At the “Identifying Long-Term Growth Opportunities” program organized by VinaCapital, Mrs. Vu Ngoc Linh – Director of Market Analysis & Research at VinaCapital, highlighted several positive aspects of the 2026 stock market outlook, driven by both domestic and international factors.

Globally, the U.S. Federal Reserve (Fed) is expected to continue its rate-cutting cycle in 2026, with approximately two reductions of 50 basis points each, bringing interest rates down to around 3%. This development is anticipated to support the stability of the Vietnamese Dong (VND) exchange rate. Meanwhile, China’s economic recovery remains slow and uneven, helping to limit the risk of cost-push inflation spreading to Vietnam through trade and supply chains. Based on these factors, VinaCapital predicts a more stable exchange rate in 2026 compared to 2025, with inflationary pressures remaining manageable.

Domestically, policies and institutional reforms are increasingly reflecting positively on the economy. VinaCapital assesses that Vietnam may transition from a phase of absorption and recovery to one of acceleration, as growth drivers collectively gain momentum. Recently, Resolution 79 of the Politburo emphasized the leading role of the state-owned economic sector, aiming for 1–3 state-owned enterprises to be among the world’s 500 largest corporations by 2030. Coupled with Decree 68 on private sector development, these policies are expected to create a foundation for more unified and sustainable domestic growth.

Regarding credit control policies, particularly in real estate, Mrs. Linh noted that in the short term, tightened credit and rising interest rates could negatively impact the real estate market, leading to recent sharp adjustments in sector stocks. However, from a long-term perspective, these measures are positive, contributing to market restructuring, bringing prices to more reasonable levels, curbing speculation, and balancing supply and demand.

According to VinaCapital, the State Bank’s early 2026 signals on credit control may initially surprise the market but also demonstrate regulators’ focus on asset quality and sustainable growth. Nevertheless, excessive credit tightening could hinder the 10% GDP growth target for this year.

In 2025, the initial credit limit was set at 16%, but actual credit growth reached approximately 19%. Therefore, policies may be adjusted after one to two quarters, depending on first-half GDP performance.

Market Still Has “Repricing” Potential

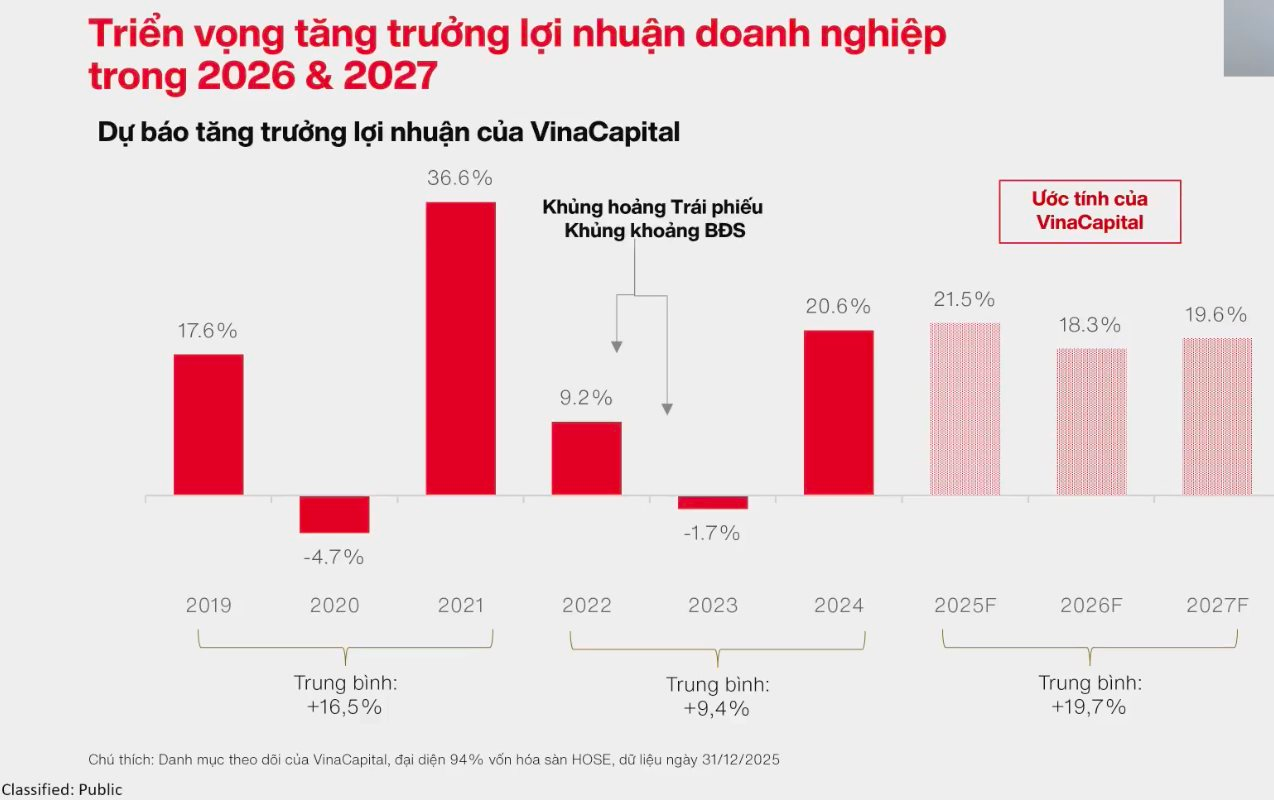

Regarding corporate profit outlooks, VinaCapital forecasts a market-wide profit growth of over 18% in 2026, reflecting significant improvements in domestic demand and profit margins. Decree 68 has already led to upward revisions in profit forecasts for several key private enterprises last year, while Resolution 79 is expected to take more time to impact state-owned enterprises noticeably.

In the real estate sector, last year’s sales were highly positive, with approximately 80–90% of units sold. Therefore, this year’s profits will primarily come from previously signed contracts, ensuring relative stability. Any negative impacts from credit policies are likely to affect next year’s profits more significantly.

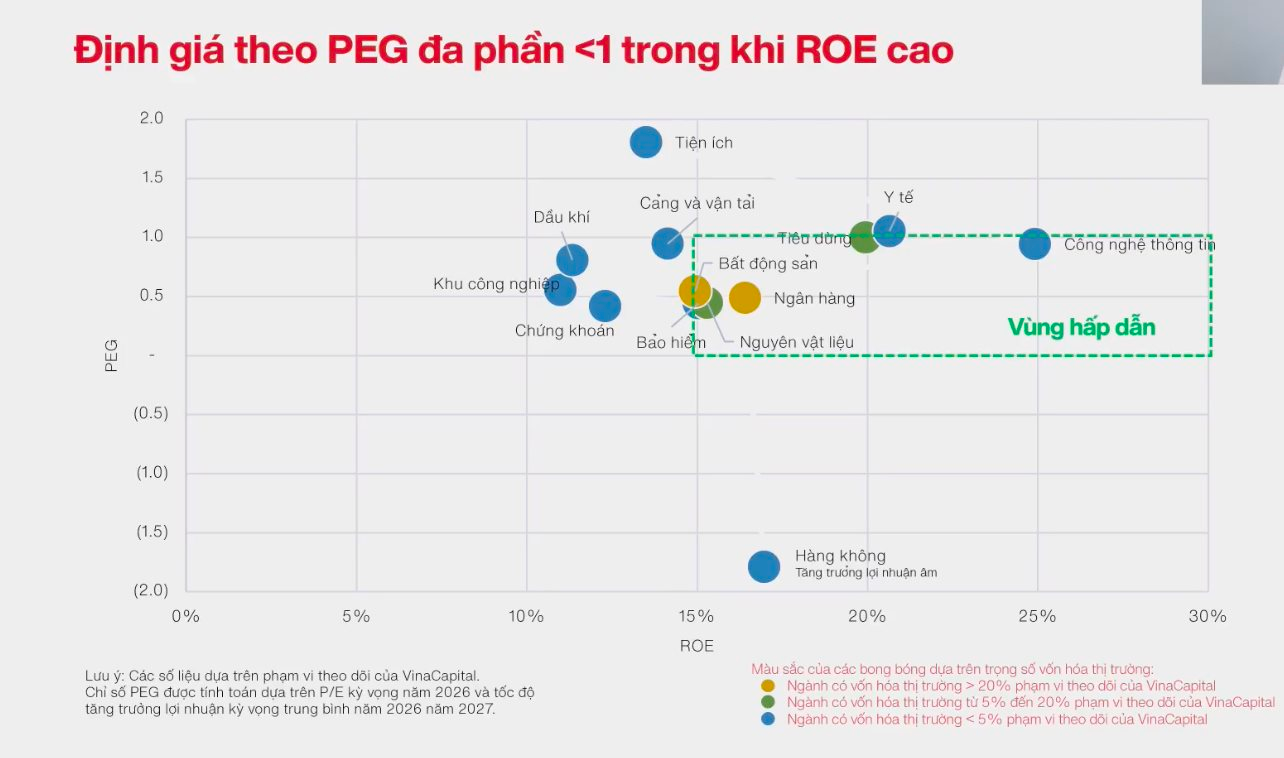

Several large companies continue to maintain strong growth rates and high profit margins, while valuations remain reasonable. According to Mrs. Linh, many sectors currently have PEG ratios below 1, alongside very high ROE levels, indicating that the market still has room for repricing. Price increases may broaden to more sectors, rather than being concentrated in a few leading stocks as in 2025.

Overall, VinaCapital projects positive profit growth across sectors in 2026, ranging from 15–30%, though disparities will persist, making stock selection crucial. Based on a market profit growth of approximately 18%, VinaCapital’s open-ended funds aim for average profit growth of 19–21%.

When Vietnam’s Average Income Reaches $10,000, Prosperity Will Truly Begin

“This insightful observation comes from Mr. Nguyễn Quang Thuân, Chairman of the Board of Directors at FiinGroup and FiinRatings.”

“VIP Guests Gather at FChoice 2025 Honors Ceremony, Sharing Insights on Seizing Investment Opportunities in 2026”

With the participation of numerous experts, business leaders, and entrepreneurs, the FChoice 2025 Awards Ceremony and the “Double-Digit Economic Growth Drivers and Investment Opportunities in 2026” Seminar emerged as a pivotal platform. This event seamlessly bridges macroeconomic perspectives with practical investment insights, fostering meaningful connections and strategic discussions.

FChoice 2025 Awards Ceremony and “Double-Digit Economic Growth Momentum & 2026 Investment Opportunities” Seminar Officially Launch Today

FChoice 2025 Awards Gala & Economic Growth Symposium: Unlocking Double-Digit Growth & Investment Opportunities in 2026

Join us on January 13, 2026, at the Sheraton Hotel in Hanoi for the prestigious FChoice 2025 Awards Ceremony and the insightful symposium, “Driving Double-Digit Economic Growth & Investment Opportunities in 2026.” This landmark event will bring together leading economists and top business representatives to explore transformative strategies and emerging opportunities shaping the future of economic growth and investment. Don’t miss this unparalleled platform for knowledge, networking, and inspiration.