Minimizing the Tax Transition Shock

Starting January 1, 2026, businesses nationwide will transition from lump-sum tax payments to self-assessment declarations. While this move is deemed necessary, such changes often bring a “transition shock,” particularly challenging for small, traditional businesses.

Ms. Vân Chi, who runs a morning noodle stall on Yên Ninh Street, expressed concern: “My food stall operates from a family-owned location, relying on trial-and-error cooking methods. With modest revenue and numerous minor expenses, I’ve never maintained detailed records or invoices.”

Similarly, the owner of a Huế clam porridge stall in Thành Công Market shared: “Despite low earnings, self-assessment requires tax knowledge to avoid errors. I’m unsure how to comply correctly. Manual sales tracking is straightforward, but formal declarations feel overwhelming.”

Mrs. Lê Thị Duyên Hải, Deputy Secretary-General of the Vietnam Tax Consultancy Association, advised: “Businesses need not worry about separating revenue streams. Banks and software providers now offer tools to simplify this process.”

Supporting this, Mrs. Lê Thị Thanh Yên, Deputy Director of Retail Products at BIDV, highlighted MyShop Pro—an all-in-one management app integrated into BIDV SmartBanking. This eliminates the need for additional software, streamlining sales management while ensuring tax and e-invoice compliance.

“MyShop Pro connects businesses, banks, tax authorities, and digital partners, enhancing sales efficiency,” Mrs. Yên stated.

MyShop Pro features include: store management (ideal for multi-location vendors), product/menu management, staff oversight, payment speaker integration, customer segmentation, free e-invoicing, QR-based transactions, revenue/expense tracking, profit reports, and lifetime free access for 2025 registrants.

A Trusted Partner

Mr. Mai Sơn, Deputy Director of the Tax Department at the Ministry of Finance, noted simplified declaration forms will be piloted from December 2025, incorporating feedback from businesses to ensure a smooth transition.

“With limited staff serving millions of businesses, collaboration with banks, tech firms, and tax agents is vital,” Mr. Sơn emphasized.

BIDV CEO Lê Ngọc Lâm stressed the importance of digital transformation for a transparent, sustainable business environment. “We’ve prepared technology, personnel, and services to support businesses in this digital era,” he affirmed.

In just over a week, BIDV branches partnered with 34 provincial tax offices and 350 local units, serving as a “financial-tech pillar” for businesses nationwide.

Mr. Mai Sơn praised BIDV’s initiatives, including MyShop Pro, e-invoicing, and 2025 incentives. “BIDV exemplifies a true partner in modernizing tax management,” he concluded.

“With the Tax Department’s commitment, BIDV’s proactive support, and businesses’ cooperation, Vietnam’s SMEs will thrive in the digital age,” Mr. Lâm added.

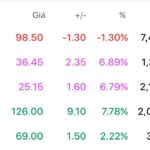

Tech & Telecom Stocks Surge: ELC, CMG Skyrocket, FPT Lags Behind

KBSV forecasts a robust recovery in global IT spending by 2026, with projected growth reaching 9.8% according to Gartner.

International Media Assesses Vietnam’s Economic Growth Prospects

Vietnam is poised to embark on an ambitious economic and infrastructure program to sustain growth, attract further foreign direct investment (FDI), and proactively navigate global economic uncertainties.