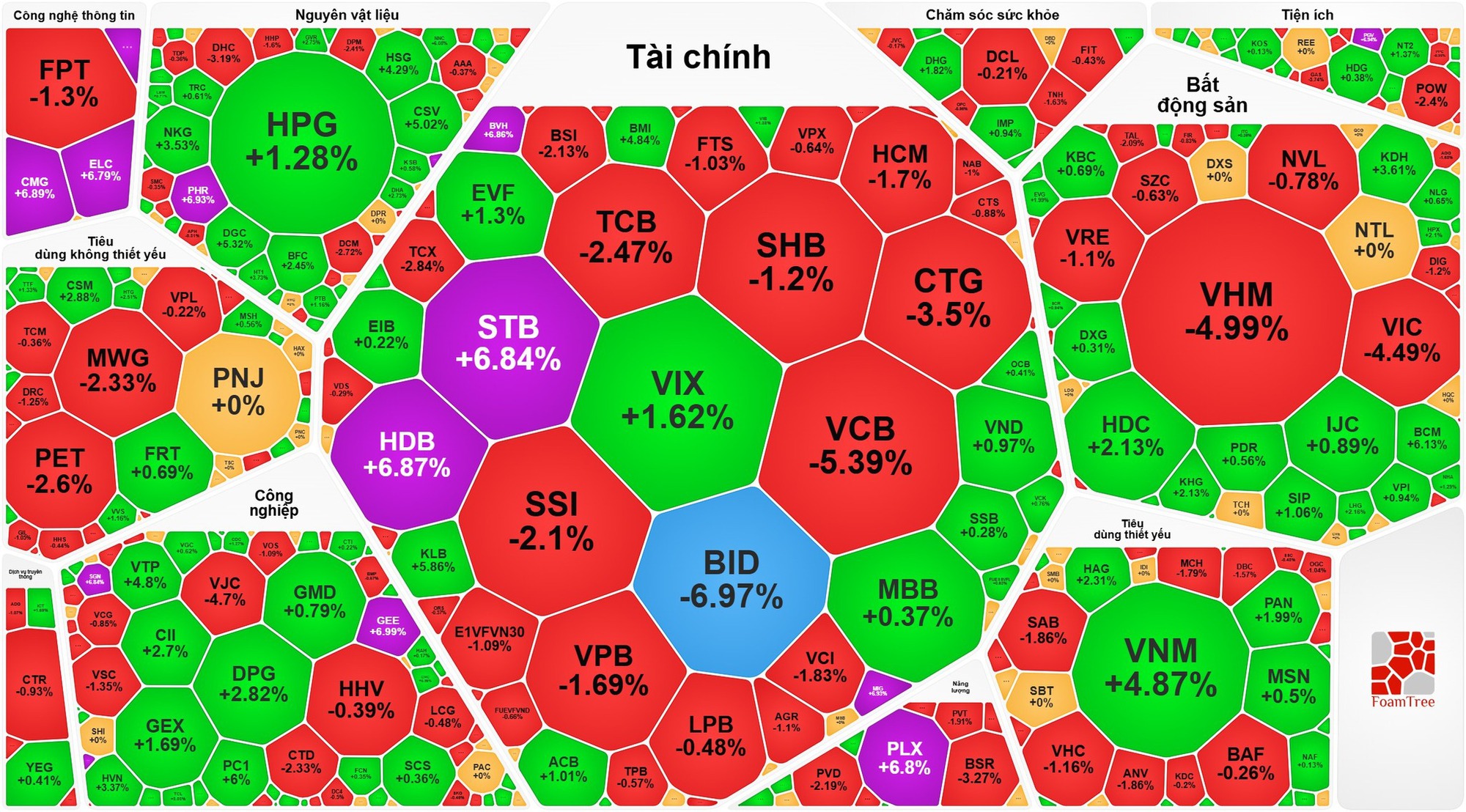

Today’s trading session was dominated by a dramatic reversal in large-cap stocks, particularly state-owned bank shares, causing the benchmark index to fluctuate wildly. By the close of trading on January 15, the VN-Index dropped 29.64 points (1.56%), settling at 1,864.80 points. This marked a notable recovery, as earlier in the session, intense sell-offs had pushed the index to its intraday low of 1,845.95 points, a near 50-point decline from the reference level.

Beyond the Vingroup stocks, state-owned bank shares—once the driving force behind the market’s surge past the 1,900-point milestone—exerted significant downward pressure. Notably, BID (BIDV) plummeted 7% to hit its lower limit at 50,700 VND, following a seven-day winning streak. Other banking giants also faced steep declines: VCB (Vietcombank) fell 5.4%, and CTG (VietinBank) dropped 3.5%. Additionally, the energy sector saw GAS decline by 3.7%.

The stock market experienced sharp polarization during the January 15 session.

However, the market’s outlook wasn’t entirely bleak. As the VN-Index dipped to around 1,840 points, bargain hunters aggressively stepped in, targeting VN30 constituents that hadn’t yet experienced significant rallies.

Standout performers included PLX (Petrolimex), STB (Sacombank), and HDB (HDBank), all of which surged to their upper limits. BCM (Becamex), a prominent industrial real estate developer, continued its upward trend with a 6.1% gain, while chemical giant DGC advanced 5.3%. VNM (Vinamilk) also contributed significantly, rising nearly 5% and helping to curb the index’s decline.

Elsewhere, upper-limit gains were scattered across sectors such as insurance, utilities, and telecommunications, indicating that capital remained active in seeking opportunities rather than exiting the market.

Market liquidity remained robust, reflecting the vibrant trading activity. Total trading value on the HoSE reached 40.92 trillion VND, with over 1.23 billion shares changing hands.

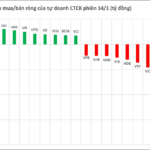

Foreign investors, who sold a net 1.2 trillion VND in the morning session, significantly reduced their selling pressure in the afternoon. By the close, net foreign outflows on the HoSE stood at 839.03 billion VND (with 4.558 trillion VND in sales and 3.719 trillion VND in purchases).

Market breadth at the close showed a tug-of-war but wasn’t overly negative, with 177 gainers and 147 decliners. The fact that more stocks rose than fell, despite the index shedding nearly 30 points, highlighted the distortion caused by large-cap stocks, while mid-cap shares saw positive capital flow.

The sharp correction during the derivatives expiry session was deemed necessary by experts to cool the market after its recent rally, creating opportunities for new capital to enter at more attractive price levels.

Foreign Block Net Selling Amid VN-Index Volatility, Counter-Trending with Over 400 Billion VND Inflow into Two Blue-Chip Stocks

Foreign investors’ transactions were a notable drawback, as they net sold approximately VND 409 billion.

Stock Market Plunges from Historic Highs

The VN-Index has retreated from its historic peak of 1,900 points as profit-taking pressure intensifies among large-cap stocks.