Financial data and market analysis reveal that Military Commercial Joint Stock Bank (HOSE: MBB) is leading in scale expansion while maintaining superior profitability compared to state-owned commercial banks. This marks a notable shift in the competitive dynamics among major banking institutions.

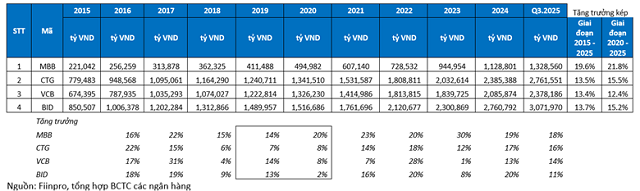

From 2020 to 2025, a key question for analysts and the market has been which bank within the Big 5 is truly driving growth and whether that growth is sustainable. Focusing on total assets—a core metric reflecting an institution’s scale—aggregated data shows MB outpacing its peers. While VietinBank (CTG) and BIDV (BID) maintain asset growth around 15.2–15.5%, and Vietcombank (VCB) at a more conservative 12.4%, MB accelerates with a compound annual growth rate (CAGR) of 21.8%. This gap highlights MB’s faster expansion compared to direct competitors in the leading group.

|

Over the long term (2015–2025), MB’s consistent growth rate of 19.6% annually surpasses the 13.4–13.7% average of the three state-owned banks. Notably, this growth is steady even during economic challenges. During the 2020–2021 COVID-19 pandemic, when credit activities slowed industry-wide, MB still achieved 20–23% annual asset growth. This resilience underscores its robust development strategy, macro-adaptive flexibility, and effective risk management.

According to MBS analysis, MB’s superior credit and asset growth stems from strong internal fundamentals rather than high-risk expansion. Its credit structure aligns with the State Bank’s policies, focusing on manufacturing, trade, SMEs, and retail secured lending. By limiting exposure to speculative real estate and corporate bonds, MB minimizes risk and secures higher credit limits from regulators.

Operational efficiency and a diversified financial ecosystem further distinguish MB. Leveraging digital credit processes, it shortens approval times, especially for retail and SME clients. Its integrated ecosystem, including securities and insurance, maximizes customer lifetime value and converts credit limits into actual loans efficiently. Additionally, a low-cost funding advantage—driven by a leading non-term deposit ratio (CASA) supported by corporate payroll accounts—enables competitive lending rates while sustaining profitability.

A critical aspect of MB’s model is balancing scale expansion with profitability. Its return on equity (ROE) surged from 12.8% in 2015 to over 20% in 2019–2025, outperforming the cyclical ROE fluctuations of other Big 5 banks. This demonstrates MB’s ability to convert scale into tangible profits, avoiding inefficient growth.

The stock market reflects MB’s financial and strategic superiority. From 2020 to 2025, its market capitalization grew at 19.5% annually, double the 8–9% rate of VCB and BID. Over 2015–2025, MB’s CAGR in market cap reached 25%, signaling investor confidence in its long-term prospects as a fast-growing, well-managed bank.

|

As Vietnam’s banking sector prioritizes quality and systemic safety, MB’s rapid scale expansion—supported by Basel II/III compliance, a healthy credit portfolio, and optimized operations—positions it as the most dynamic Big 5 bank. This shift underscores a new competitive paradigm where growth speed and quality define market leadership.

Services

– 09:48 17/01/2026

Q4/2025 Financial Report Update: Bank Profits Surge 124% in Q4, While Seafood Company Posts Loss

The fourth quarter of 2025 is shaping up to be a promising period for businesses, as early indicators reveal robust growth across various sectors. This quarter’s earnings outlook is painting a picture of profitability, with many companies already reporting impressive gains. The initial results set the stage for what could be a highly successful end to the fiscal year.