Kienlong Bank (KienlongBank; HoSE: KLB), a leading commercial joint-stock bank in Vietnam, has released its consolidated financial report for Q4 2025, showcasing impressive business performance.

During this period, interest income from customer loans reached VND 2,243 billion, a 15% increase year-on-year. Meanwhile, interest expenses on deposits rose by 18.55% to VND 1,186 billion. As a result, net interest income, the bank’s core business segment, surged by 33.13% to VND 1,056 billion.

Additionally, service activities generated VND 425.4 billion, and other operations contributed VND 129.8 billion, both significantly higher than the same period in 2024.

Consequently, KienlongBank reported an after-tax profit of VND 628 billion for Q4 2025, a remarkable 123.8% growth compared to Q4 2024.

For the full year 2025, the bank’s net interest income totaled VND 3,767 billion, an 18.6% increase from the previous year (VND 3,191 billion). Service activities brought in VND 897.7 billion, foreign exchange operations contributed VND 88.4 billion, and other activities added VND 409.1 billion, all showing positive growth.

By the end of the 2025 fiscal year, KienlongBank’s after-tax profit reached VND 1,856 billion, a substantial 109% increase year-on-year.

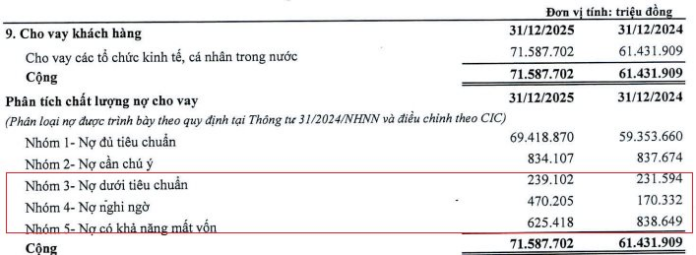

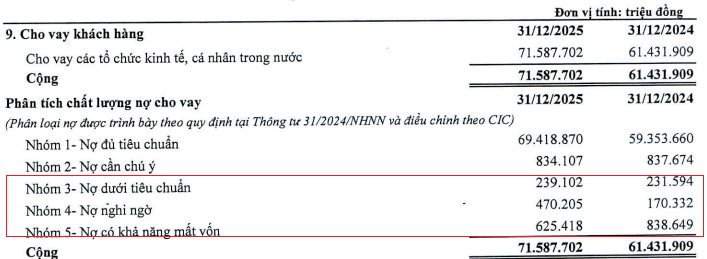

As of December 31, 2025, the bank’s total assets stood at VND 103,302 billion, a 12.7% increase from the beginning of the year, equivalent to a VND 11,126 billion rise. Customer loan outstanding reached VND 71,587 billion, up by 16.53%.

KienlongBank successfully reduced its non-performing loan ratio to below 2% by the end of 2025.

Notably, the bank’s credit quality significantly improved, with total non-performing loans amounting to VND 1,334 billion by the end of 2025, a 7.59% decrease from the beginning of the year.

Specifically, substandard loans (Group 3) increased by 3.24% to VND 239.1 billion; doubtful loans (Group 4) rose by 176.05% to VND 470.2 billion; and loss loans (Group 5) decreased sharply by 25.43% to VND 625.4 billion.

As a result, the bank’s non-performing loan ratio decreased significantly from 2.02% at the beginning of the year to 1.86% by the end of 2025.

On the stock market, January 15, 2026, marked a significant milestone as over 586 million KLB shares of KienlongBank were officially listed on the HoSE. This listing represents a pivotal moment in the bank’s development strategy.

By the end of the morning session on January 15, KLB shares were trading at VND 17,150 per share, a 5.86% increase from the reference price, with nearly 1.5 million shares traded.

The upward trend of KLB shares during the morning session on January 15 boosted KienlongBank’s market capitalization to nearly VND 10,000 billion.

VVS Stock Fluctuates Ahead of Q4 2025 Earnings Report

“Ahead of the Q4/2025 financial report release, VVS stock experienced a sharp short-term decline. This movement starkly contrasts with the company’s highly positive business outlook and growth that surpassed initial projections.”