Agribank’s Hoang Mai Branch (Hanoi) is auctioning 30 Kia Morning vehicles, which serve as collateral for loans taken by BG Taxi Joint Stock Company. BG Taxi has voluntarily surrendered these assets to the bank for liquidation in accordance with legal debt recovery procedures.

The starting price for the entire lot is VND 1.8 billion, equivalent to VND 60 million per vehicle.

Established in 2007, BG Taxi operates in the traditional taxi transportation sector with its headquarters in Hanoi. In 2012, the company was suspended by the Ministry of Transport’s Inspectorate due to violations in its transportation business operations.

Bank auctions 30 cars at a starting price of VND 60 million each. Illustrative image |

In addition to BG Taxi’s assets, Agribank and its affiliated branches are auctioning several other vehicles used as collateral.

Agribank’s Tan Dinh Branch (Ho Chi Minh City) is auctioning a 2008 Mitsubishi Pajero GL specialized vehicle with license plate 57L-5834. The starting price is VND 80 million. This type of vehicle is commonly used by banks for cash-in-transit services.

The same branch is also auctioning a 2009 Hyundai Santafe specialized vehicle with license plate 51A-524.25, starting at VND 150 million.

Furthermore, Agribank AMC is auctioning a 2019 Land Rover passenger car with license plate 51F-892.57. This vehicle serves as collateral for a loan taken by PGV Investment LLC under a 2019 credit agreement with Agribank’s An Phu Branch, co-signed by Mr. P.V.D. and Ms. D.T.T.T. The starting price is VND 2.63 billion.

All auctioned assets are sold in their current condition, including physical state and legal status, on an “as-is” basis.

Bidders are responsible for inspecting the assets and verifying their quality, quantity, and legal status based on actual conditions.

Successful bidders must independently contact relevant authorities to complete legal documentation and transfer ownership rights.

Participation in the auction implies acceptance of the asset’s condition, legal status, and associated risks. Bidders are solely responsible for any issues and agree not to file complaints post-auction.

Tuấn Nguyễn

– 10:11 17/01/2026

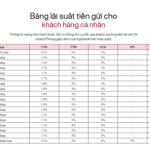

Banks Attract Record-Breaking Deposits

In 2025, numerous banks reported significant growth in deposits from individuals and businesses, bolstering their capital inflows and creating a robust foundation to accelerate credit expansion. This surge in deposits enables banks to meet the increasing demand for capital, supporting the recovery and growth of economic production and business activities.

Bad Debt Auctions Surge as Banks Offload Corporate Non-Performing Loans

As the Lunar New Year approaches, the pace of non-performing loan (NPL) resolution intensifies across commercial banks. With numerous businesses struggling to secure funds for timely debt repayment, banks are increasingly resorting to auctioning off collateralized assets and debt portfolios to recover capital.

Bad Debt Auctions Surge as Banks Offload Corporate Non-Performing Loans

As the Lunar New Year approaches, the pace of non-performing loan (NPL) resolution intensifies across commercial banks. With numerous businesses struggling to secure funds for timely debt repayment, banks are increasingly resorting to auctioning off collateralized assets and debts to recover capital.

Why More Banks Are Raising Interest Rates on Social Housing Loans

Unlock exclusive savings with Agribank’s unbeatable 5.6%/year interest rate for the first 5 years of your loan. Meanwhile, top banks like Vietcombank, BIDV, and Vietinbank have halted their special 5.2-5.5% fixed-rate offers for borrowers under 35, making Agribank’s deal even more irresistible. Act now to secure your financial future!