Which statement is most accurate regarding the percentage rate used to determine disinflation?

Disinflation in economics refers to a very low and gradually decreasing inflation rate. It is a challenge in macroeconomic management. In Vietnam, many people often confuse disinflation with deflation. There is no precise criterion for the inflation rate percentage that defines disinflation. Some economic literature suggests that inflation rates of 3-4% per year or lower are classified as disinflation. However, in countries where monetary authorities (central banks) strongly dislike inflation, such as Germany and Japan, an inflation rate of 3-4% per year is considered entirely normal, not low enough to be deemed disinflation. In Vietnam during 2002-2003, the inflation rate was 3-4% per year, but many Vietnamese economists considered it disinflation. |

In economics, what phenomenon does the term “Bubble” refer to?

A Bubble is an economic cycle marked by a rapid escalation in market prices, especially asset prices, followed by a swift value decline. |

In monetary policy, how is “Currency Devaluation” understood?

Currency Devaluation is the intentional reduction of a nation’s currency value relative to another currency, group of currencies, or currency standard. Countries with fixed or semi-fixed exchange rates use this monetary policy tool. It is often confused with depreciation and contrasts with revaluation, which refers to adjusting the exchange rate of a currency. |

– 8:00 PM, January 17, 2026

The New Interest Rate Cycle: Who Holds the Advantage in the Stock Market?

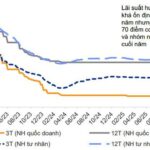

In 2026, Vietnam’s financial market is witnessing a new reality: the era of low interest rates is gradually coming to an end. As capital costs rise, securities companies with strong capital potential, unique ecosystems, and the ability to mobilize foreign capital, such as VPBankS (VPX), are emerging as the “leaders” driving the competitive race.

Vietnam’s Economy in 2026: Navigating Tight Credit Margins and Fiscal Pivot to Drive Growth

In 2026, Vietnam embarks on a pivotal phase with the launch of its Socio-Economic Development Plan for 2026–2030, a period critical to sustaining high and sustainable growth. Amid this backdrop, macroeconomic policy management faces a complex challenge: balancing growth support with macroeconomic stability, inflation control, and financial system resilience.

Price Stability: The Critical Factor Supporting the 10% GDP Target

In 2026, inflation is forecasted to stabilize around 3.5%, according to experts, driven by effective monetary and fiscal policies, alongside efficient price management. Key sectors such as food, energy, and construction materials are expected to remain steady, while exchange rates, interest rates, and logistics costs will be carefully regulated to maintain economic balance.