Joint Stock Commercial Bank for Foreign Trade of Vietnam – Vietcombank has issued an important announcement regarding the adjustment of Card Service Fees, scheduled to take effect from January 22, 2026. The changes primarily focus on international debit cards and international credit cards issued by Vietcombank.

For international debit cards, Vietcombank will introduce a transaction processing fee for domestic currency transactions conducted outside Vietnam in Vietnamese Dong (VND). The fee is set at 1% of the transaction amount, with a minimum charge of 9,000 VND per transaction, excluding Value Added Tax (VAT).

Details of international debit card service fees. (Source: Vietcombank)

Additionally, the fee for cash withdrawals at ATMs outside Vietnam has been adjusted to 3.64% of the transaction amount, with a minimum fee of 45,454 VND per withdrawal, excluding VAT.

For cash withdrawals at counters outside the Vietcombank network abroad, a similar fee of 3.64% applies, with a minimum charge of 45,454 VND per transaction, excluding VAT.

For cash withdrawals at ATMs outside the Vietcombank network but within Vietnam, the bank charges a fee of 9,090 VND per transaction, excluding VAT.

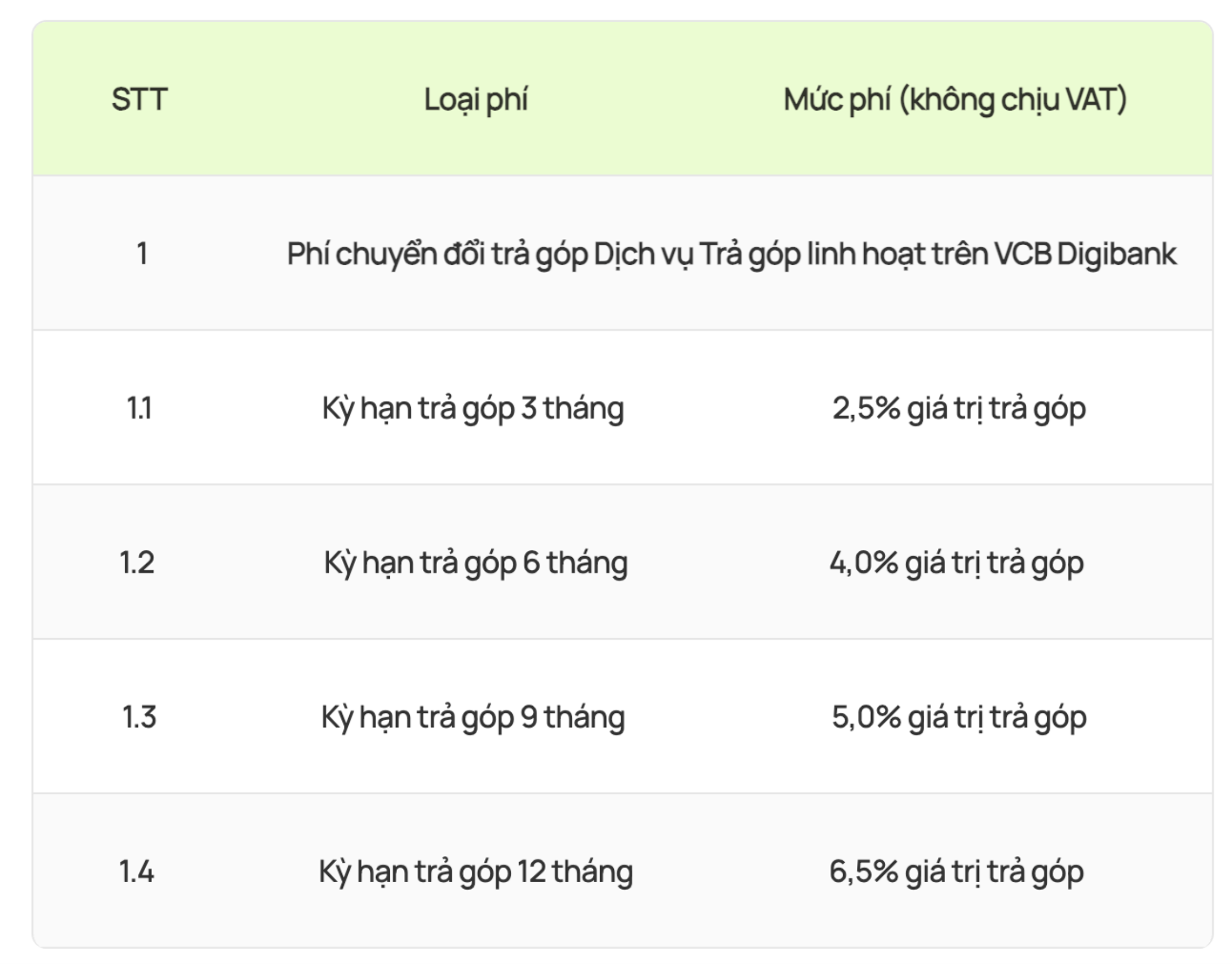

Regarding international credit cards, Vietcombank has introduced installment conversion fees for the Flexible Installment Service on the VCB Digibank platform. These fees are VAT-exempt and are calculated directly on the installment value of the transaction.

Specifically, the fees are categorized by installment periods as follows:

Details of international credit card service fees. (Source: Vietcombank)

– 3-month installment: 2.5% of the installment value

– 6-month installment: 4% of the installment value

– 9-month installment: 5% of the installment value

– 12-month installment: 6.5% of the installment value

This fee adjustment aims to update Vietcombank’s card service policies in response to the growing demand for digital banking services, cross-border transactions, and flexible installment options.

The bank advises customers to carefully review these changes to make informed decisions and choose transaction methods that best suit their individual needs.

Vietcombank Sets New Record with Over 600 Trillion VND in Achievements

In just over a week of trading in early 2026, VCB shares surged by more than 26%, propelling Vietcombank’s market capitalization to over 607 trillion VND—the highest ever achieved by a Vietnamese bank.

Banks Attract Record-Breaking Deposits

In 2025, numerous banks reported significant growth in deposits from individuals and businesses, bolstering their capital inflows and creating a robust foundation to accelerate credit expansion. This surge in deposits enables banks to meet the increasing demand for capital, supporting the recovery and growth of economic production and business activities.

Bad Debt Auctions Surge as Banks Offload Corporate Non-Performing Loans

As the Lunar New Year approaches, the pace of non-performing loan (NPL) resolution intensifies across commercial banks. With numerous businesses struggling to secure funds for timely debt repayment, banks are increasingly resorting to auctioning off collateralized assets and debts to recover capital.