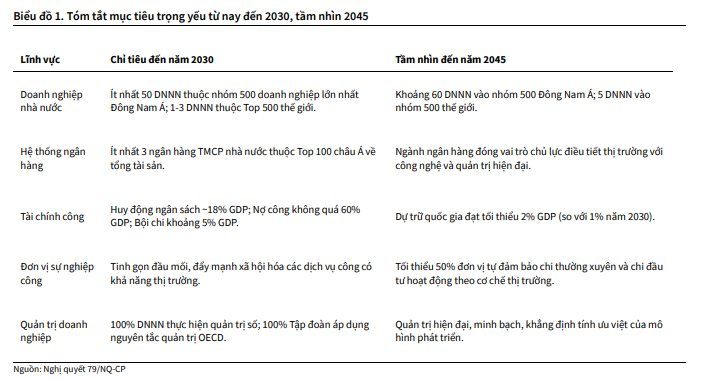

According to a recent report by KBSV, Resolution 79 – NQ/TW is expected to significantly impact various sectors and listed companies, particularly state-owned enterprises.

In the banking sector, the resolution emphasizes the growth of state-owned banks’ asset scale, potentially accelerating capital increases in the coming period. The goal is to have at least three state-owned commercial banks among Asia’s top 100 banks by total assets.

As of Q3/2025, the total assets of VCB, CTG, and BID were approximately VND 2,300 trillion, VND 2,700 trillion, and VND 3,000 trillion, respectively. Meanwhile, the minimum asset size for Asia’s top 100 banks is around USD 150–200 billion, growing at an average annual rate of 5%.

To achieve this goal within five years, these banks would need an average annual asset growth of 13–17%, similar to the 2020–2025 period. Such high growth rates could strain capital adequacy ratios (CAR), potentially leading to state divestment or strategic investor sales in the near future.

Additionally, Resolution 79 allows the full use of proceeds from equitization and state divestment, along with increased retained earnings ratios. This mechanism enables state-owned banks to accelerate capital growth through retained profits, ensuring compliance with capital safety standards and sustainable long-term growth.

In the energy and oil & gas sector, the resolution highlights the role of state-owned enterprises like EVN and PVN in developing critical energy projects, including nuclear and offshore wind power, to ensure national energy security. Legal procedures for state-led energy infrastructure projects have been significantly streamlined.

Specifically, power grid projects under the Power Master Plan are exempt from investment approval and land allocation procedures under Resolution 253/2025/QH15. Additionally, adjustments to total investment levels are more flexible under Resolution 666/2025.

State-owned enterprises are encouraged to diversify funding sources, including equitization proceeds, retained earnings, and revaluation of fully depreciated but still-used assets. These mechanisms are expected to attract private investment into state-owned enterprises.

In the technology sector, the 2025 Digital Industry Law aims to boost demand for domestic digital industrial products. By integrating digital data into production and promoting AI applications, the law creates an environment conducive to increased R&D investment.

The resolution targets raising R&D spending to 2% of GDP, with over 60% contributed by the private sector. A minimum of 3% of the annual state budget will be allocated to science, technology, innovation, and digital transformation, supporting long-term growth in the tech sector.

For the aviation sector, Resolution 79 allows state-owned enterprises to retain profits for capital increases and reinvestment, enabling ACV and HVN to enhance financial capacity and fund major projects like airports, fleets, and technical infrastructure. Prioritizing resources for key aviation projects is expected to expand airport capacity and modernize air traffic management systems, improving competitiveness and international cooperation in aviation logistics.

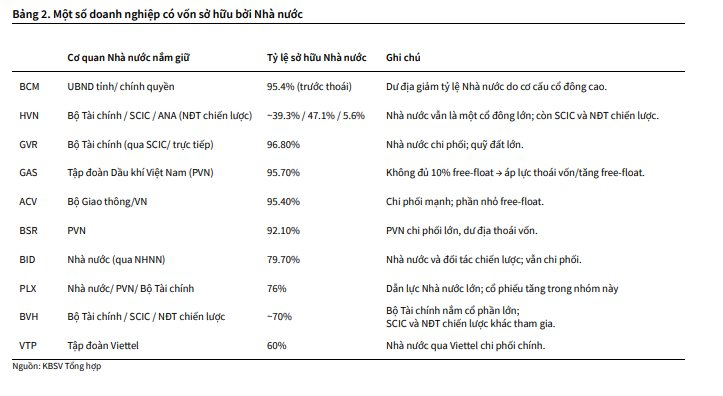

From a capital market perspective, Resolution 79 accelerates the equitization and restructuring of state-owned enterprises to enhance efficiency and attract non-state capital. This aligns with Law 56/2024/QH15, effective from January 1, 2025, requiring listed companies to have at least 100 retail investors holding a minimum of 10% of voting shares. State-owned enterprises with concentrated ownership structures must expedite divestment to comply with this regulation.

While 10% is not a large proportion, this requirement is expected to enhance market liquidity, improve stock liquidity, and boost market expectations of price increases, facilitating state divestment.

Enhancing State Economic Governance: The Imperative of Resolution 79

Amidst the nation’s pursuit of elevated, comprehensive, and sustainable development, the Political Bureau’s Resolution No. 79-NQ/TW on state economic development emerged as a pivotal response to these newfound imperatives.

Vietnam’s Tech and Telecom Giant Surges, Hitting Record-High Valuation of Over $13 Billion

The stock has just marked its third ceiling-hitting surge in the last four sessions, emerging as one of the hottest focal points in the market during the early days of the new year.

Market Pulse 14/01: Real Estate Sector Struggles as VN-Index Fails to Break 1,900-Point Barrier

At the close of trading, the VN-Index fell by 8.49 points (-0.45%), settling at 1,898.44 points, while the HNX-Index rose by 0.47 points (+0.19%), reaching 253.32 points. Market breadth was relatively balanced, with 394 gainers and 317 decliners. Similarly, the VN30 basket showed equilibrium, featuring 14 advancers, 13 decliners, and 3 unchanged stocks.