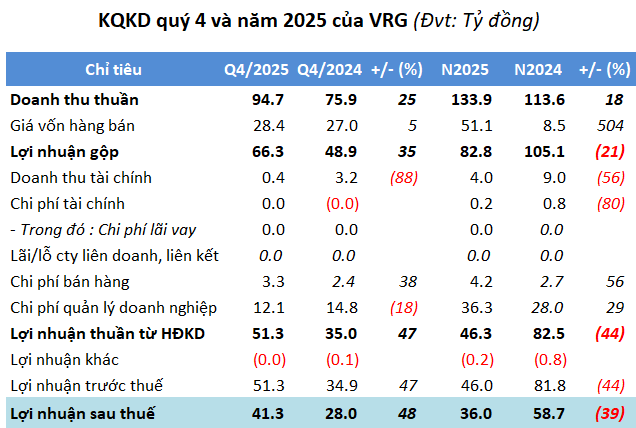

In the final quarter of 2025, Vietnam Rubber Urban and Industrial Park Development Joint Stock Company (UPCoM: VRG) reported a net revenue of nearly VND 95 billion, a 25% increase compared to the same period last year. After-tax profit exceeded VND 41 billion, marking a 48% growth.

According to the company’s explanation, the primary driver was the signing of two land lease contracts with infrastructure in the Communal Industrial Park during Q4/2025.

One contract, covering an area of approximately 12,469m², was recognized as revenue using the one-time accounting method. The other contract, spanning over 25,291m², had 90% of its value recognized, significantly boosting the quarter’s profit compared to the previous year.

| VGR incurred a loss of over VND 5 billion in the first three quarters of 2025 |

However, the final quarter’s results were not enough to offset the challenges faced throughout 2025. For the entire year, VRG generated a net revenue of nearly VND 134 billion, an 18% increase from the previous year, with the majority (over VND 109 billion) coming from infrastructure leasing activities. The cost of goods sold increased by more than 500%, primarily due to rising industrial park infrastructure investment costs, resulting in a gross profit of only VND 83 billion, a 21% decrease. Consequently, the annual net profit reached nearly VND 36 billion, 39% lower than the previous year.

Compared to the annual targets of VND 358.5 billion in revenue and VND 133.5 billion in pre-tax profit, the company achieved only 37% and 35% respectively, falling short of its goals.

Source: VietstockFinance

|

As of the end of 2025, VRG‘s total assets amounted to nearly VND 942 billion, an 8% decrease from the beginning of the year. The company held over VND 105 billion in cash and cash equivalents, a 17% reduction. Construction in progress costs were nearly VND 160 billion, down 52%. VRG also set aside over VND 28 billion for short-term uncollectible receivables.

Total liabilities stood at nearly VND 592 billion, a 5% decrease from the start of the year, primarily consisting of long-term unearned revenue of approximately VND 260 billion, down 3%, with no financial debt.

– 11:27 16/01/2026

Viglacera Approved for $235 Million Industrial Park Investment in Thai Nguyen

With a total investment capital exceeding 5.399 trillion VND, investor contributions account for over 809.9 billion VND, representing 15% of the overall investment.

CEO Group to Break Ground on $120 Million Industrial Park in Hai Phong by Year-End

Unveiling the Tien Lang Airport Industrial Park – Zone B, a groundbreaking 186-hectare development with a total investment of over 2.795 billion VND, spearheaded by a subsidiary of CEO Group. This visionary project aims to establish an eco-friendly, high-tech industrial zone, slated to commence construction by year-end.