Honda Launches Premium Electric Motorcycles

Honda recently announced a move that surprised few, revealing plans to sell 2.2 million motorcycles in Vietnam by 2025, capturing a staggering 85.9% market share. Simultaneously, the Japanese giant is taking a controversial path in the “future” segment of transportation: electric motorcycles.

In early January 2026, Honda officially unveiled the pricing for its flagship CUV e: model at 65 million VND (including battery) or 45 million VND with a battery rental option at 250,000 VND/month. Shortly after, the mid-range UC3 model was introduced, featuring a fixed LFP battery with a 120km range. While the UC3’s price remains undisclosed, its pricing in other markets suggests it won’t be a budget-friendly option. In Thailand, the Honda UC3 is priced at approximately 110 million VND.

In terms of pricing, Honda’s product lineup is positioned at or above competitors already established in Vietnam’s electric motorcycle market.

For instance, in the premium segment, the CUV e:’s 65 million VND price tag competes with models like the VinFast Theon S (around 56.9 million VND) and Dat Bike Weaver ++ (65.9 million VND).

The Honda UC3 electric motorcycle was launched alongside the CUV e: with its pricing announcement.

In the lower segment (entry-level to mid-range), the ICON e: is priced similarly to the VinFast Feliz S (27 million VND) and Yadea models like the Voltguard (ranging from 26 to 28 million VND).

However, when comparing technical specifications, Honda’s electric motorcycles generally fall short. For example, the Honda CUV e: offers a modest range of only 76 km on a full charge and is equipped with CBS braking instead of ABS.

In contrast, for a similar price, the Dat Bike Weaver ++ provides a range of up to 200 km, while the VinFast Theon S reaches a top speed of 99 km/h, features ABS braking, and delivers significantly more powerful performance.

Even in the lower segment, the ICON e: only caters to short urban commutes of around 70 km. Conversely, the VinFast Feliz S offers a range of 198 km per charge, extending to 262 km with the dual-battery option.

Clearly, with its current pricing strategy, Honda is not aiming to compete directly on specifications or price with its rivals.

What is the Japanese Giant’s Strategy?

Explaining the questions surrounding Honda’s electric motorcycle offerings, Mr. Nguyen Manh Thang, community manager at Auto+, suggests that this is essentially a “counter-current” business strategy aimed at establishing brand prestige.

For the CUV e: model, the 65 million VND price point is part of a well-thought-out plan. Mr. Thang notes that in regional markets like Thailand and Indonesia, this model is priced between 3,300 and 3,800 USD, equivalent to about 85–91 million VND. Therefore, the price in Vietnam has been adjusted to better align with local purchasing power.

“Honda’s goal is to position its product in the premium segment, thereby positioning domestic users as owners of a luxury item,” Mr. Thang emphasizes.

The expert further analyzes that once the market accepts this high price point, introducing mid-range and entry-level models later will create a psychological “affordable” effect, making it easier for the company to sell these products.

Sharing a similar view, journalist Nguyen Thuc Hoang Linh assesses that the newly launched UC3 model is the “backbone” product, playing a role similar to what the Honda Lead did during the boom of gasoline scooters. According to Mr. Linh, the company’s competitive strength does not lie in flashy specifications but in the overall driving experience.

“There are values in operational stability, battery reliability, and after-sales service that cannot be fully described through technical specifications,” the journalist shares.

Honda has a strategy to popularize electric motorcycles in Vietnam, with models like the CUV e: serving as a test before entering the green transition roadmap.

According to experts, with its current dominance of over 85% of the motorcycle market, Honda is fully aware of the pressure from the government’s green transition roadmap and has prepared a robust plan to popularize electric motorcycles in Vietnam to maintain its market share in the future.

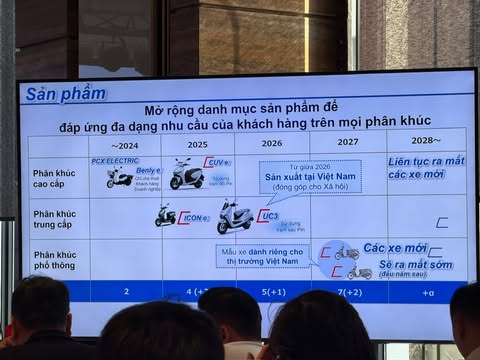

Instead of racing for speed, Honda is taking a more cautious approach. The Japanese motorcycle manufacturer has outlined a clear 5-year strategy with a product portfolio spanning all three segments: high-end, mid-range, and entry-level. This includes plans to localize some electric motorcycle models.

Specifically, Honda plans to produce the UC3 electric motorcycle from mid-2026 and launch two entry-level electric motorcycle models exclusively for the Vietnamese market from early 2027. From 2028 onwards, the company will continuously introduce new products at more accessible price points to compete for market share. This strategy is built on four core pillars: product durability, an existing dealer network, asset value protection, and traffic safety.

It’s also important to note that Honda still maintains a dense lineup of gasoline motorcycles, covering various segments and remaining a “cash cow” for the company. If it were to immediately launch competitive, affordable electric motorcycle models, it could inadvertently hinder its own gasoline motorcycle sales.

Prime Minister: Advanced Semiconductor Chip Plant Completes Vietnam’s Critical Link in the Global Supply Chain

Speaking at the groundbreaking ceremony for Vietnam’s first high-tech semiconductor chip manufacturing plant, Prime Minister Pham Minh Chinh emphasized that this project confirms Vietnam’s ability to gradually master advanced technology and complete a critical link in the semiconductor value chain—chip manufacturing. This marks a transformative shift from participation to ownership, from assembly to innovation, enhancing Vietnam’s capabilities and standing in the digital era.

Repositioning the Service Sector in the Economy

As Vietnam embarks on its “era of national ascent,” aiming for double-digit growth by 2026, the strategic identification of key industries for focused investment has never been more critical.