Last week, the VN-Index experienced a mix of gains and losses, primarily driven by the rotation of capital among large-cap stocks. The index began the week on a positive note, extending its upward momentum from previous weeks, led by state-owned enterprises, particularly the trio of state-owned banks.

During the week, the VN-Index reached a new all-time high, surpassing the 1,918-point mark at one point. However, selling pressure quickly emerged, largely from Vingroup-related stocks, significantly narrowing the market’s overall gains. It wasn’t until the final session of the week that the market regained its upward trajectory, as these stocks rebounded alongside other leading shares.

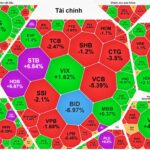

After four consecutive weeks of growth, analysts noted that profit-taking pressure was expected. Most sectors recorded positive gains, with the exception of real estate, which faced significant declines due to the underperformance of Vingroup-related stocks. Notable performers included technology, telecommunications, insurance, energy, industrial zones, rubber, retail, and construction materials, primarily driven by leading stocks with high state ownership ratios.

Last week, the VN-Index reached a new all-time high, surpassing the 1,918-point mark.

Market liquidity improved significantly, with average trading volume reaching approximately 1.23 billion shares per session, a 23.3% increase from the previous week. Notably, foreign investors turned net sellers, offloading nearly VND 1,843 billion on HoSE, ending a four-week buying streak and nearly locking in profits from their strong buying position since the beginning of 2026.

According to expert Nguyen Tan Phong from Pinetree Securities, capital flow is shifting away from state-owned stocks that have seen substantial gains over the past two weeks, with some returning to beta stocks that had previously experienced sharp declines.

Mr. Phong predicts that the index will likely remain stable in the first half of next week to commemorate the Party Congress starting on January 19, before experiencing more significant volatility in the following week, depending on new policies and messages. Historically, the VN-Index has often seen strong growth after the conclusion of the Party Congress. Additionally, next week will see many companies begin to announce their Q4 2025 earnings, which will also influence market trends.

However, the current market trend remains unclear. Investors should maintain a balanced portfolio of stocks and cash, prioritize portfolio management, and avoid FOMO (fear of missing out) on stocks that have already seen substantial gains.

Analysts from Saigon-Hanoi Securities (SHS) suggest that, given the short-term selling pressure and rapid capital rotation across sectors, the most suitable strategy is to hold positions in line with the VN-Index’s medium-term upward trend. Investors should focus on leading stocks driving the market and only consider adjustments if clear trend reversal signals emerge.

In addition to holding positions, investors can actively seek new opportunities in other leading stocks that are forming new upward trends after prolonged accumulation phases.

However, SHS cautions against high-speculation positions and excessive leverage. In the current phase, investors should consider portfolio restructuring and gradually reduce margin debt, especially as Q4 2025 margin lending data from securities companies is set to be released, which could add further market pressure.

Foreign Investors Net Sell Over VND 1,000 Billion in Session 15/1: Which Stocks Were Hit Hardest?

In a contrasting move, foreign investors actively accumulated large-cap stocks, with VIC leading the charge as they net bought approximately VND 211 billion worth of shares.

January 15th Session: Securities Firms’ Proprietary Trading Net Sells Hundreds of Billions in Bank Stocks, Bucking the Trend to Heavily Accumulate MWG

Proprietary trading firms significantly reduced their net selling activities on the Ho Chi Minh Stock Exchange (HOSE), with net sales dropping to just VND 14 billion.