to a progressive penalty system based on the number of invoice violations. Under the new regulations, penalties for issuing invoices at the wrong time range from a warning to a fine of 70 million VND, depending on the number of invoices and the type of transaction. Meanwhile, penalties for failing to issue invoices are detailed from a warning to a fine of 80 million VND, depending on the number of invoices and the severity of the violation.

The Hanoi City Tax Department notes that if an administrative violation of tax or invoice regulations is committed before the effective date of this Decree and is discovered after the Decree takes effect, the provisions of this Decree will apply.

It is important to note that the above penalties apply to organizations, individuals, households, and business households at half the penalty level of organizations.

Revamped Title:

“Starting 2026: Streamlined Regulations for Derivatives Trading in Securities”

Decree No. 306/2025/NĐ-CP, effective from January 9, 2026, introduces significant amendments and supplements to the conditions and documentation required for obtaining the Certificate of Eligibility for Derivatives Trading Business.

Where Can People Exchange USD Without Risking Severe Penalties?

Authorized currency exchange agents are clearly identified with signage. Engaging in unauthorized foreign currency transactions with individuals is illegal and carries significant risks.