TTD is set to pay a dividend yield of 10%, equivalent to VND 1,000 per share. With approximately 15.6 million outstanding shares, the company is expected to disburse nearly VND 15.6 billion for this interim payment. The payment date is scheduled for February 3rd.

Source: VietstockFinance

|

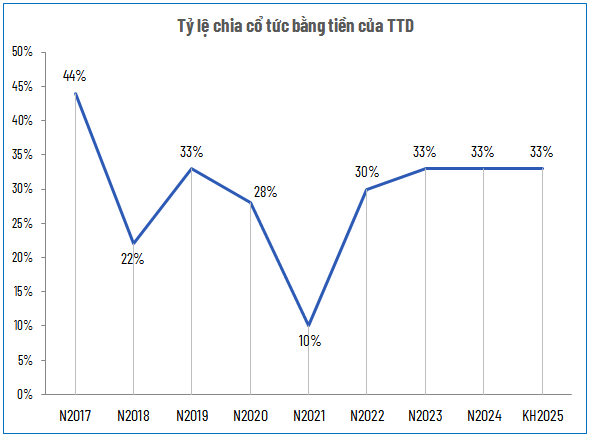

For 2025, TTD aims for a revenue target of VND 750 billion, a 5% decrease compared to 2024. However, the company plans to maintain a cash dividend payout ratio of 33%, consistent with the previous year. This marks the third consecutive year that Tim Tam Duc Hospital has sustained this dividend rate, amidst a net profit of over VND 80 billion, following a peak of VND 92 billion in 2022.

| TTD’s Financial Performance Over the Years |

According to the 2025 distribution plan, the company has already made a first interim payment of 10% in August 2025. The second installment, also at 10%, is upcoming, with a final payment of 13% expected after the 2026 Annual General Meeting.

Source: VietstockFinance

|

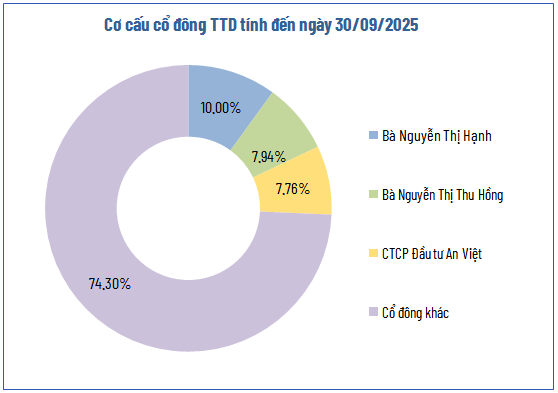

As of September 30, 2025, TTD’s top three shareholders are Mrs. Nguyen Thi Hanh (10% ownership), Mrs. Nguyen Thi Thu Hong (7.94%), and An Viet Investment Corporation (7.76%). Based on these holdings, out of the total VND 51 billion in dividends for 2025, Mrs. Hanh is estimated to receive over VND 5 billion, Mrs. Hong over VND 4 billion, and An Viet Investment nearly VND 4 billion.

| TTD’s 9-Month Financial Performance Over the Years |

In terms of business operations, during the first nine months of 2025, TTD recorded over VND 611 billion in net revenue and more than VND 70 billion in net profit, representing an 8% and 21% increase year-over-year, respectively. The profit growth outpaced revenue due to improved gross margins and a 60% rise in financial income. Consequently, the hospital achieved 81% of its revenue target and 83% of its profit goal for the year.

– 13:30 15/01/2026

VIX Stock Surges, Achieving 2025 Profit Targets Ahead of Schedule

VIX Securities Corporation is rapidly emerging as a standout player in the brokerage industry, showcasing exceptional profit growth that outpaces its peers.

Sacombank Announces 2025 Business Results: Proactively Boosting Provisions to Strengthen Financial Security Foundation

Sacombank (HOSE: STB) has unveiled its 2025 business results. Amid a volatile economic and financial landscape, the bank has sustained stable core operations while proactively bolstering credit risk provisions to fortify asset quality and financial foundations for future growth.