Illustrative Image

Recently, the FChoice 2025 Awards Ceremony and the “Double-Digit Economic Growth Drivers and 2026 Investment Opportunities” Seminar took place. During the event, Mr. Nguyễn Quang Thuân, Chairman of the Board of Directors of FiinGroup and FiinRatings, presented a discussion on the topic: “2026 Economic Outlook and Capital Mobilization Channels for Growth.” How can sustainable double-digit growth be achieved?

He reviewed some of FiinRating’s assessments of Vietnam’s current growth, what is lacking, and how to achieve sustainable double-digit growth.

In 2025, growth primarily comes from investment, with Vietnam remaining an investment-driven economy. Last year, public investment contributed 30%, and FDI was also very high. These two growth sources are mainly in the form of money, directly flowing into GDP. However, private sector investment remains weak, and consumer demand is also very low.

Additionally, domestic investment only increased by 8.4%, a concerning figure, while public investment contributed 30%, and the FDI sector performed well. Consumer demand remains weak, with a 6% increase in Vietnam considered pessimistic. Mr. Thuân’s view is that only when Vietnam’s per capita income approaches $10,000 will there be substantial consumption, and consumer demand will surge significantly.

Over the next 3-6 years, Vietnam’s economy will continue to grow based on investment. The first issue with investment is where the money will come from. Despite ambitious strategies, financial analysts will see that, beyond increasing productivity, applying science and technology, and digital transformation, we must have sufficient capital, especially long-term investment capital.

Mr. Thuân’s message is concise: we have big dreams, but we need to reshape our strategies to unlock investment capital sources, particularly from the private sector. The private sector here includes not only private enterprises but also state-owned enterprises. If current projects are just big dreams without financial viability or if they are pursued with high risks, sustainability will be very low.

Despite the lack of long-term capital, Vietnam has developed by using short-term capital from the banking system to finance long-term projects. This is evident in the renewable energy sector, where many companies with good models but lacking long-term capital have defaulted. This is an important lesson for the future.

Looking back, the two current strategic capital sources are public investment and bank capital, which are dominant. Mr. Thuân asserts that their potential will not last much longer. Although public investment is prioritized for disbursement, the value of projects will not double immediately. FiinRatings hopes to strengthen not only transportation infrastructure but also sectors collaborating with the private sector through PPP (public-private partnerships) or refinancing. The strategic capital channel he mentions is capital from the private sector, equity capital, and foreign currency loans from abroad.

Discussing the 2025 economic landscape, Dr. Võ Trí Thành believes Vietnam has learned an important lesson: fiscal policy space remains, with public debt at a low level (below 36% of GDP), allowing continued use of public investment as a growth lever. However, Vietnam cannot sustain excessively high credit growth indefinitely, as the credit-to-GDP ratio has reached 140–150%, far exceeding the usual safety threshold of around 120%.

This requires close coordination between fiscal and monetary policies to create space, ensure flexibility, and integrate the entire policy system effectively.

Another notable point is that despite relatively good growth, Vietnam’s economic resources are not fully utilized. Currently, the savings rate is around 37% of GDP, while the investment rate is only 32–33% of GDP, with a significant portion being foreign investment. This indicates that a large amount of household savings is tied up in real estate, gold, USD, Bitcoin, and other financial channels.

According to calculations, for sustainable growth, the investment rate needs to reach around 37–38% of GDP, while Vietnam currently stands at just over 33%. This means Vietnam’s development potential remains vast, provided capital flows are unlocked and societal savings are effectively transformed into long-term growth investments.

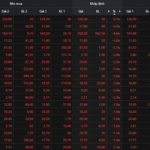

Liquidity Averages Projected to Reach VND 40-50 Trillion by 2026, Says Nguyen Thanh Lam (Maybank)

Maybank’s experts predict that the target P/E ratio for 2026 could reach 14.5 times, aligning with the 5-year average. This projection sets the VN-Index on course to hit the 2,000-point milestone by 2026.

Anticipating the 14th National Party Congress: Selecting the Right ‘Breakthrough of Breakthroughs’ to Elevate the Nation’s Stature

The 14th National Party Congress convenes amidst profound global shifts, as Vietnam stands poised on the brink of a transformative era of robust development. Scholars and intellectuals alike anticipate the Congress to chart the right strategic priorities, fostering genuine breakthroughs in institutional frameworks, growth models, enterprise development, and high-quality human resources. Such advancements are expected to propel the nation onto a trajectory of rapid, sustainable progress.