Vietnam Steel Trading and Manufacturing LLC has registered to sell 7.5 million shares of POM, equivalent to a 2.7% stake in Pomina, to fulfill debt obligations on behalf of the company. The transaction is expected to be executed via order matching and negotiated trading from January 19 to February 13.

Vietnam Steel Trading and Manufacturing LLC, founded by Mr. Đỗ Duy Thái and currently led by him as CEO, is Pomina’s largest shareholder, holding over 146.3 million shares (52.54% of capital). If successful, their ownership will decrease to 49.8%.

This move comes as POM shares surged in nine consecutive ceiling sessions, tripling in value to VND 6,000 per share. Notably, POM remains under restricted trading, only allowed on Fridays. Pomina’s market capitalization stands at VND 1.7 trillion, while its charter capital is nearly VND 2.8 trillion.

The rally began after Vingroup appointed Mr. Đỗ Tiến Sĩ, Pomina’s Vice Chairman and CEO, as CEO of VinMetal (Vingroup’s VND 15 trillion subsidiary) in early November 2025. However, by late November, he stepped down to focus on restructuring Pomina.

Concurrently, Vingroup announced a zero-interest working capital loan for Pomina, valid for up to two years, and prioritized the company as a supplier for its ecosystem projects. Vingroup also supports Pomina’s restructuring and management team enhancement.

Vingroup’s preferential funding will help Pomina improve cash flow, restore supply chains, stabilize production, and gradually recover financial metrics. Mr. Nguyễn Việt Quang, Vingroup’s Vice Chairman and CEO, expressed optimism that Pomina will regain growth momentum and strengthen its domestic market position, contributing further to the nation.

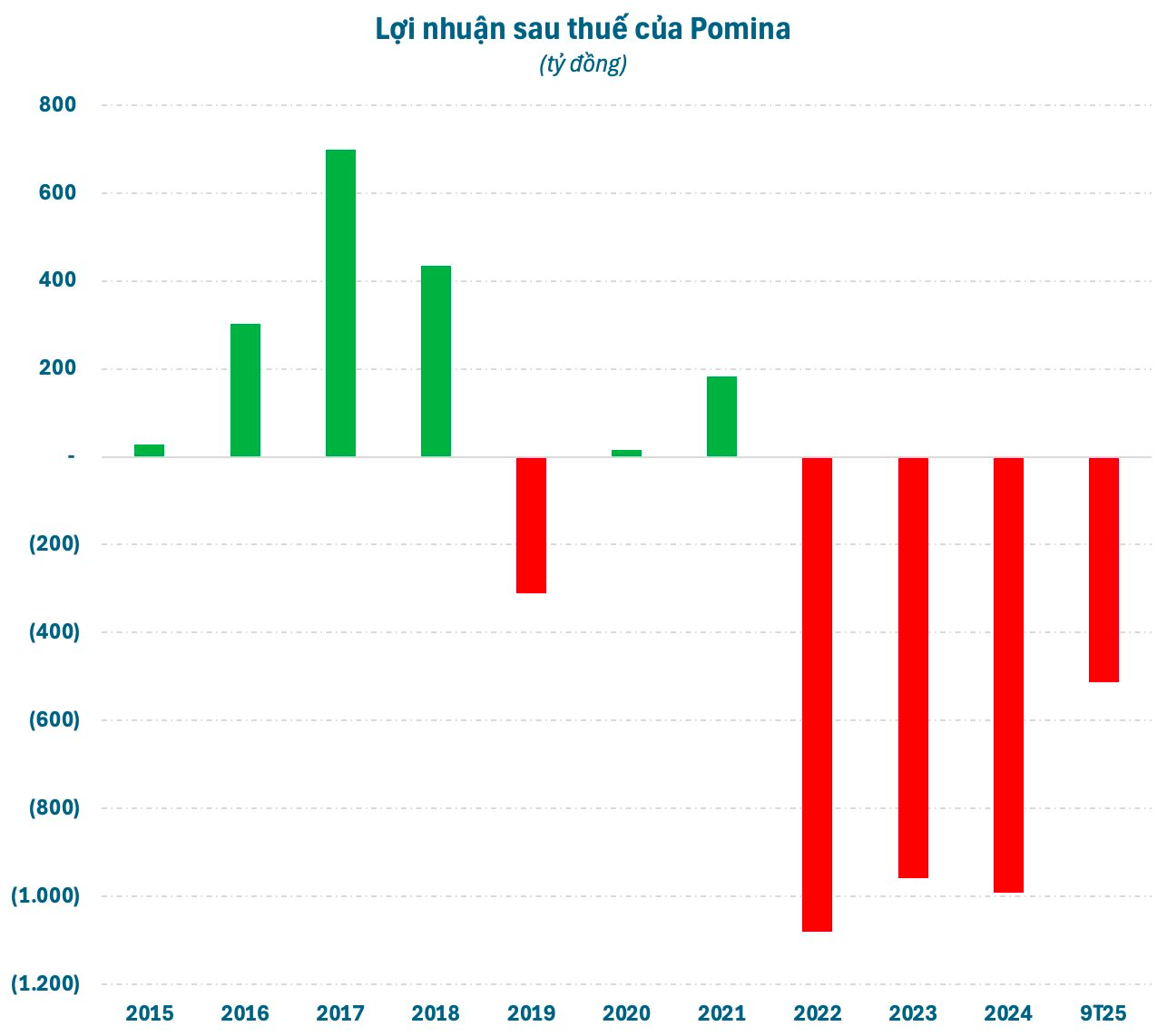

Prior to partnering with Vingroup, Pomina operated a construction steel production line and a blast furnace with capacities of 1.1 million tons and 1.5 million tons annually, respectively. However, operational inexperience led to frequent furnace shutdowns, resulting in continuous losses from Q2 2022 onward, with financial pressures mounting (loans at 65% of assets, negative equity by Q3 2025).

KBSV’s recent analysis highlights mutual benefits from the partnership, with potential market share risks for competitors if successful.

For Pomina, Vingroup’s working capital support and operational expertise will optimize construction steel production and sales, especially if Vingroup fully absorbs output. This could improve EBITDA and reduce mid-term debt pressure. Vingroup’s Vinhomes and Vincons will benefit from Pomina’s competitively priced steel. With 1.5 million tons annually, Pomina’s output represents 15% of the industry’s 2024 consumption.

KBSV estimates Pomina’s current market share at ~1%, with prices 2% higher than competitors. Analysts believe Vingroup will need time to upgrade Pomina’s production lines, enhance competitiveness, and reduce costs to maximize partnership benefits.

VN-Index Projected to Reach 2,040 Points by 2026, According to ACBS

In 2026, ACB Securities’ Market Analysis and Strategy Division (ACBS) forecasts the VN-Index to reach 2,040 points under its base-case scenario. ACBS’s 2026 strategic portfolio emphasizes leading stocks in banking, retail, residential real estate, and public investment sectors.

Vietnam Needs $200-300 Billion Enterprises to Lead Its Economic Transformation

“With a population of 100 million, a vast and dynamic workforce, a robust domestic market, and an unwavering ambition to rise, the emergence of globally competitive enterprises is not just desirable but essential. We must embrace this vision as a unified national goal as we step into an era of unprecedented growth and transformation,” shared economic expert Đinh Thế Hiển with Tiền Phong.