The latest Vietcombank Securities (VCBS) steel industry strategy report for 2026 forecasts a rebound in global crude steel production, projecting an output of 1.81–1.85 billion tons, marking a 1–3% recovery from the 2025 low.

Growth momentum is primarily driven by emerging markets (excluding China), such as India (+9%), Southeast Asia, and the Middle East. Meanwhile, production in the EU is expected to recover gradually due to persistent weak demand and high energy costs.

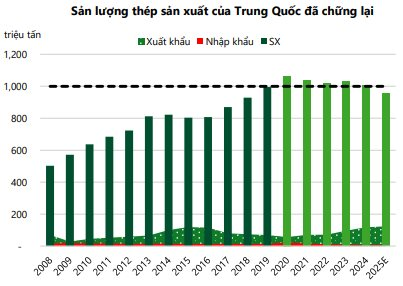

VCBS anticipates a slight decline in China’s crude steel output as mills proactively reduce production. Global steel consumption is also expected to rise modestly, reaching nearly 1.8 billion tons. Asia and the Pacific remain the largest consumers, with approximately 1.3 billion tons, a 1% increase from 2025. This growth is primarily supported by India and other developing economies, while China’s consumption continues to decline slightly.

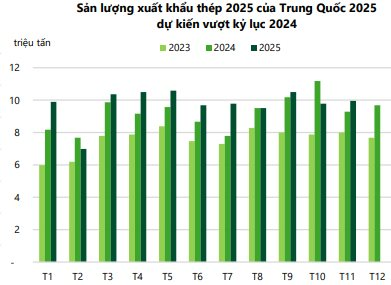

In the medium term, China’s policy of “restricting negative competition” is expected to accelerate crude steel production cuts, supporting global steel prices. Despite reduced production, China’s steel exports are projected to rise, reflecting persistent oversupply within the country.

In Vietnam, crude steel production is forecast to rise in 2026, partly due to Hoa Phat’s completion of the Dung Quat 2 project in late 2025. Total market supply is expected to reach 25–26 million tons, the highest in years.

According to VCBS analysts, the steel industry’s profit is projected to grow by 22% in 2026, though distribution will be uneven, favoring companies with upstream production advantages.

China’s Steel Exports Shift from Low-Cost to High-Quality

China recently reinstated its steel export management mechanism after a 16-year hiatus (since 2009). VCBS believes this strategic shift will reshape the global steel trade landscape.

On December 12, 2025, China’s Ministry of Commerce (MOFCOM) and General Administration of Customs issued “Notice No. 79-2025,” adjusting approximately 300 HS codes for steel products. This covers nearly the entire steel value chain, from raw materials to finished products, requiring export permits for each shipment.

To obtain a permit, exporters must submit an export contract and a quality certification from the manufacturer. Effective January 1, 2026, the detailed 10-digit HS code list ensures comprehensive regulation, leaving no loopholes for circumvention. The goal is to shift focus from “quantity” to “quality.”

VCBS views this not as an export ban but as an administrative barrier to control the flood of low-cost exports (which have triggered global anti-dumping investigations) and force small, low-tech mills out of the export market.

“Notice 79” serves as a soft quota tool, allowing China to regulate global steel prices rather than letting mills freely dump low-cost products as before.

Regarding Vietnam, analysts believe China’s policy shift will impact pricing and volumes. In early 2026, China’s export volumes are expected to decline, while prices rise. For importing countries like Vietnam, the domestic steel industry is poised for short-term gains. Adjusting to the new permit process may slow Chinese imports, enabling domestic steel prices and production to recover.

Vietnamese steelmakers may maintain or raise prices (due to recent raw material cost increases) after a prolonged price decline in late 2025. Vietnamese steel gains a competitive edge as Chinese imports face additional procedural costs and risks, narrowing the price gap between domestic and imported steel.

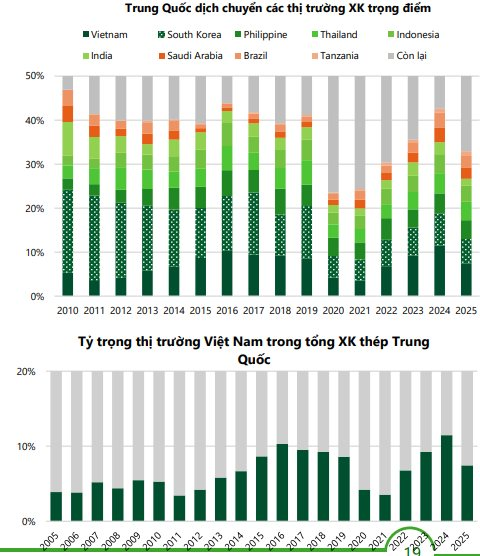

In the medium term, VCBS expects the policy to trigger a significant consolidation within China’s steel trade sector, benefiting large companies with robust quality management systems and formal export channels. These firms will enhance their negotiating power and reclaim market share from smaller players. Temporary disruptions and potential price increases create opportunities for China’s steel competitors. From 2026, China’s primary export markets may shift from Vietnam to Africa and Latin America.

This shift could enable Vietnamese steelmakers to swiftly dominate the domestic market and expand exports to countries like India, Indonesia, and Japan.

“This is a golden opportunity for Vietnam’s domestic steel industry, particularly upstream companies (HPG, FHS), to reduce competition from low-cost Chinese imports, improve gross profit margins, and increase exports to markets where China faces procedural challenges, especially with HPG’s significant growth in hot-rolled coil production in 2026,” the report highlights.

Construction and Real Estate Revival: A Boost for Steel Demand

Additionally, the resurgence of the construction and real estate sectors will be a key driver of steel demand in the coming period.

VCBS notes that the construction industry is expected to maintain growth, fueled by (1) increased public investment and (2) a rebound in residential construction as real estate projects resolve legal issues.

Public investment disbursement is accelerating: as of December 31, 2025, VND 755 trillion has been disbursed, reaching ~83% of the target. The remaining VND 147 trillion must be disbursed by Q1/2026 to meet the 100% goal.

For the 2026–2030 period, infrastructure investment is a key growth pillar, with a significant increase from the previous phase, potentially reaching VND 8,500 trillion (compared to VND 2,870 trillion planned for 2021–25).

The medium-term public investment plan for 2026–2030 prioritizes major national projects. Transportation projects (North-South Expressway Phase 2, Long Thanh Airport) will continue driving construction steel demand, boosting domestic consumption by 5–8% in 2026.

The residential real estate sector shows positive prospects, with many projects resolving legal issues (under Resolution 171) and commencing construction, driving steel demand in the coming years. Legally cleared projects began strong construction in late 2025. The number of licensed NOTM projects also surged in Q3/2025 and is expected to rise further. Peak steel consumption for residential real estate will occur from mid-2026 (during the main structure completion phase).

However, VCBS analysts caution that challenges in 2026 may arise from excess capacity and low-cost Chinese steel. Additionally, the EU’s CBAM technical barrier and narrowing quotas for steel exports to the EU (effective July 1, 2026) will pose obstacles for Vietnam’s steel industry.

Steel Stock Surges 90% from Lows as Executives Unanimously Register to Divest

Recently, three key executives at B.C.H Joint Stock Company (UPCoM: BCA) have collectively registered to sell nearly 3.2 million BCA shares, following a remarkable 90% surge in the stock price from its recent low.

Steel Giant’s HoSE Ascent: Holding $136M in Cash, Q3 Profits Surge 58%

The Ho Chi Minh City Stock Exchange (HoSE) has officially announced the acceptance of the listing application for all 149 million shares of Ton Dong A Joint Stock Company (stock code: GDA). This milestone marks a significant step in the company’s transition to the main bourse, following over two years of trading on the UPCoM market.

SMC Sells Assets Worth VND 315 Billion Amid Capital Shortage

SMC Investment and Trading JSC (HOSE: SMC) is set to transfer land use rights and assets valued at VND 315 billion from two of its subsidiaries.