At the “Identifying Long-Term Growth Opportunities” dialogue program hosted by VinaCapital on the afternoon of January 16, 2026, experts provided forecasts on the 2026 macroeconomic outlook and key risks to monitor.

VinaCapital‘s dialogue program on the afternoon of January 16, 2026. Screenshot.

|

Positive Macroeconomic Outlook for 2026

According to Ms. Vũ Ngọc Linh, Director of Market Analysis and Research at VinaCapital, the macroeconomic landscape in 2026 is shifting positively, supported by robust factors both globally and domestically.

Globally, external pressures are easing as the U.S. Federal Reserve (Fed) is likely to continue its rate-cutting path this year, with an expected two cuts of 50 basis points each, bringing rates to around 3%. This move is crucial in reducing pressure on exchange rates, significantly stabilizing the Vietnamese Dong (VND) compared to 2025. Additionally, China’s slow and uneven economic recovery has indirectly benefited Vietnam by limiting the risk of “cost-push inflation” through trade and import supply chains. Collectively, these factors indicate that 2026 will be characterized by stable exchange rates and well-controlled inflation.

Domestically, the economy is transitioning from a phase of “absorption and recovery” to “acceleration” as policies and institutions begin to yield synchronized results. A notable highlight is the issuance of Resolution 79 by the Politburo, reaffirming the dominant role of the state-owned sector with the ambitious goal of having 1 to 3 state-owned enterprises enter the top 500 global corporations by 2030. When combined with Decree 68 on private sector development, a comprehensive strategy emerges to create a unified and sustainable domestic growth foundation, supported by both public and private pillars.

Recently, the market has reacted cautiously to tighter controls on real estate credit, causing short-term price declines in related stocks. However, from a long-term investment perspective, VinaCapital views this as a positive and necessary step to restructure the market. These measures help curb speculation, bring property prices to reasonable levels, and balance actual supply and demand, ensuring financial system stability. Moreover, real estate companies’ profits in 2026 remain secure due to strong sales in the previous year, with 80-90% of revenue already realized and awaiting recognition. Thus, any impact from credit policies will be more evident in the following year.

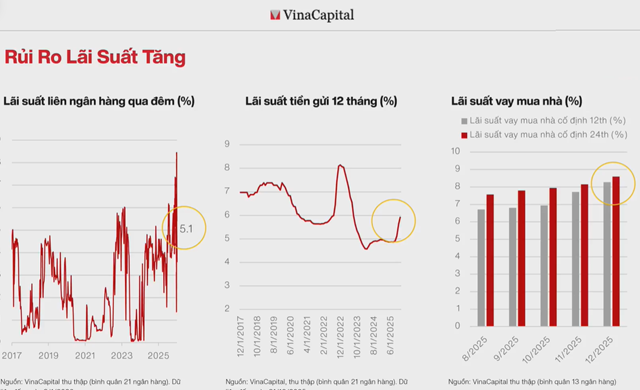

Monitoring Interest Rate Risks and NIM Decline

VinaCapital highlights key challenges for the market in 2026, with the most significant concern being the upward trend in interest rates. After a prolonged period of low rates to support the economy, the rate environment is rising as an inevitable norm. At times, overnight interbank rates surged to 7-8%, savings rates at some banks reached 8% for 12-month terms, and mortgage rates at major banks climbed to 14%.

The consequences of rising rates are multifaceted, directly impacting investors’ finances. First, higher borrowing costs erode corporate cash flows and profits, particularly for highly leveraged firms. Second, increased rates elevate discount rates in valuation models, leading to downward adjustments in stock prices. Most critically, as deposit rates become more attractive, capital may shift from equities to safer channels like savings or bonds, reducing market liquidity and fostering investor caution.

However, VinaCapital believes the anticipated 50-100 basis point increase by year-end, returning rates to pre-COVID-19 levels, remains manageable for macroeconomic stability and growth support. Concerns arise only if rates rise excessively beyond this scenario.

Delving deeper into market structure, Mr. Thái Quang Trung, Investment Director at VinaCapital, highlights risks in the banking sector—the economy’s backbone. While the sector has maintained healthy net interest margins (NIM) over the past two years (around 3% for state-owned banks and 4% for private banks), pressures are mounting. The loan-to-deposit ratio (LDR) stands at a decade-high of approximately 110% when calculated solely on customer deposits. Historically, when LDR tightens, liquidity pressures force banks to raise deposit rates, significantly compressing NIM. Thus, NIM decline is a tangible risk for banks failing to manage funding costs and liquidity effectively in 2026.

Additionally, tighter credit controls, especially in real estate, warrant close monitoring. While the State Bank of Vietnam’s (SBV) focus on asset quality and sustainability signals long-term market health by curbing speculation and normalizing property prices, short-term cash flow shocks for real estate firms and associated banks are inevitable. Recognizing these risks early, VinaCapital has maintained a low allocation to real estate and restructured its bank portfolio selectively, favoring institutions capable of safeguarding margins amid the new rate environment.

– 19:42 16/01/2026

VinaCapital Fund Group Eyes Major Acquisition of Real Estate Stocks

Based on the closing price of the session on January 15th, it is estimated that the fund will need to allocate approximately 300 billion VND to increase its ownership stake.

VinaLiving’s First Bond Issuance: What Makes It Stand Out?

In early January 2026, VinaLiving Holdings JSC (VinaLiving) successfully raised capital through the issuance of two bond tranches, both offering interest rates exceeding 10% per annum. The company is currently 99.98% foreign-owned.