An analysis of the Inter-Industry Balance Sheet (I.O) from 2012 and 2019 data has revealed significant insights into the true role of the service sector in Vietnam’s economy and economic growth.

High Efficiency but Low Spillover Effect of the Service Sector

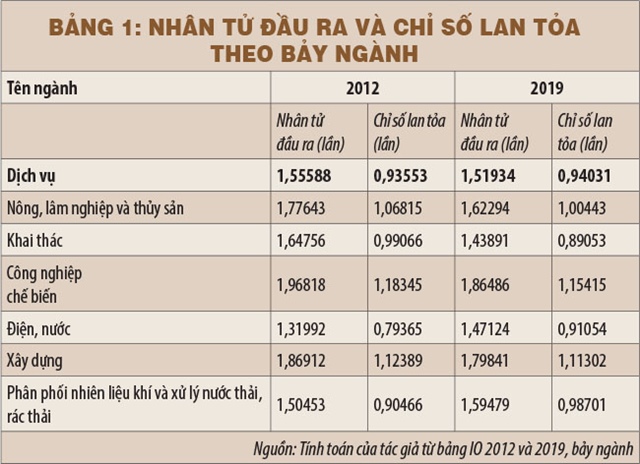

The analysis highlights an intriguing paradox: while the service sector’s output spillover index was only 0.94 in 2019 (below average), its value-added spillover index reached 1.15—the highest among the seven surveyed industry groups (Table 1). Notably, the service sector’s import spillover index was the lowest at 0.64.

Impressive Transformation of Key Service Sub-sectors

A detailed analysis of 11 industry groups reveals a remarkable shift in the “hospitality and catering” sub-sector. Its value-added spillover effect surged from 0.42 in 2012 to 1.52 in 2019—a 3.6-fold increase (Table 2). This indicates strengthened linkages with other sectors, including agriculture (food), manufacturing (beverages, furniture), transportation, and communications.

|

The trade sector also demonstrated its importance, with its value-added spillover index rising from 0.8 in 2012 to 1.18 in 2019, while significantly reducing import dependence (from 1.44 to 0.48). This reflects a positive shift in the circulation of goods, with a higher proportion of domestic products. The finance and banking sector maintained its strong position, with a high value-added spillover index (1.25 in 2019) and very low import spillover (0.28), underscoring its role in generating domestic income (Tables 3, 4).

Low Regional and Global Standing

Despite impressive efficiency figures, the service sector’s GDP share in Vietnam (42.4% in 2023) remains among the lowest. In Southeast Asia, Vietnam ranks 7th out of 11 countries, on par with Myanmar and only ahead of Brunei, Laos, and Cambodia. Globally, Vietnam ranks 94th out of 105 countries—lagging not only developed nations but also many developing countries like China, India, and even some African nations.

|

This lag stems from various factors: (1) Vietnam’s late transition to a market economy; (2) low service professionalization, with many activities remaining self-sufficient; (3) a high informal labor rate in the service sector (61.7% in 2019), hindering accurate statistics and development.

Policy Implications: Repositioning Services as a Priority Sector

Based on these findings, key policy recommendations include:

First, reposition the service sector as a national priority, not just based on GDP share but also on its efficiency in generating domestic value-added and retaining resources. The focus on increasing the industrial sector’s share should be reevaluated, given its high processing nature and role in the trade deficit.

Second, prioritize high-spillover service sub-sectors like finance, trade, and especially hospitality. For hospitality, policies should support linkages with domestic supply chains to maximize its improved spillover effects.

Third, enhance professionalization and formalization of the service sector workforce through institutional reforms, simplified procedures, and expanded social insurance. This will improve statistics, productivity, and service quality.

Fourth, boost service exports, particularly in tourism (via hospitality and transportation) and digital services. The service export share dropped from 15% in 2012 to 11% in 2019, while service imports, mainly transportation and insurance costs in CIF (Cost, Insurance, Freight), increased—a concerning trend that needs addressing.

Finally, enhance transportation and insurance services to reduce import dependence. The transportation sector’s import spillover index rose from 0.94 in 2012 to 1.05 in 2019, reflecting increased use of foreign equipment and intermediate services.

Conclusion

The analysis shows that while the service sector’s output spillover is lower than manufacturing, its domestic value-added is significantly higher and less prone to leakage through imports. This is crucial for a developing economy like Vietnam, ensuring real growth over “illusory” growth from assembly-based industries.

Conversely, the manufacturing sector, often seen as a growth driver, presents a concerning picture. Despite a high output spillover index (1.15 in 2019), its value-added spillover is only 0.73, with an import spillover of 1.64—indicating high processing and heavy reliance on imported inputs, the root cause of persistent trade deficits.

To realize this potential, a shift in focus toward “high-quality services” is essential. This strategic move will elevate Vietnam to regional and global standards, fostering a modern, efficient, and sustainable economy.

Khúc Văn Quý – Bùi Gia – Bùi Trinh

– 07:00 16/01/2026

Will Air and Rail Fares Drop as Services Increase for the Lunar New Year?

Experience seamless travel this Tet holiday with enhanced connectivity across Vietnam. Major airlines now offer overnight flights from six key regional airports: Tho Xuan, Dong Hoi, Chu Lai, Phu Cat, Pleiku, and Tuy Hoa. Additionally, the railway network has increased services on major routes, ensuring convenient and efficient travel for all your festive and spring exploration needs.

International Financial Center Enters Infrastructure Development and Investor Attraction Phase, Announces Finance Minister

Finance Minister Nguyen Van Thang announced that key institutional and judicial framework tasks have been completed on schedule, laying the groundwork for the International Financial Center to commence full operations by 2026.

Prime Minister Announces Launch of International Financial Center in Ho Chi Minh City by February 9th

On the afternoon of January 16th, concluding the first meeting of the Steering Committee for the International Financial Center in Vietnam, Prime Minister Pham Minh Chinh, Head of the Steering Committee, emphasized that the International Financial Center in Ho Chi Minh City must be launched no later than February 9, 2026.